PNC Bank 2002 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

Pursuant to their bylaws, the Corporation and its

subsidiaries provide indemnification to directors, officers and,

in some cases, employees and agents against certain liabilities

incurred as a result of their service on behalf of or at the

request of the Corporation and its subsidiaries and also

advance on behalf of covered individuals costs incurred in

defending against certain claims, subject to written

undertakings by each such individual to repay all amounts so

advanced if it is ultimately determined that the individual is

not entitled to indemnification. The Corporation advanced

such defense costs on behalf of several such individuals during

2002 with respect to pending litigation or investigations. It is

not possible to determine the aggregate potential exposure

resulting from the obligation to provide this indemnity or to

advance such costs.

In connection with the lending of securities held by its

mutual fund processing services business on behalf of certain

of its customers, PNC provides indemnification to those

customers against the failure of the borrower to return the

securities. Each borrower’s obligation to return the securities

is fully secured on a daily basis, and thus the exposure to the

Corporation is limited to temporary shortfalls in the collateral

as a result of short-term fluctuations in trading prices of the

borrowed securities. At December 31, 2002, the aggregate

maximum potential exposure as a result of these indemnity

obligations was $6.0 billion, although PNC held cash collateral

at the time in excess of that amount.

Contingent Payments in Connection with Certain

Acquisitions

A number of the acquisition agreements to which PNC is a

party and under which it has purchased various types of assets,

including the purchase of entire businesses, partial interests in

companies, or other types of assets, require PNC to make

additional payments in future years if certain predetermined

goals, such as revenue targets, are achieved or if other

contingencies, such as specified declines in the value of the

consideration paid, occur within a specified time. As certain of

these provisions do not specify dollar limitations, it is not

possible to quantify the aggregate exposure to PNC resulting

from these agreements.

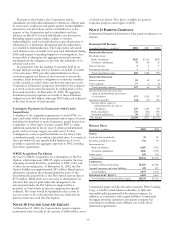

NBOC Acquisition Put Option

See Note 2 NBOC Acquisition for a description of the Put

Option, which represents NBOC’s right to transfer the then

remaining Serviced Portfolio, as defined, to PNC at the end

of the loan servicing term. At December 31, 2002, the Put

Option liability was approximately $57 million. Based upon a

third party valuation, the estimated purchase price of the

discontinued loan portfolio at the Put Option exercise date is

$175 million. While there is no recourse to third parties for

amounts that may be paid under this arrangement, the

amount paid under the Put Option is supported by a

portfolio of loans which in turn are supported by specific

collateral. The loans would be liquidated in due course to

recover some or all of the amounts that may ultimately be

paid in connection with this Put Option.

NOTE 30 UNUSED LINE OF CREDIT

At December 31, 2002, the Corporation’s parent company

maintained a line of credit in the amount of $460 million, none

of which was drawn. This line is available for general

corporate purposes and expires in 2003.

NOTE 31 PARENT COMPANY

Summarized financial information of the parent company is as

follows:

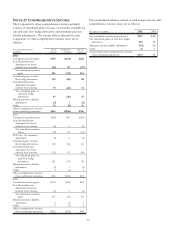

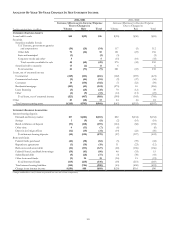

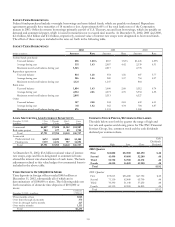

Statement Of Income

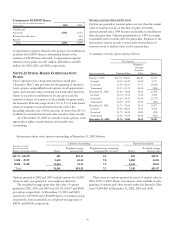

Year ended December 31 - in millions 2002 2001 2000

OPERATING REVENUE

Dividends from:

Bank subsidiaries $525 $1

,

116 $690

Nonbank subsidiaries 71 60 55

Interest income 369

Noninterest income 121

Total operating revenue 600 1,184 755

OPERATING EXPENSE

Interest expense 50 50 54

Other expense 77 6(6)

Total operating expense 127 56 48

Income before income taxes and

equity in undistributed net income

of subsidiaries 473 1,128 707

Income tax benefits (52) (17) (21)

Income before equity in

undistributed net income of

subsidiaries 525 1,145 728

Bank subsidiaries 631 (531) 386

Nonbank subsidiaries 28 (237) 165

Net income $1,184 $377 $1,279

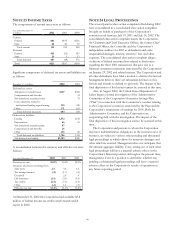

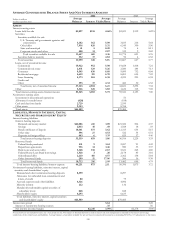

Balance Sheet

December 31 - in millions 2002 2001

ASSETS

Cash and due from banks $1 $1

Securities available for sale 192 94

Investments in:

Bank subsidiaries 6,285 5,324

Nonbank subsidiaries 1,696 1,555

Other assets 160 152

T

otal assets $8,334 $7,126

LIABILITIES

Nonbank affiliate borrowings $1,256 $1,086

Accrued expenses and other liabilities 219 217

T

otal liabilities 1,475 1,303

SHAREHOLDERS’ EQUITY 6,859 5,823

Total liabilities and shareholders’ equity $8,334 $7,126

Commercial paper and all other debt issued by PNC Funding

Corp., a wholly owned finance subsidiary, is fully and

unconditionally guaranteed by the parent company. In

addition, in connection with certain affiliates’ commercial

mortgage servicing operations, the parent company has

committed to maintain such affiliates’ net worth above

minimum requirements.