Rogers 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

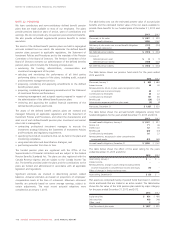

Transactions

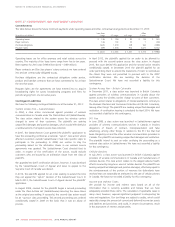

We have entered into business transactions with companies whose

partners or senior officers are directors of Rogers, including the

chairman and chief executive officer of a firm that is paid commissions

for insurance coverage, the senior partner and chairman of a law firm

that provides legal services, and the chairman of a company that

provides printing services.

We record these transactions at the amount agreed to by the related

parties. The transactions are reviewed by the Audit Committee of our

Board of Directors. The amounts owing are unsecured, interest-free and

due for payment in cash within one month from the date of the

transaction. There are no significant outstanding balances with these

related parties at December 31, 2013.

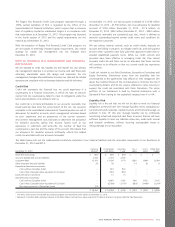

Transaction value

Balance outstanding,

December 31,

2013 2012 2013 2012

Printing, legal services and

commission paid on premiums

for insurance coverage $43 $43 $2 $1

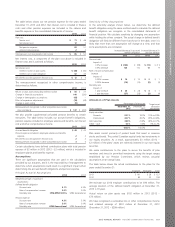

Subsidiaries, Joint Arrangements and Associates

We have the following significant subsidiaries:

• Rogers Communications Partnership

• Rogers Media Inc.

We have 100% ownership interest in all of these subsidiaries. Our

subsidiaries are incorporated in Canada and have the same reporting

period for annual financial statements reporting.

When necessary, adjustments are made to conform the accounting

policies with those of Rogers. There are no significant restrictions on the

ability of subsidiaries, joint arrangements and associates to transfer

funds to Rogers as cash dividends or to repay loans or advances.

We carried out the following business transactions with our joint

arrangements and associates. Transactions between us and our

subsidiaries have been eliminated on consolidation and are not

disclosed in this note.

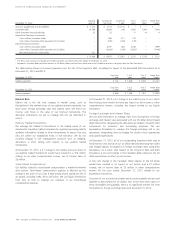

Transaction value

2013 2012

Revenues $3 $1

Purchases 83 38

Sales to and purchases from our joint arrangements and associates are

made at terms equivalent to those that prevail in arm’s length

transactions. Outstanding balances at year-end are unsecured and

interest-free, and settled in cash. The outstanding balances with these

related parties relating to similar business transactions as at

December 31, 2013 was $14 million and included in accounts payable

and accrued liabilities (December 31, 2012 – $1 million payable).

In 2012, we acquired certain network assets and 2500 MHz spectrum

from Inukshuk, a 50% owned joint venture. As a result, we recorded a

gain of $233 million in other income, as the portion of the excess of fair

value over carrying value related to the other non-related venturer’s

50% interest in the spectrum licences (see note 14).

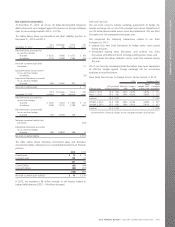

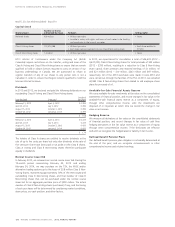

NOTE 26: GUARANTEES

We had the following guarantees at December 31, 2013 and 2012 as

part of our normal course of business:

Business Sale and Business Combination Agreements

As part of transactions involving business dispositions, sales of assets or

other business combinations, we may be required to pay counterparties

for costs and losses incurred as a result of breaches of representations

and warranties, intellectual property right infringement, loss or

damages to property, environmental liabilities, changes in laws and

regulations (including tax legislation), litigation against the

counterparties, contingent liabilities of a disposed business or

reassessments of previous tax filings of the corporation that carries on

the business.

Sales of Services

As part of transactions involving sales of services, we may be required

to make payments to counterparties as a result of breaches of

representations and warranties, changes in laws and regulations

(including tax legislation) or litigation against the counterparties.

Purchases and Development of Assets

As part of transactions involving purchases and development of assets,

we may be required to pay counterparties for costs and losses incurred

as a result of breaches of representations and warranties, loss or

damages to property, changes in laws and regulations (including tax

legislation) or litigation against the counterparties.

Indemnifications

We indemnify our directors, officers and employees against claims

reasonably incurred and resulting from the performance of their services

to Rogers. We have liability insurance for our directors and officers and

those of our subsidiaries.

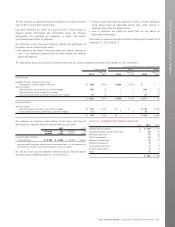

We are unable to make a reasonable estimate of the maximum

potential amount we would be required to pay to counterparties. The

amount also depends on the outcome of future events and conditions,

which cannot be predicted. No amount has been accrued in the

consolidated statements of financial position relating to these types of

indemnifications or guarantees at December 31, 2013 or 2012.

Historically, we have not made any significant payments under these

indemnifications or guarantees.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 123