PNC Bank 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.REPORTS ON CONSOLIDATED FINANCIAL STATEMENTS

THE PNC FINANCIAL SERVICES GROUP, INC.

67

MANAGEMENT’S RESPONSIBILITY FOR

FINANCIAL REPORTING

The management of The PNC Financial Services Group, Inc.

is responsible for the preparation, integrity and fair

presentation of its published consolidated financial

statements. The accompanying consolidated financial

statements have been prepared in accordance with accounting

principles generally accepted in the United States of America

and, as such, include judgments and estimates of

management. The PNC Financial Services Group, Inc. also

prepared the other information included in the Annual Report

and is responsible for its accuracy and consistency with the

consolidated financial statements.

Management is responsible for establishing and

maintaining effective internal controls over financial reporting

and disclosure controls and procedures. The internal control

system is augmented by written policies and procedures and

by audits performed by an internal audit staff, which reports

to the Audit Committee of the Board of Directors. Internal

auditors test the operation of the internal control system and

report findings to management and the Audit Committee, and

corrective actions are taken to address identified control

deficiencies and other opportunities for improving the system.

The Audit Committee, composed solely of independent

directors, provides oversight to management’s conduct of the

financial reporting process.

There are inherent limitations in the effectiveness of any

system of internal control, including the possibility of human

error and circumvention or overriding of controls.

Accordingly, even effective internal control can provide only

reasonable assurance with respect to financial statement

preparation. Further, because of changes in conditions, the

effectiveness of internal control may vary over time.

Management assessed The PNC Financial Services Group,

Inc.’s internal controls over financial reporting and disclosure

controls and procedures as of December 31, 2002. This

assessment was based on criteria for effective internal controls

over financial reporting described in “Internal Control-

Integrated Framework” issued by the Committee of

Sponsoring Organizations of the Treadway Commission and

on requirements for disclosure controls and procedures

arising from the Sarbanes-Oxley Act of 2002. Based on this

assessment, management believes that The PNC Financial

Services Group, Inc. maintained effective internal controls

over financial reporting and disclosure controls and

procedures as of December 31, 2002.

James E. Rohr William S. Demchak

REPORT OF DELOITTE & TOUCHE LLP,

INDEPENDENT AUDITORS

To the Board of Directors and Shareholders of

The PNC Financial Services Group, Inc.

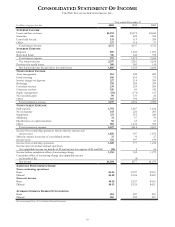

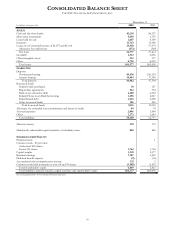

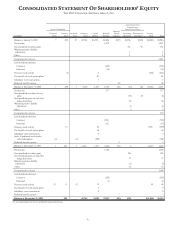

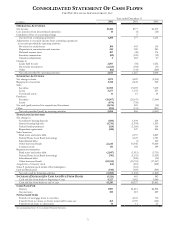

We have audited the accompanying consolidated balance sheet

of The PNC Financial Services Group, Inc. and subsidiaries as

of December 31, 2002, and the related consolidated statements

of income, shareholders’ equity, and cash flows for the year

then ended. These financial statements are the responsibility of

The PNC Financial Services Group, Inc.’s management. Our

responsibility is to express an opinion on these financial

statements based on our audit. The financial statements of The

PNC Financial Services Group, Inc. for the years ended

December 31, 2001 and 2000 were audited by other auditors

whose report, dated March 1, 2002, expressed an unqualified

opinion on those statements.

We conducted our audit in accordance with auditing

standards generally accepted in the United States of America.

Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. An audit also

includes assessing the accounting principles used and

significant estimates made by management, as well as

evaluating the overall financial statement presentation. We

believe that our audit provides a reasonable basis for our

opinion.

In our opinion, such consolidated financial statements

present fairly, in all material respects, the financial position of

The PNC Financial Services Group, Inc. and subsidiaries as of

December 31, 2002, and the consolidated results of their

operations and their cash flows for the year then ended in

conformity with accounting principles generally accepted in the

United States of America.

As discussed in Note 14 to the consolidated financial

statements, in 2002 The PNC Financial Services Group, Inc.

changed its method of accounting for goodwill and other

intangible assets to conform with Statement of Financial

Accounting Standards No. 142.

Pittsburgh, Pennsylvania

February 17, 2003

Chairman and Vice Chairman and

Chief Executive Officer Chief Financial Officer