Rogers 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

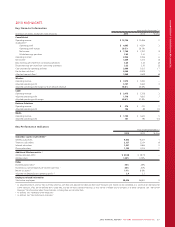

MANAGEMENT’S DISCUSSION AND ANALYSIS

KEY CHANGES IN FINANCIAL RESULTS THIS YEAR COMPARED TO 2012

(In millions of dollars) Change see page

Operating revenue changes – higher (lower):

Network revenue – Wireless $ 29 39

Equipment sales – Wireless (39) 39

Cable 117 42

Business Solutions 23 45

Media 84 48

Corporate items and intercompany eliminations 6

Higher operating revenue compared to 2012 220

Adjusted operating profit changes – higher (lower):

Wireless 94 39

Cable 113 42

Business Solutions 17 45

Media (29) 48

Corporate items and intercompany eliminations (36)

Higher adjusted operating profit 1compared to

2012 159

Higher stock-based compensation expense (7) 51

Lower restructuring, acquisition and other expenses 7 51

Higher depreciation and amortization (79) 51

Impairment recognized in 2012 80 51

Higher operating income 2compared to 2012 160

Higher finance costs (71) 52

Gain on sale of interest in TVtropolis 47 52

Gain on Inukshuk spectrum distribution in 2012 (233) 52

Other 17 53

Lower income taxes 24 52

Decrease in net income from continuing

operations compared to 2012 (56)

Loss from discontinued operations in 2012 32 52

Decrease in net income compared to 2012 (24)

1Adjusted operating profit is a Non-GAAP measure and should not be considered as

a substitute or alternative for GAAP measure. It is not a defined term under IFRS,

and does not have a standard meaning, so may not be a reliable way to compare

us to other companies. See “Non-GAAP Measures” for information about these

measures, including how we calculate them.

2As defined. See “Additional GAAP Measures”.

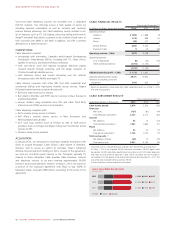

Operating Revenue

Wireless network revenue was higher than last year because of higher

adoption and usage of wireless data services, partially offset by the

introduction of lower priced roaming plans and pricing changes made

over this year.

Cable operating revenue was higher than last year mainly because of

growth in Internet and phone revenues and the acquisition of Mountain

Cable, partially offset by a decline in television revenue related

principally from competitive TV subscriber losses.

Business Solutions operating revenue was higher than last year mainly

because we completed the acquisitions of Blackiron Data and Pivot

Data Centres earlier this year combined with the continued growth in

on-net and next generation services, partially offset by planned decline

in legacy voice and data services.

Media operating revenue was higher than last year mainly because of

revenue growth at Sportsnet, higher attendance at Toronto Blue Jays

games and higher sales at The Shopping Channel.

Adjusted Operating Profit

Wireless adjusted operating profit was higher this year because of

higher network revenue, our continued cost management and

productivity initiatives implemented across various areas and lower cost

of equipment.

Cable adjusted operating profit was higher than last year because of

the continued growth in revenue combined with a shift in our product

mix towards higher margin Internet and phone products.

Media’s adjusted operating profit was lower compared to last year. The

increase in operating revenue this year was more than offset by the

combined impact of higher player salaries at the Toronto Blue Jays, the

NHL player lockout in 2012 and the costs associated with broadcasting

more NHL hockey games in 2013 because of the condensed 2012-2013

season which started in January 2013 and the compressed 2013-2014

season schedule associated with the upcoming winter Olympics.

Adjusted operating profit relating to Corporate items and intercompany

eliminations was lower compared to last year because of continued

investment in growth initiatives such as Rogers’ credit card, Outrank,

Rogers Alerts and other digital opportunities.

Operating Income and Net Income

Operating income was higher than last year while net income was

lower. The increase in operating income is mainly because of the

increase in adjusted operating profit. Net income was lower mainly

because in 2012 we realized a $233 million gain on spectrum licenses

that Inukshuk sold to our non-related venture partner as well as the

related income tax benefits we recorded that year.

36 ROGERS COMMUNICATIONS INC. 2013 ANNUAL REPORT