Rogers 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

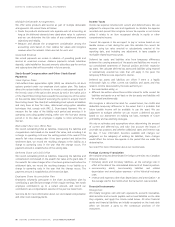

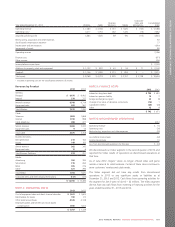

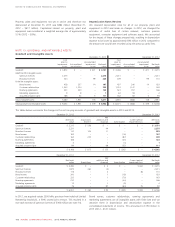

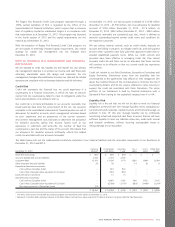

Final Fair Values of Assets Acquired and Liabilities Assumed

The table below summarizes the final fair values of the assets acquired and liabilities assumed for all the acquisitions described above.

Mountain Cable Blackiron theScore 1Pivot Other Total

Fair value of consideration transferred $ 398 $ 198 $ 167 $ 158 $ 40 $ 961

Cash ––52 2 9

Current assets 3 4 12 6 – 25

Property, plant and equipment 53 35 11 58 1 158

Customer relationships 2135 45 – 36 17 233

Broadcast licence 3– – 104 – – 104

Current liabilities (5) (8) (6) (7) (2) (28)

Other liabilities – – – (4) (3) (7)

Deferred tax liabilities (44) (7) (7) (11) – (69)

Fair value of net identifiable assets acquired and liabilities assumed 142 69 119 80 15 425

Goodwill $ 256 $ 129 $ 48 $ 78 $ 25 $ 536

Acquisition transaction costs $ 2 $ 1 $ 19 4$ 1 $– $23

Goodwill allocated to the following segments Cable Business

Solutions

Media Business

Solutions

Multiple

segments 5

1We paid the $167 million related to theScore on October 19, 2012.

2Customer relationships are amortized over a period ranging from 5 to 10 years.

3Broadcast licence is an indefinite life intangible asset.

4Acquisition transaction costs for theScore include $17 million related to the CRTC tangible benefits commitments that were required as a condition of the CRTC’s approval of the

transaction.

5Goodwill related to other acquisitions was allocated to Media and Business Solutions.

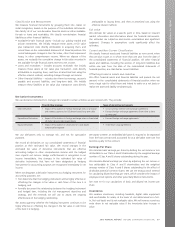

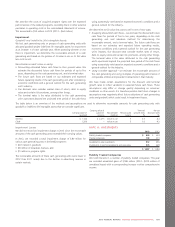

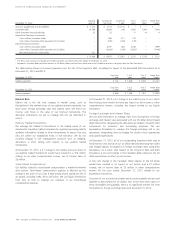

Pro Forma Disclosures

The table below shows the incremental revenue, operating income (loss), depreciation and amortization and restructuring, acquisition and other

expenses for each acquisition since the respective dates of acquisition to December 31, 2013.

Mountain Cable Blackiron theScore Pivot

Incremental revenue $ 44 $ 27 $ 24 $ 8

Operating expenses:

Operating costs 17 22 17 5

Restructuring, acquisition and other costs 1––4 –

Depreciation and amortization 24 7 3 3

Operating income (loss) 3 (2) – –

1Excludes acquisition transaction costs.

If all of the above acquisitions had occurred on January 1, 2013, we estimate our incremental revenue from these acquisitions would have been

$172 million and incremental operating income would have been $3 million for 2013.

The pro forma disclosures are based on estimates and assumptions we believe are reasonable. The information provided is not necessarily an

indication of what our consolidated financial results will be in the future.

2012 Acquisitions

There were no individually material business combinations or divestitures in 2012.

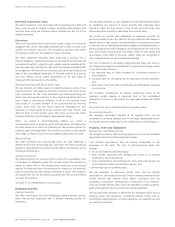

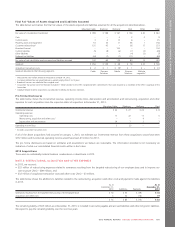

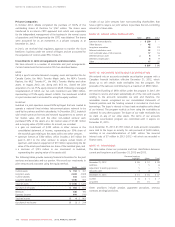

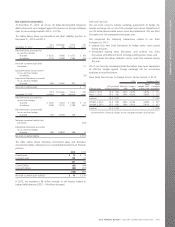

NOTE 8: RESTRUCTURING, ACQUISITION AND OTHER EXPENSES

In 2013, we incurred:

• $53 million of restructuring expenses related to severances resulting from the targeted restructuring of our employee base and to improve our

cost structure (2012 – $89 million), and

• $32 million of acquisition transaction costs and other costs (2012 – $3 million).

The table below shows the additions to liabilities related to the restructuring, acquisition and other costs and payments made against the liabilities

in 2013.

As at

December 31,

2012 Additions Payments

As at

December 31,

2013

Severances resulting from the targeted restructuring of the employee base $ 50 $ 53 $ (59) $44

Acquisition and other costs 3 32 (16) 19

$ 53 $ 85 $ (75) $63

The remaining liability of $63 million as at December 31, 2013, is included in accounts payable and accrued liabilities and other long-term liabilities.

We expect to pay the remaining liability over the next two years.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 105