PNC Bank 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

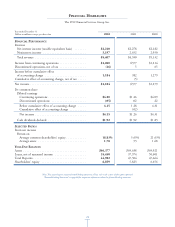

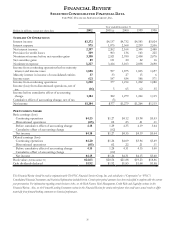

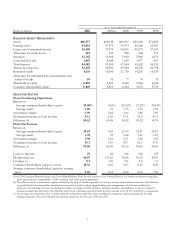

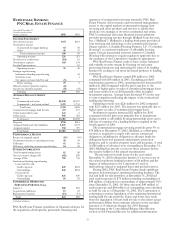

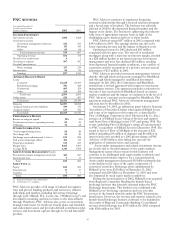

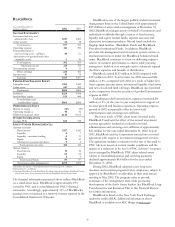

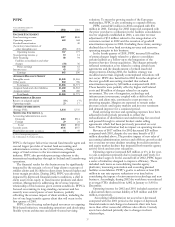

BALANCE SHEET HIGHLIGHTS

During 2002, the Corporation emphasized the growth and

retention of value-added transaction deposits while changing

the mix of earning assets, including a reduction of institutional

loans held for sale. These actions have resulted in a significant

risk repositioning of the Corporation as reflected in the

Consolidated Balance Sheet and Consolidated Average

Balance Sheet line items discussed below.

Total assets were $66.4 billion at December 31, 2002

compared with $69.6 billion at December 31, 2001. Average

interest earning assets were $55.3 billion in 2002, down $4.0

billion from 2001 due primarily to a decrease in average loans

that was partially offset by increases in average securities and

average loans held for sale.

Average loans for 2002 were $37.1 billion compared with

$44.8 billion in 2001, a decline of $7.7 billion or 17%. Loans

represented 67% of average interest-earning assets for 2002

compared with 76% for 2001. The decreases were primarily

due to a decline in residential mortgages and institutional

lending portfolios that more than offset an increase in PNC

Business Credit loans resulting from the acquisition in 2002 of

a portion of National Bank of Canada’s (“NBOC”) U.S. asset-

based lending business. The term “loans” in this report

excludes loans held for sale and securities that represent

interests in pools of loans.

Changes in loans held for sale are described in 2001

Strategic Repositioning and in Loans Held for Sale in the

Consolidated Balance Sheet Review section of this Financial

Review.

Average securities totaled $12.0 billion for 2002, an

increase of $1.1 billion from 2001. Securities comprised 22%

of average interest-earning assets for 2002 compared with 18%

for 2001. The increases were primarily due to net securities

purchases upon redeployment of funds resulting from loan

downsizing and interest rate risk management activities.

Funding cost is affected by the volume and composition of

funding sources as well as related rates paid thereon. Average

deposits comprised 66% of total sources of funds for 2002

compared with 64% for 2001, respectively, with the remainder

comprised primarily of wholesale funding obtained at

prevailing market rates.

Average interest-bearing demand and money market

deposits totaled $22.1 billion for 2002 compared with $21.3

billion in 2001. The increase reflected focused marketing

efforts to grow and maintain more valuable transaction

accounts while higher cost, less valuable retail certificates of

deposit were not emphasized. Average borrowed funds for

2002 decreased $2.8 billion, to $10.7 billion, compared with

2001 commensurate with the decline in average earning assets.

See the Consolidated Average Balance Sheet and Net Interest

Analysis for additional information.