PNC Bank 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

As such, goodwill value is supported ultimately by revenue

which is driven by the volume of business transacted and, for

certain businesses, the market value of assets under

administration. A decline in earnings as a result of a lack of

growth or the Corporation’s inability to deliver cost effective

services over sustained periods can lead to impairment of

goodwill which could result in a charge and adversely impact

earnings in future periods.

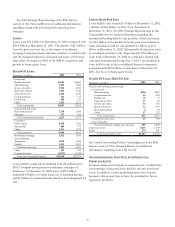

Total goodwill was $2.3 billion and other intangible assets,

net of accumulated amortization, totaled $333 million at

December 31, 2002. See Note 1 Accounting Policies and Note

14 Goodwill And Other Intangible Assets for additional

information.

SUPERVISION AND REGULATION

The Corporation operates in highly regulated industries.

Applicable laws and regulations restrict permissible activities

and investments and require compliance with protections for

loan, deposit, brokerage, fiduciary, mutual fund and other

customers, among other things. They also restrict the

Corporation’s ability to repurchase stock or to receive

dividends from its bank subsidiaries and impose capital

adequacy requirements. The consequences of noncompliance

can include substantial monetary and nonmonetary sanctions.

In addition, the Corporation is subject to comprehensive

examination and supervision by, among other regulatory

bodies, the Federal Reserve Board (“FRB”) and the Office of

the Comptroller of the Currency (“OCC”). These regulatory

agencies generally have broad discretion to impose

restrictions and limitations on the operations of a regulated

entity where the agencies determine, among other things, that

such operations are unsafe or unsound, fail to comply with

applicable law or are otherwise inconsistent with laws and

regulations or with the supervisory policies of these agencies.

This supervisory framework could materially impact the

conduct, growth and profitability of the Corporation’s

operations. For more information, see the “Supervision and

Regulation” section of Part I, Item 1 of the Corporation’s

2002 Annual Report on Form 10-K and Note 3 Regulatory

Matters.

In July 2002, the Corporation announced that in order to

settle an inquiry by the Securities and Exchange Commission

(“SEC”) in connection with three 2001 transactions that gave

rise to a financial statement restatement announced by the

Corporation on January 29, 2002, PNC had consented to an

SEC cease and desist order. The Corporation did not admit

or deny the SEC’s findings. At the same time, the

Corporation announced that it had entered into a written

agreement with the Federal Reserve Bank of Cleveland

(“Federal Reserve”) and that its principal subsidiary, PNC

Bank, had entered into a written agreement with the OCC.

These agreements address such issues as risk, management

and financial controls. The Corporation and PNC Bank also

entered into agreements with the Federal Reserve and the

OCC, respectively, requiring the Corporation and PNC Bank

to provide a plan for PNC Bank to meet the “well

capitalized” and “well managed” criteria within a 180-day

period.

As of December 19, 2002, the Federal Reserve and the

OCC notified the Corporation and PNC Bank, respectively,

that PNC Bank now met both the “well capitalized” and “well

managed” criteria. This removed the limitations placed in July

2002 on the Corporation’s engaging in new activities or

making new investments and on PNC Bank’s financial

subsidiary activities. However, the written agreements remain

in place, and the Corporation and PNC Bank in certain

circumstances must continue to obtain prior approval from

the Federal Reserve or the OCC, respectively, before making

acquisitions or engaging in new activities. In addition, under

applicable regulations, as long as the Corporation remains

subject to the written agreement with the Federal Reserve, the

Corporation must obtain prior regulatory approval to

repurchase its common stock in amounts that exceed

10 percent of consolidated net worth in any 12-month period.

The Corporation has incurred, and may continue to incur,

additional operating costs in connection with compliance with

these agreements including, among others, incremental staff

and continued higher legal and consulting expenses. Further,

the reputational risk created by the SEC cease and desist order

and the written agreements with the Federal Reserve and the

OCC could still have an impact on such matters as business

generation and retention, the ability to attract and retain

management, liquidity and funding.

The Corporation believes that it has made substantial

progress to date in enhancing its risk management and

governance practices and improving its regulatory relations,

while addressing the various requirements set forth in its

written agreements with the Federal Reserve and the OCC.

There can be no assurance, however, as to the precise timing

for determining that all required corrective actions have been

taken to the appropriate satisfaction of the Federal Reserve

and the OCC. The Board and senior management team are