Rogers 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

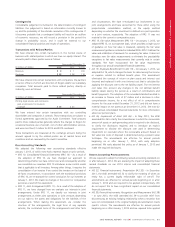

MANAGEMENT’S DISCUSSION AND ANALYSIS

and services on a timely basis, it could have a material adverse effect on

our business, financial condition and results of operations. Any

interruption in the supply of equipment for our networks could also

affect the quality of our service or impede network development and

expansion.

Organizational Structure and Talent

The industry is competitive in attracting and retaining a skilled

workforce. Losing certain employees or changes in morale due to a

restructuring or other event could affect our revenue and profitability in

certain circumstances.

Holding Company Structure

As a holding company, our ability to meet our financial obligations

depends primarily on receiving interest and principal payments on

intercompany advances, rental payments, cash dividends and other

payments from our subsidiaries, together with proceeds raised by us

through issuing debt and equity and selling assets.

Substantially all of our business activities are operated by our

subsidiaries. All of our subsidiaries are distinct legal entities that have no

obligation, contingent or otherwise, to make funds available to us

whether by dividends, interest payments, loans, advances or other

payments, subject to payment arrangements on intercompany

advances. Any of these payments must meet statutory or contractual

restrictions, are contingent on the earnings of those subsidiaries, and

are subject to various businesses and other considerations.

Increasing Programming Costs

Acquiring programming is the single most significant purchasing

commitment in our cable business. Programming costs have increased

significantly over the past few years, particularly with the recent growth

in subscriptions to digital specialty channels. Programming is also a

material cost for Media television properties. Higher programming costs

could adversely affect the operating results of our business if we are

unable to pass on these costs to subscribers.

Channel Placement

Unfavourable channel placement could negatively affect the tier status

and results of certain channels, including The Shopping Channel,

Sportsnet, SportsnetONE, Sportsnet World, and our specialty channels,

including Outdoor Life Network, The Biography Channel (Canada), G4

Canada, and FX (Canada).

Migrating from Conventional Media to New Media

Our Media business operates in many industries that can be affected by

customers migrating from conventional to digital media, which is

driving shifts in the quality and accessibility of data and mobile

alternatives to conventional media. We have been shifting our focus

towards the digital market to limit this risk. Our Media results could be

negatively affected if we are unsuccessful in anticipating the shift in

advertising dollars from conventional to digital platforms.

Our Market Position in Radio, Television or Magazine

Readership

Advertising dollars typically migrate to media properties that are leaders

in their respective markets and categories, particularly when advertising

budgets are tight. Although most of our radio, television and magazine

properties currently perform well in their respective markets, this may

not continue in the future. Advertisers base a substantial part of their

purchasing decisions on ratings and readership data generated by

industry associations and agencies. If our radio and television ratings or

magazine readership levels decrease substantially, our advertising sales

volumes and the rates that we charge advertisers could be adversely

affected.

FINANCIAL RISKS

Capital Commitments Liquidity, Debt and Interest Payments

Our capital commitments and financing obligations could have

important consequences including:

• requiring us to dedicate a substantial portion of cash flow from

operations to pay dividends, interest and principal, which reduce

funds available for other business purposes including other financial

operations

• making us more vulnerable to adverse economic and industry

conditions

• limiting our flexibility in planning for, and/or reacting to, changes in

our business and/or industry

• putting us at a competitive disadvantage compared to competitors

who may have more financial resources and, or less financial

leverage, or

• restricting our ability to obtain additional financing to fund working

capital and capital expenditures and for other general corporate

purposes.

Our ability to satisfy our financial obligations depends on our future

operating performance and economic, financial, competitive and other

factors, many of which are beyond our control. Our business may not

generate sufficient cash flow and future financings may not be available

to provide sufficient net proceeds to meet these obligations or to

successfully execute our business strategy.

Income Tax and Other Taxes

We collect, pay and accrue significant amounts of income and other

taxes such as federal and provincial sales tax, employment taxes and

property taxes, for and to various taxation authorities.

We have recorded significant amounts of deferred income tax liabilities

and current income tax expense, and calculated these amounts based

on substantively enacted income tax rates in effect at the relevant time.

A legislative change in these rates could have a material impact on the

amounts recorded and payable in the future.

We have also recorded the benefit of income and other tax positions

that are more likely than not of being sustained on examination and are

measured at the amount expected to be realized when we have an

ultimate settlement with taxation authorities.

While we believe we have paid and provided for adequate amounts of

tax, our business is complex and significant judgement is required in

interpreting tax legislation and regulations. Our tax filings are subject to

audit by the relevant government revenue authorities and the results of

the government audit could materially change the amount of our actual

income tax expense, income taxes payable or receivable, other taxes

payable or receivable and deferred income tax assets or liabilities and

could, in certain circumstances, result in an assessment of interest and

penalties.

2013 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 77