PNC Bank 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

2001 VERSUS 2000

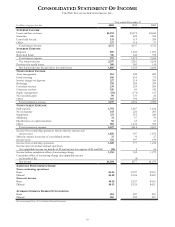

CONSOLIDATED INCOME STATEMENT REVIEW

Summary Results

Consolidated net income for 2001 was $377 million or $1.26

per diluted share. Excluding the effect of adopting the new

accounting standard for financial derivatives, net income was

$382 million or $1.28 per diluted share compared with $1.279

billion or $4.31 per diluted share for 2000. Income from

continuing operations in 2001 was $377 million or $1.26 per

diluted share compared with $1.214 billion or $4.09 per diluted

share in 2000. Income from discontinued operations was $5

million or $.02 per diluted share in 2001 compared with $65

million or $.22 per diluted share in 2000. Results for 2001

reflect the actions taken during the year to accelerate the

repositioning of PNC’s lending business and other strategic

initiatives. These charges, totaling $1.2 billion pretax, reduced

2001 net income by $768 million or $2.65 per diluted share.

Return on average common shareholders’ equity was

5.65% and return on average assets was .53% for 2001

compared with 20.52% and 1.76%, respectively, for 2000.

Net Interest Income

Taxable-equivalent net interest income of $2.278 billion for

2001 increased 4% compared with 2000 net interest income of

$2.182 billion. The increase was primarily due to the impact of

transaction deposit growth and a lower rate environment that

was partially offset by the impact of continued downsizing of

the loan portfolio. The net interest margin widened 20 basis

points to 3.84% for 2001 compared with 3.64% for 2000. The

increase was primarily due to the impact of the lower rate

environment, the benefit of growth in transaction deposits and

the downsizing of higher-cost, less valuable retail certificates

and wholesale deposits.

Provision For Credit Losses

The provision for credit losses was $903 million for 2001

which included $714 million associated with institutional

lending repositioning initiatives in 2001. The provision was

$136 million in 2000.

Noninterest Income

Noninterest income was $2.652 billion for 2001 compared

with $2.950 billion in 2000. Noninterest income in 2001

included charges of $259 million for valuation adjustments on

loans held for sale related to the institutional lending

repositioning and $17 million of charges for asset impairments

associated with other strategic initiatives. A $111 million

increase in net securities gains and growth in asset

management, fund servicing, consumer services and other

revenue was more than offset by net losses of $179 million

resulting from lower valuations of equity management

investments as well as reduced brokerage and corporate

services revenue as a result of lower capital markets activity.

Asset management fees of $848 million for 2001 increased

$39 million or 5% primarily driven by new institutional

business and strong fixed-income performance at BlackRock

which more than offset decreases at PNC Advisors primarily

due to the impact of declining equity markets. Consolidated

assets under management were $284 billion at December 31,

2001, a 12% increase compared with December 31, 2000.

Fund servicing fees were $833 million for 2001, a $120 million

increase compared with 2000 primarily driven by new client

growth.

Service charges on deposits increased 6% to $218 million

for 2001 mainly due to an increase in transaction deposit

accounts. Brokerage fees were $206 million for 2001

compared with $249 million for 2000 as increased fees from

sales of insurance products were more than offset by declines

in other brokerage revenue due to weak equity markets.

Consumer services revenue of $229 million for 2001

increased $20 million or 10% compared with 2000 mainly due

to the expansion of PNC’s ATM network and the increase in

transaction deposit accounts.

Corporate services revenue was $60 million for 2001

compared with $342 million for 2000. Revenue in 2001 was

adversely impacted by valuation adjustments on loans held for

sale of $259 million. In addition, increases in treasury

management and commercial mortgage-backed securities

servicing revenue were more than offset by the comparative

impact of losses resulting from lower valuations of equity

investments and lower capital markets fees in 2001.

Equity management (private equity activities) reflected net

losses of $179 million for 2001 compared with net gains of

$133 million in 2000. The decrease primarily resulted from a

decline in the estimated fair value of both limited partnership

and direct investments.

Net securities gains were $131 million for 2001 compared

with $20 million in 2000.

Other noninterest income was $306 million for 2001

compared with $269 million for 2000. Excluding $12 million

of asset write-downs in the fourth quarter of 2001, other

noninterest income increased 18% primarily due to higher

revenue from trading activities and gains on the sale of

residential mortgage loans. Net trading income included in

other noninterest income was $142 million in 2001 compared

with $84 million in 2000.