PNC Bank 2002 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

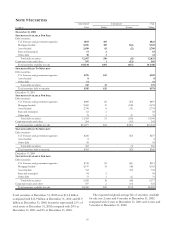

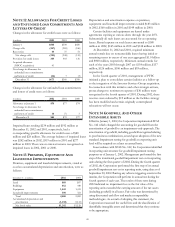

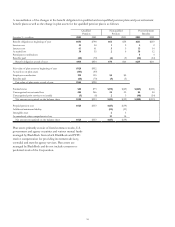

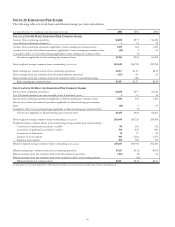

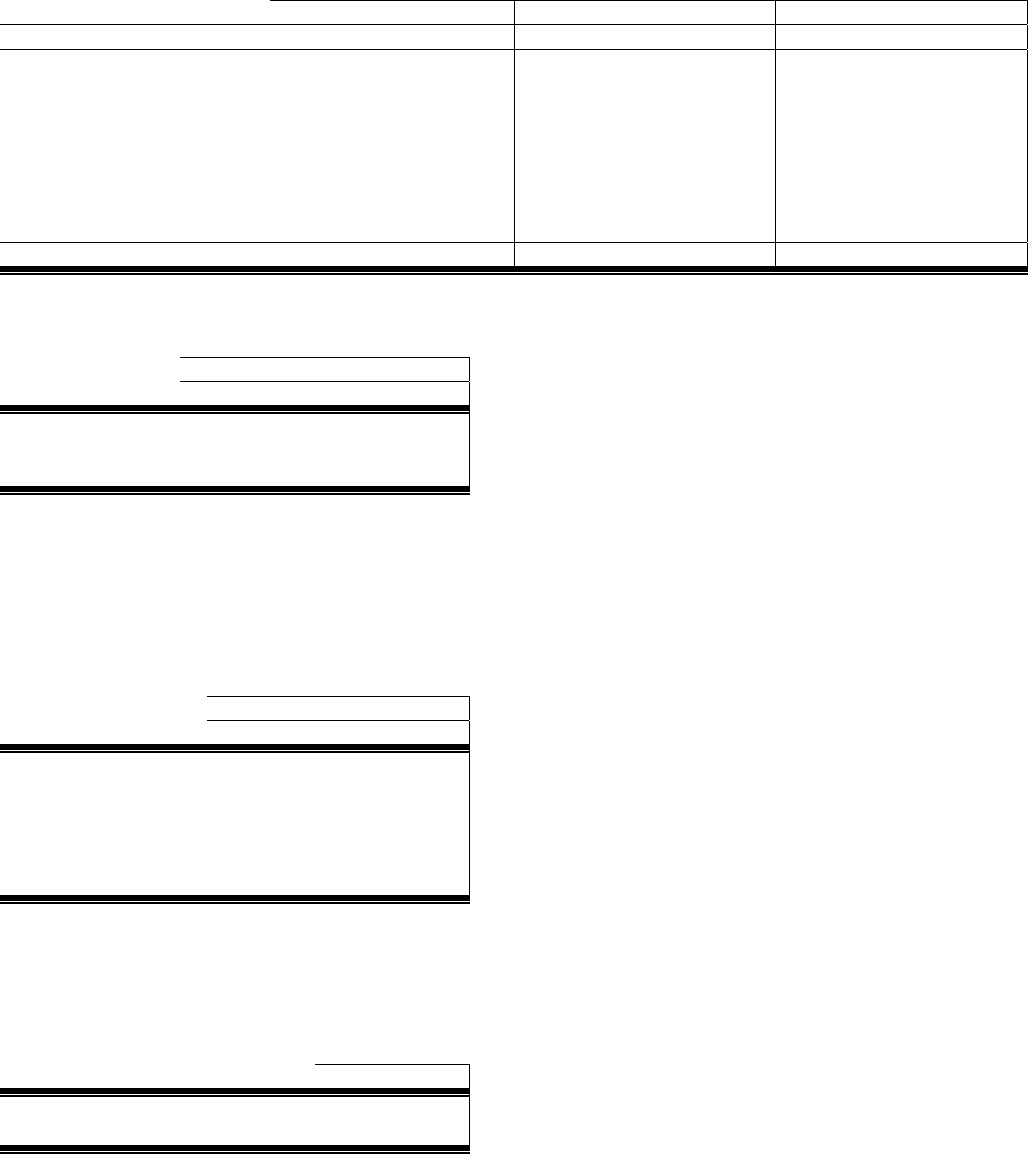

The components of net periodic pension and post-retirement benefit cost were as follows:

Q

ualified Pension Plans Non

q

ualified Pension Plans Post-retirement Benefits

Year ended December 31 – in millions 2002 2001 2000 2002 2001 2000 2002 2001 2000

Service cost $33 $30 $31 $1 $2 $2 $2 $2 $2

Interest cost 61 61 60 55515 14 14

Expected return on plan assets (97) (97) (93)

Transition amount amortization (5) 1

Curtailment gain (3)

Amortization of prior service cost (1) (1) (1) (6) (6) (6)

Recognized net actuarial loss 19 2 2(1)2

Losses due to settlements 7

Net

p

eriodic cost $15 $

(

7

)

$

(

8

)

$8 $9 $14 $13 $7 $10

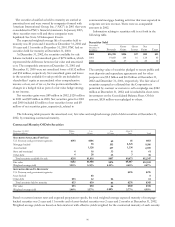

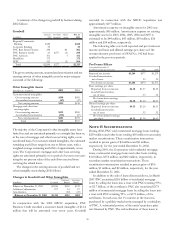

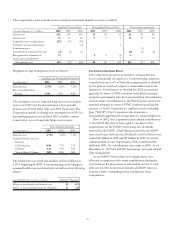

Weighted-average assumptions were as follows:

Q

ualified and Non

q

ualified Pensions

As of December 31 2002 2001 2000

Discount rate 6.75% 7.25% 7.50%

Rate of compensation

increase 4.00 4.50 4.50

The assumption for the expected long-term return on plan

assets was 9.50% for the determination of net periodic

pension cost for the 2002, 2001 and 2000 fiscal years. The

Corporation intends to change this assumption to 8.50% for

determining pension cost in fiscal 2003 to reflect a more

conservative view of long-term future trust returns.

Post-retirement Benefits

As of December 31 2002 2001 2000

Discount rate 6.75% 7.25% 7.50%

Expected health care cost

trend rate

Following year 11.00 7.75 7.75

Ultimate 5.25 5.50 5.00

Y

ear to Reach Ultimate 2009 2005 2005

The health care cost trend rate declines until it stabilizes at

5.25% beginning in 2009. A one-percentage-point change in

assumed health care cost trend rates would have the following

effects:

Year ended December 31, 2002 – in millions Increase Decrease

Effect on total service and interest cost $1 $(1)

Effect on post-retirement benefit obligation 13 (11)

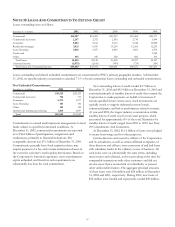

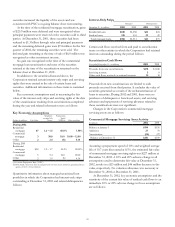

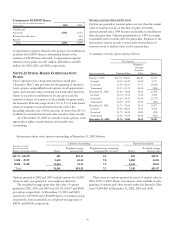

INCENTIVE SAVINGS PLAN

The Corporation sponsors an incentive savings plan that

covers substantially all employees. Under this plan, employee

contributions up to 6% of biweekly compensation as defined

by the plan are matched, subject to Internal Revenue Code

limitations. Contributions to the plan for 2002 are matched

primarily by shares of PNC common stock held in treasury,

except for participants who have exercised their diversification

election rights. Contributions to the Plan for prior years were

matched primarily by shares of PNC common stock held in

treasury, or by the Corporation’s employee stock ownership

plan (“ESOP”). The Corporation also maintains a

nonqualified supplemental savings plan for certain employees.

Prior to 2002, the Corporation made annual contributions

to the ESOP that were at least equal to the debt service

requirements on the ESOP’s borrowings less dividends

received by the ESOP. All dividends received by the ESOP

were used to pay debt service. Dividends used for debt service

totaled $8 million in 2001 and $9 million in 2000. To satisfy

additional debt service requirements, PNC contributed $1

million in 2001. No contributions were made in 2000. As of

December 31, 2001 the ESOP’s borrowings were paid off and

fully extinguished.

As the ESOP’s borrowings were repaid, shares were

allocated to employees who made contributions during the

year based on the proportion of annual debt service to total

debt service. The Corporation includes all ESOP shares as

common shares outstanding in the earnings per share

computation.