Rogers 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Other Claims

There are certain other claims and potential claims against us. We do

not expect any of these to have materially adverse effect on our

consolidated financial position.

The outcome of all the proceedings and claims against us, including the

matters described above, is subject to future resolution that includes the

uncertainties of litigation. Based on information currently known to us,

we believe that it is not probable that the ultimate resolution of any of

these proceedings and claims, individually or in total, will have a

material adverse effect on our consolidated financial position or results

of operations. If it becomes probable that we are liable, we will record a

provision in the period the change in probability occurs, and it could be

material to our consolidated financial position and results of operations.

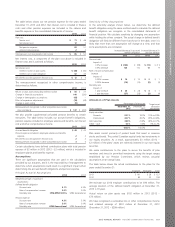

NOTE 28: SUBSEQUENT EVENTS

The following events occurred after the year ended December 31,

2013:

Increase in Annual Dividend Rate and Declaration of

Dividends

In February 2014, the Board approved an increase of 5% in the

annualized dividend rate, to $1.83 per Class A Voting share and Class B

Non-Voting share, effective immediately to be paid in quarterly amounts

of $0.4575. The Board last increased the annualized dividend rate in

February 2013, from $1.58 to $1.74 per Class A Voting and Class B

Non-Voting share. Dividends are payable when declared by the Board.

In February 2014, the Board declared a quarterly dividend of $0.4575

per Class A Voting share and Class B Non-Voting share, to be paid on

April 4, 2014, to shareholders of record on March 14, 2014. This is the

first quarterly dividend in 2014 and reflects the new dividend rate.

Cash Tender Offers

On January 29, 2014, we announced that one of our wholly-owned

subsidiaries commenced cash tender offers for any and all of our

US $750 million 6.375% senior notes due 2014 and our

US $350 million 5.500% senior notes due 2014. The tender offer

consideration will be US $1,000 for each $1,000 principal amount of

notes (plus accrued and unpaid interest to, but not including, the

settlement date) and a consent payment equal to US $2.50 per

US $1,000 principal amount of notes.

Normal Course Issuer Bid

In February 2014, we filed a notice with the TSX of our intention to

renew our normal course issuer bid for our Class B Non-Voting shares

for another year. Subject to acceptance by the TSX, this notice gives us

the right to buy up to an aggregate $500 million or 35,780,234 Class B

Non-Voting shares of RCI, whichever is less, on the TSX, NYSE and/or

alternate trading systems any time between February 25, 2014 and

February 24, 2015. The number of Class B Non-Voting shares we

actually buy under the normal course issuer bid, if any, and when we

buy them, will depend on our evaluation of market conditions, stock

prices, our cash position, alternative uses of cash and other factors.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 125