Rogers 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

BUSINESS SOLUTIONS

LEADING-EDGE COMMUNICATIONS SERVICES TO

CANADIAN BUSINESSES

• sells to medium and large enterprises, governments and

financial institutions amongst others

• 7,298 on-net fibre connected buildings

• fibre passes next to an additional 20,014 near-net buildings.

SERVICES THAT MEET THE INCREASING DEMANDS OF

TODAY’S CRITICAL BUSINESS APPLICATIONS

• voice, data networking, Internet protocol (IP) and ethernet services

over multiservice customer access devices that allow customers to

scale and add services such as private networking, Internet, IP voice

(SIP) and cloud solutions which blend seamlessly to grow with their

business requirements

• optical wave, Internet, ethernet and multi-protocol label switching

(MPLS) services provide scalable and secure metro and wide area

private networking that enable and interconnect critical business

applications for businesses that have one or many offices, data

centres or points of presence (as well as cloud applications) across

Canada

• extensive wireless and cable access networks services for primary,

bridging and back-up connectivity

• contracts are typically for 1 to 5 year terms, supported by

comprehensive service level agreements.

NETWORK

Business Solutions is supported by Rogers networks and a dedicated

business support network monitoring team that provides Business

Solutions customers with proactive network monitoring and problem

resolution.

DISTRIBUTION

Our enterprise and carrier wholesale sales team sells Business Solutions

services to Canadian business and public sector telecom customers. An

extensive network of third-party channel distributors deal with IT

integrators, consultants, local service providers and other indirect sales

relationships. This diverse approach gives greater breadth of coverage

and sustains strong sales growth for next generation services.

COMPETITION

A number of different players in the Canadian market compete for

enterprise network and communications services. There are relatively

few national providers, but each market has its own competitors that

usually focus on the geographic markets where they have the most

extensive networks.

In the wireline voice and data market, we compete with facilities and

non-facilities-based telecommunications service providers. In markets

where we own network infrastructure, we compete with incumbent

fibre-based providers. The following are our main competitors, but

there are also regional competitors:

• Ontario: Bell, Cogeco Data Services and Allstream

• Quebec: predominantly Bell and Videotron

• Atlantic Canada: Bell Alliant and Eastlink.

• Western Canada: Shaw and Telus

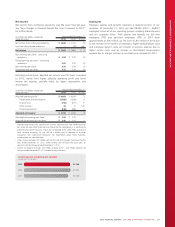

$0.36

BILLION

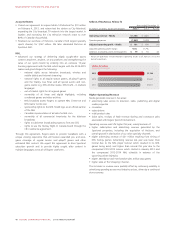

(%)

2013 BUSINESS SOLUTIONS SERVICE REVENUE MIX

NEXT GENERATION 59%

LEGACY 41%

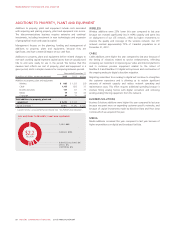

ACQUISITIONS

We made two major acquisitions this year that allow Business Solutions

to further enhance its suite of enterprise-level data centre and cloud

computing services, enabling Canadian businesses to benefit from a

single provider able to ensure end-to-end security and reliability of

critical business applications.

• Blackiron (from Primus Telecommunications Canada Inc.) for

$198 million on April 17, 2013

• Pivot Data Centres for $158 million on October 1, 2013.

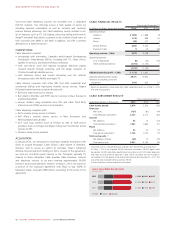

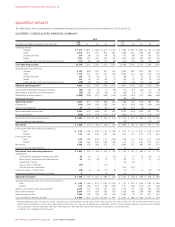

BUSINESS SOLUTIONS FINANCIAL RESULTS

Years ended December 31

(In millions of dollars, except percentages) 2013 12012 %Chg

Operating revenue

Next generation $ 213 $ 162 31

Legacy 149 183 (19)

Service revenue 362 345 5

Equipment sales 12 6 100

Operating revenue – Business Solutions 374 351 7

Operating expenses (268) (262) 2

Adjusted operating profit – Business

Solutions $ 106 $89 19

Adjusted operating profit margin 28.3%25.4%

Additions to property, plant and equipment $ 107 $61 75

1Results of operations include Blackiron’s operating results as of April 17, 2013 and

Pivot Data Centres as of October 1, 2013 (the dates of acquisition).

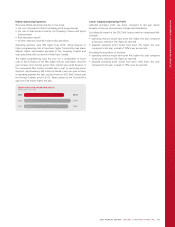

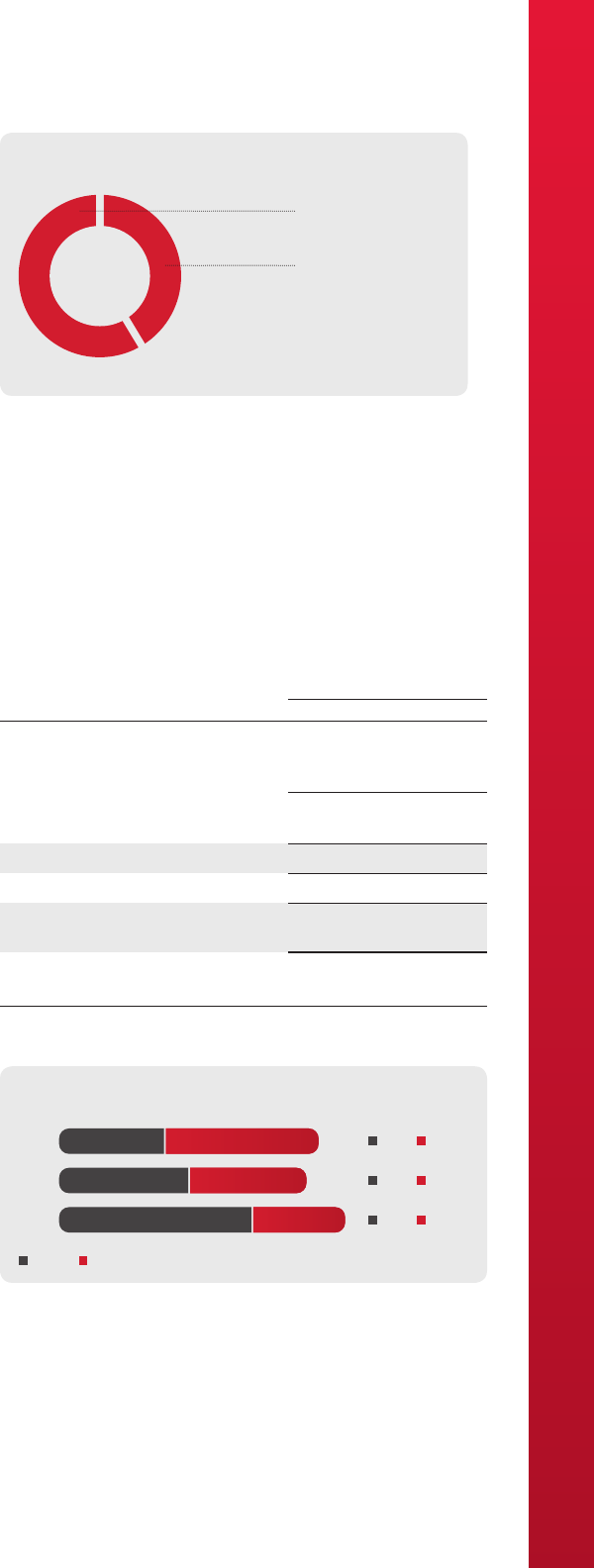

(IN MILLIONS OF DOLLARS)

BUSINESS SOLUTIONS SERVICE REVENUE BREAKDOWN

2013

2012

2011

$149 $213

$183$162

$271 $128

Next GenerationLegacy

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 45