PNC Bank 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

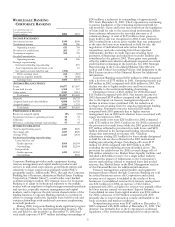

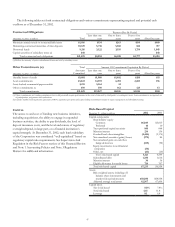

PFPC

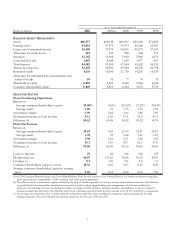

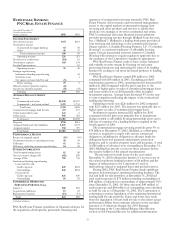

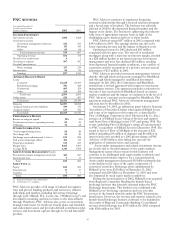

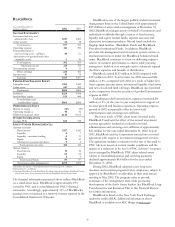

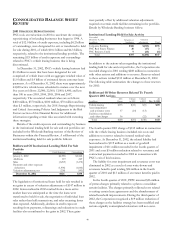

Year ended December 31

Dollars in millions 2002 2001

INCOME STATEMENT

Fund servicing revenue $817 $846

Operating expense 669 644

Goodwill amortization 40

(Accretion)/amortization of

other intangibles, net (19) (15)

Operating income 167 177

Nonoperating income (a) 10 14

Debt financing 88 94

Facilities consolidation and other

charges (19) 36

Pretax earnings 108 61

Income taxes 43 25

Earnings $65 $36

AVERAGE BALANCE SHEET

Intangible assets $1,028 $1,065

Other assets 860 706

Total assets $1,888 $1,771

Assigned funds and other liabilities $1,680 $1,563

Assigned capital 208 208

Total funds $1,888 $1,771

PERFORMANCE RATIOS

Return on assigned capital 31% 17%

Operating margin 23 17

OTHER INFORMATION

Average FTEs 5,834 5,737

SERVICING STATISTICS (b)

Accounting/administration assets

Domestic $481 $514

Foreign 29 21

Total $510 $535

Custody assets $336 $357

Shareholder accounts (in millions) 51 49

(a) Net of nonoperating expense.

(b) At December 31. Dollars in billions.

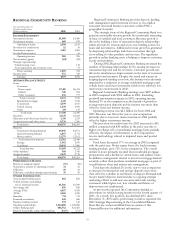

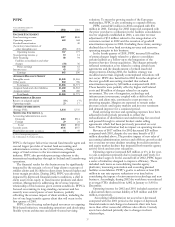

PFPC is the largest full-service mutual fund transfer agent and

second largest provider of mutual fund accounting and

administration services in the United States, offering a wide

range of fund services to the investment management

industry. PFPC also provides processing solutions to the

international marketplace through its Ireland and Luxembourg

operations.

The financial results for this business may be significantly

impacted by the net gain or loss of large clients or groups of

smaller clients and by shifts in client assets between higher and

lower margin products. During 2002, PFPC was adversely

impacted by depressed financial market conditions, a shift in

client assets from equity to fixed income products and client

attrition. Management is addressing the revenue/expense

relationship of this business given current conditions. PFPC is

focused on retaining its long-standing customers and has

recently won several pieces of new business, partially

offsetting the revenue impact of client attrition, including the

loss of one large transfer agency client that will occur in the

first quarter of 2003.

PFPC is also focusing technological resources on targeting

Web-based initiatives, streamlining operations and developing

flexible system architecture and client-focused servicing

solutions. To meet the growing needs of the European

marketplace, PFPC is also continuing to expand offshore.

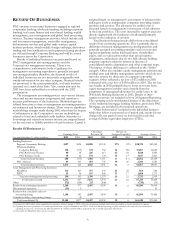

PFPC earned $65 million in 2002 compared with $36

million in 2001. Earnings for 2002 improved compared with

the prior year due to a reduction in the facilities consolidation

reserve originally established in 2001, a one-time revenue

adjustment of $13 million related to the renegotiation of a

customer contract in 2002 and the cessation of goodwill

amortization expense in 2002. Excluding those items, earnings

declined due to lower fund servicing revenue and narrower

operating margins in this business.

In the fourth quarter of 2001, PFPC incurred $36 million

of pretax charges largely related to a plan to consolidate

certain facilities as a follow-up to the integration of the

Investor Services Group acquisition. The charges primarily

reflected termination costs related to exiting certain lease

agreements and the abandonment of related leasehold

improvements. During 2002, the facilities strategy was

modified and certain originally contemplated relocations will

not occur. PFPC also benefited in 2002 from the adoption of

the new goodwill accounting standard that reduced

amortization expense by $40 million compared with 2001.

These benefits were partially offset by higher staff-related

costs and $8 million of charges related to an equity

investment. The cost of integration, technology and

infrastructure investments, coupled with a shift in both

product and client mix, continued to exert pressure on

operating margins. Margins are expected to remain under

pressure at least until equity markets and investor sentiment

and demand improve for a sustained period.

Fund servicing revenue and operating expenses have been

adjusted in both periods presented to reflect the

reclassification of distribution and underwriting fees received

and passed through to external brokers under selling

agreements which had been previously presented on a net

basis. This reclassification had no impact on operating income.

Revenue of $817 million for 2002 decreased $29 million

compared with 2001, despite the one-time benefit of $13

million described above. The positive impact of new sales of

accounting/administration services and offshore growth could

not overcome revenue declines resulting from client attrition

and equity market declines that impacted both transfer agency

activity levels and net asset valuations.

Operating expense increased $25 million or 4% in the year-

to-year comparison primarily due to increased staff levels for

new product support. In the second half of 2002, PFPC began

a series of initiatives designed to improve efficiency. These

included such items as consolidating transfer agency

platforms, increasing automation and executing planned

facilities consolidation. PFPC’s goal is to achieve at least $50

million in run rate expense reductions over time before

considering the impact of reinvestment in technology and new

business. Accordingly, during 2002 the workforce was reduced

as average FTEs declined from 6,082 in January to 5,401 in

December.

Operating income for 2002 and 2001 included accretion of

a discounted client contract liability of $35 million and $30

million, respectively.

Accounting/administration net assets have decreased

compared with the 2001 period as the impact of depressed

financial markets and changes in domestic client mix have

more than offset successful offshore sales efforts. Custody

assets have declined primarily due to changes in client

relationships.