PNC Bank 2002 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

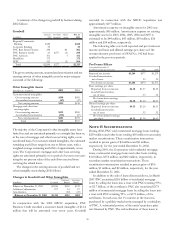

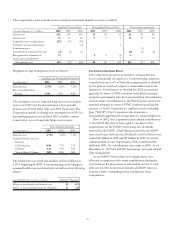

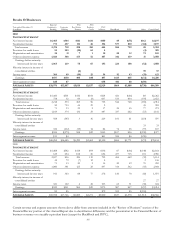

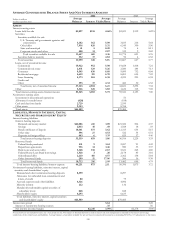

NOTE 26 SEGMENT REPORTING

PNC operates seven major businesses engaged in regional

community banking; wholesale banking, including

corporate banking, real estate finance and asset-based

lending; wealth management; asset management and global

fund processing services. Assets, revenue and earnings

attributable to foreign activities were not material for the

years ended December 31, 2002, 2001 or 2000.

Results of individual businesses are presented based on

PNC’s management accounting practices and the

Corporation’s management structure. There is no

comprehensive, authoritative body of guidance for

management accounting equivalent to generally accepted

accounting principles; therefore, PNC’s results of individual

businesses are not necessarily comparable with similar

information for any other company. Financial results are

presented, to the extent practicable, as if each business

operated on a stand-alone basis.

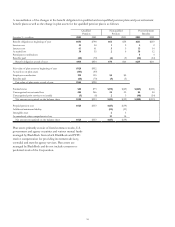

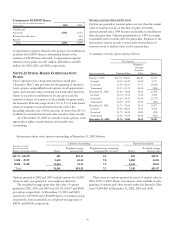

The management accounting process uses various

balance sheet and income statement assignments and

transfers to measure performance of the businesses.

Methodologies are refined from time to time as

management accounting practices are enhanced and

businesses change. There were no significant methodology

changes made during 2002 other than the impact of

refinements to the Corporation’s reserve methodology

related to loans and unfunded credit facilities. Securities or

borrowings and related net interest income are assigned

based on the net asset or liability position of each business.

Capital is assigned based on management’s assessment of

inherent risks and equity levels at independent companies

providing similar products and services. The allowance for

credit losses is allocated based on management’s

assessment of risk inherent in the loan portfolios. The costs

incurred by support areas not directly aligned with the

businesses are allocated primarily based on the utilization

of services.

Total business financial results differ from

consolidated results from continuing operations. This is

primarily due to differences between management

accounting practices and generally accepted accounting

principles, such as economic capital assignments rather

than legal entity shareholders’ equity, unit cost allocations

rather than actual expense assignments, and policies that do

not fully allocate holding company expenses; minority

interest in income of consolidated entities; eliminations and

other corporate items. The impact these differences is

reflected in the “Other” category. Other also includes

equity management activities and residual asset and liability

management activities which do not meet the criteria for

disclosure as a separate reportable segment.

The impact of the institutional lending repositioning

and other strategic actions that occurred during 2001 and

2000 is reflected in the business results.

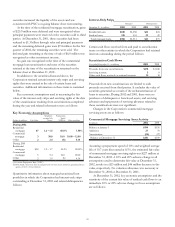

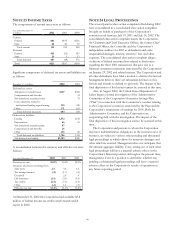

BUSINESS SEGMENT PRODUCTS AND SERVICES

Regional Community Banking provides deposit, lending,

cash management and investment services to two million

consumer and small business customers within PNC’s

geographic footprint.

Wholesale Banking includes the results for Corporate

Banking, PNC Real Estate Finance and PNC Business

Credit.

Corporate Banking provides credit, equipment leasing,

treasury management and capital markets products and

services to mid-sized corporations, government entities and

selectively to large corporations primarily within PNC’s

geographic region. Treasury management activities, which

include cash and investment management, receivables

management, disbursement services and global trade

services; capital markets products, which include foreign

exchange, derivatives trading and loan syndications; and

equipment leasing products are offered through Corporate

Banking and sold by several businesses across the

Corporation.

PNC Real Estate Finance specializes in financial

solutions for the acquisition, development, permanent

financing and operation of commercial real estate

nationally. PNC Real Estate Finance offers treasury and

investment management, access to the capital markets,

commercial mortgage loan servicing and other products

and services to clients that develop, own, manage or invest

in commercial real estate. PNC’s commercial real estate

financial services platform provides processing services

through Midland Loan Services, Inc., a leading third-party

provider of loan servicing and technology to the

commercial real estate finance industry. Columbia Housing

Partners, LP is a national syndicator of affordable housing.

PNC Business Credit provides asset-based lending,

treasury management and capital markets products and

services to middle market customers nationally. PNC

Business Credit’s lending services include loans secured by

accounts receivable, inventory, machinery and equipment,

and other collateral, and its customers include

manufacturing, wholesale, distribution, retailing and service

industry companies.

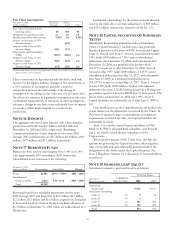

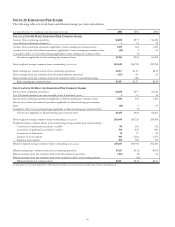

PNC Advisors provides a full range of tailored

investment, trust and banking products and services to

affluent individuals and families, including full-service

brokerage through J.J.B. Hilliard, W.L. Lyons, Inc. and

investment consulting and trust services to the ultra-

affluent through Hawthorn. PNC Advisors also serves as

investment manager and trustee for employee benefit plans

and charitable and endowment assets and provides defined

contribution plan services and investment options through

its Vested Interest product.

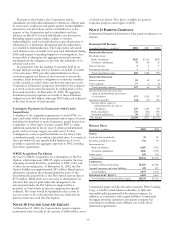

BlackRock is one of the largest publicly traded

investment management firms in the United States with

approximately $273 billion of assets under management at

December 31, 2002. BlackRock manages assets on behalf

of institutions and individuals worldwide through a variety

of fixed income, liquidity and equity mutual funds, separate

accounts and alternative investment products. Mutual

funds include the flagship fund families, BlackRock Funds

and BlackRock Provident Institutional Funds. In addition,

BlackRock provides risk management and investment

system services to institutional investors under the

BlackRock Solutions brand name.

PFPC is the largest full-service mutual fund transfer

agent and second largest provider of mutual fund

accounting and administration services in the United States,

offering a wide range of fund services to the investment

management industry. PFPC also provides processing

solutions to the international marketplace through its

Ireland and Luxembourg operations.