PNC Bank 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

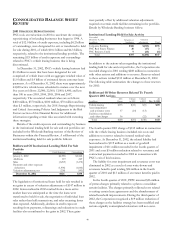

30

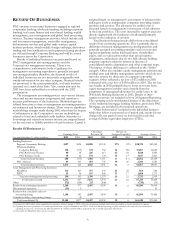

REVIEW OF BUSINESSES

PNC operates seven major businesses engaged in regional

community banking; wholesale banking, including corporate

banking, real estate finance and asset-based lending; wealth

management; asset management and global fund processing

services. Treasury management activities, which include cash

and investment management, receivables management,

disbursement services and global trade services; capital

markets products, which include foreign exchange, derivatives

trading and loan syndications; and equipment leasing products

are offered through Corporate Banking and sold by several

businesses across the Corporation.

Results of individual businesses are presented based on

PNC’s management accounting practices and the

Corporation’s management structure. There is no

comprehensive, authoritative body of guidance for

management accounting equivalent to generally accepted

accounting principles; therefore, the financial results of

individual businesses are not necessarily comparable with

similar information for any other company. Financial results

are presented, to the extent practicable, as if each business

operated on a stand-alone basis. Also, certain amounts for

2001 have been reclassified to conform with the 2002

presentation.

The management accounting process uses various balance

sheet and income statement assignments and transfers to

measure performance of the businesses. Methodologies are

refined from time to time as management accounting practices

are enhanced and businesses change. There were no significant

methodology changes made during 2002 other than the impact

of refinements to the Corporation’s reserve methodology

related to loans and unfunded credit facilities. Securities or

borrowings and related net interest income are assigned based

on the net asset or liability position of each business. Capital is

assigned based on management’s assessment of inherent risks

and equity levels at independent companies providing similar

products and services. The allowance for credit losses is

allocated based on management’s assessment of risk inherent

in the loan portfolios. The costs incurred by support areas not

directly aligned with the businesses are allocated primarily

based on the utilization of services.

Total business financial results differ from consolidated

results from continuing operations. This is primarily due to

differences between management accounting practices and

generally accepted accounting principles such as economic

capital assignments rather than legal entity shareholders’

equity, unit cost allocations rather than actual expense

assignments, and policies that do not fully allocate holding

company expenses; minority interest in income of

consolidated entities; eliminations and other corporate items.

The impact of these differences is reflected in the “Other”

category. Other also includes equity management activities and

residual asset and liability management activities which do not

meet the criteria for disclosure as a separate reportable

segment. Other reflected a net loss of $72 million in 2002

compared with a net loss of $190 million in 2001. The net loss

was smaller in 2002 primarily due to lower net losses from

equity management activities and a benefit from the

assignment of unassigned allowance for credit losses to the

Wholesale Banking businesses in 2002. Details of inter-

segment revenues are included in Note 26 Segment Reporting.

The operating results and financial impact of the disposition

of the residential mortgage banking business, previously PNC

Mortgage, are included in discontinued operations.

“Other Information” included in the individual business

tables that follow is presented as of period end, except for net

charge-offs, net gains (losses) on loans held for sale and

average full-time equivalent employees (FTEs).

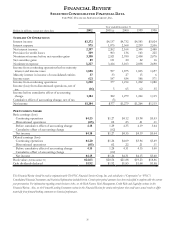

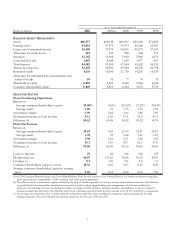

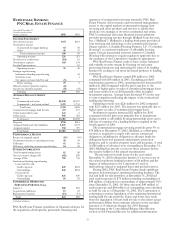

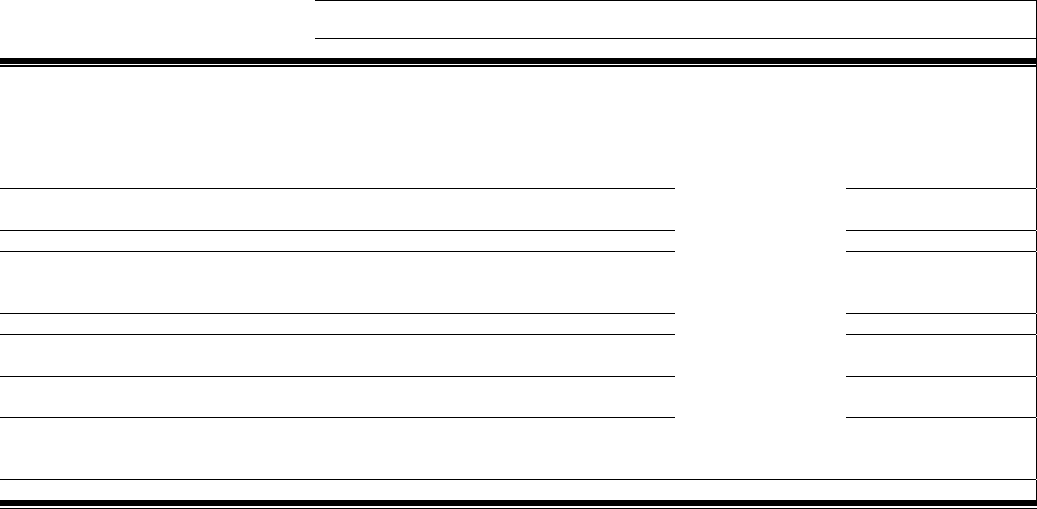

Results Of Businesses (a)

O

p

eratin

g

Return on

Earnings(Loss) Revenue (b) Assigned Capital(c) Average Assets

Year ended December 31 - dollars in millions 2002 2001 2002 2001 2002 2001 2002 2001

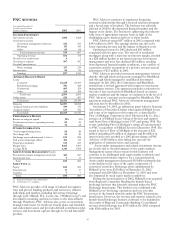

Banking Businesses

Regional Community Banking $697 $596 $2,098 $2,145 27% 22% $38,976 $40,285

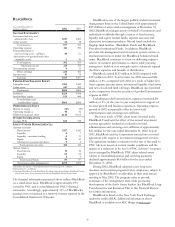

Wholesale Banking

Corporate Banking 150 (375) 631 764 14 (30) 13,807 16,685

PNC Real Estate Finance 90 38 226 213 23 10 5,018 5,290

PNC Business Credit 40 22 193 134 16 13 3,837 2,463

Total wholesale banking 280 (315) 1,050 1,111 17 (17) 22,662 24,438

PNC Advisors 97 143 654 735 19 26 2,929 3,330

Total banking businesses 1,074 424 3,802 3,991 22 864,567 68,053

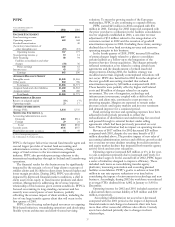

Asset Management and Processing businesses

BlackRock 133 107 577 533 24 25 864 684

PFPC 65 36 817 846 31 17 1,888 1,771

Total asset management and processing 198 143 1,394 1,379 26 22 2,752 2,455

Total business results 1,272 567 5,196 5,370 23 10 67,319 70,508

Other (72) (190) 211 (440) (730) (74)

Results from continuing operations 1,200 377 5,407 4,930 19 666,589 70,434

Discontinued operations (16) 551

Results before cumulative effect of

accounting change 1,184 382 5,407 4,930 19 666,589 70,485

Cumulative effect of accounting change (5)

Total consolidated (b) $1,184 $377 $5,407 $4,930 19 6$66,589 $70,485

(a) Amounts for 2002 reflect, where applicable, the adoption, effective January 1, 2002, of the new accounting standard under which goodwill is no longer amortized to expense.

(b) Operating revenue is presented on a taxable-equivalent basis except for BlackRock and PFPC. Total consolidated operating revenues included in the table above exceeded total

operating revenues on a book basis for 2002 and 2001 by $13 million and $16 million, respectively, due to taxable-equivalent adjustments.

(c) Percentages for BlackRock reflect return on equity.