PNC Bank 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.82

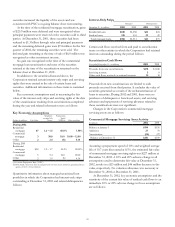

servicing term the realized credit losses in the Serviced

Portfolio exceed $50 million plus the specific reserves, then

PNC Business Credit will advance cash to NBOC for these

excess losses net of recoveries (“Excess Loss Payments”).

PNC is to be reimbursed by NBOC for any Excess Loss

Payments if the Put Option is not exercised. If the Put Option

is exercised, the Put Option purchase price will be reduced by

the amount of any Excess Loss Payments.

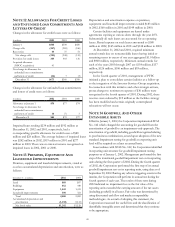

As part of the allocation of the purchase price for the

business acquired, PNC Business Credit established a liability of

$112 million to reflect its obligation under the Put Option. An

independent third party valuation firm valued the Put Option by

estimating the difference between the anticipated fair value of

loans from the Serviced Portfolio expected to be outstanding at

the put date and the anticipated Put Option purchase price. The

Put Option liability is revalued on a quarterly basis by the

independent valuation firm with changes in the value included

in earnings. At December 31, 2002 the Put Option liability was

approximately $57 million. A $28 million reduction from the

acquisition date amount was recognized in earnings in 2002 as

other noninterest income. In addition, $27 million has been

paid to NBOC as Excess Loss Payments.

If the Put Option is exercised, then PNC would record the

loans acquired as loans held for sale at the purchase price less

the balance of the Put Option liability at that date, which

should approximate fair value. The Put Option purchase price

will be NBOC’s outstanding principal balance for the loans

remaining in the Serviced Portfolio adjusted for the realized

credit losses during the servicing term and Excess Loss

Payments. As the realized credit losses have exceeded $50

million plus the specific reserves used, the Excess Loss

Payments made by PNC Business Credit to NBOC will be

deducted from NBOC’s outstanding principal balance in

determining the Put Option purchase price.

At December 31, 2002, the independent valuation firm

estimated that loans outstanding in the Serviced Portfolio at

the put date would be $175 million. The total credit losses over

the 18-month term of the servicing agreement are estimated to

be $87 million. Using these and other assumptions, if the Put

were exercised at the end of the servicing term, PNC would

record the acquired loans at $114 million. Actual results may

differ materially from these assumptions. See Note 29

Commitments And Guarantees.

Prior to closing of the acquisition, PNC Business Credit

transferred $49 million of nonperforming loans to NBOC in a

transaction accounted for as a financing. Those loans are

subject to the terms of the servicing agreement and are

included in the Serviced Portfolio amounts set forth above.

The loans were transferred to loans held for sale on PNC’s

balance sheet reflecting a loss of $9.9 million, which was

recognized as a charge-off in the first quarter of 2002. The

carrying amount of those loans held for sale was $5 million at

December 31, 2002 and is included in PNC’s nonperforming

assets. Excluding these loans, the Serviced Portfolio in January

2002 was $608 million of credit exposure including $414

million of outstandings of which $88 million was

nonperforming. At December 31, 2002, comparable amounts

were $249 million, $183 million and $53 million, respectively.

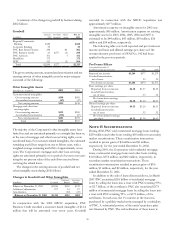

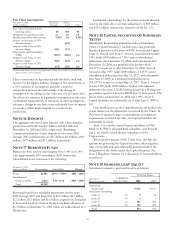

NOTE 3 REGULATORY MATTERS

The Corporation is subject to the regulations of certain federal

and state agencies and undergoes periodic examinations by

such regulatory authorities.

In July 2002, the Corporation announced that in order to

settle an inquiry by the Securities and Exchange Commission

(“SEC”) in connection with three 2001 transactions that gave

rise to a financial statement restatement announced by the

Corporation on January 29, 2002, PNC had consented to an

SEC cease and desist order. The Corporation did not admit or

deny the SEC’s findings. At the same time, the Corporation

announced that it had entered into a written agreement with

the Federal Reserve Bank of Cleveland (“Federal Reserve”)

and that its principal subsidiary, PNC Bank, had entered into a

written agreement with the Office of the Comptroller of the

Currency (“OCC”). These agreements address such issues as

risk, management and financial controls. The Corporation and

PNC Bank also entered into agreements with the Federal

Reserve and the OCC, respectively, requiring the Corporation

and PNC Bank to provide a plan for PNC Bank to meet the

“well capitalized” and “well managed” criteria within a 180-

day period.

As of December 19, 2002, the Federal Reserve and the

OCC notified the Corporation and PNC Bank, respectively,

that PNC Bank now met both the “well capitalized” and “well

managed” criteria. This removed the limitations placed in July

2002 on the Corporation’s engaging in new activities or

making new investments and on PNC Bank’s financial

subsidiary activities. However, the written agreements remain

in place, and the Corporation and PNC Bank in certain

circumstances must continue to obtain prior approval from

the Federal Reserve or the OCC, respectively, before making

acquisitions or engaging in new activities. In addition, under

applicable regulations, as long as the Corporation remains

subject to the written agreement with the Federal Reserve, the

Corporation must obtain prior regulatory approval to

repurchase its common stock in amounts that exceed 10

percent of consolidated net worth in any 12-month period.

The Corporation has incurred, and may continue to incur,

additional operating costs in connection with compliance with

these agreements including, among others, incremental staff

and continued higher legal and consulting expenses. Further,

the reputational risk created by the SEC cease and desist order

and the written agreements with the Federal Reserve and the

OCC could still have an impact on such matters as business

generation and retention, the ability to attract and retain

management, liquidity and funding.