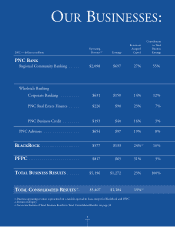

PNC Bank 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Companies rely on

PNC Bank, a trusted

financial advisor, to

support their growth

and success. Wholesale

Banking is distin-

guished in many ways.

PNC’s approach to Wholesale

Banking is evolving from a

product focus to a client-driven

model — one that seeks to

deepen existing relationships

primarily with middle market

companies. Our Wholesale

Banking businesses, which

include Corporate Banking,

PNC Real Estate Finance, and

PNC Business Credit, work

together to sell PNC’s breadth

of financial services. The goal

is to attract clients that meet

our risk-return criteria and

become their primary financial

services provider.

PNC’s key advantage

is its attractive suite of value-

added, noncredit products. The

focus, and opportunity for

growth, resides in the thousands

of middle market companies in

PNC’s traditional five-state

footprint. We offer core prod-

ucts and services, such as capital

markets, commercial real estate

loan servicing (offered through

Midland Loan Services), treasury

management, and equipment

leasing, to clients when we con-

sider the relationship risk/returns

to be appropriate and competi-

tive advantages exist.

This approach is designed

to help Wholesale Banking con-

tinue improving its credit risk

profile. We made significant

progress on this front in 2002

by liquidating $2.3 billion, or

88%, of the institutional held-

for-sale loan portfolio.

With our initiative to

reduce lower-return assets

largely behind us, Wholesale

Banking is working to improve

sales momentum and deliver

stronger returns moving forward.

PNC BANK WHOLESALE BANKING

•PNC Business Credit, a top

five asset-based lender

nationally, added more than

90 clients in 2002

•The nation’s ninth largest

treasury management

business almost doubled

customer usage of its A/R

Advantage product

•PNC Capital Markets obtained

financing of more than $600

million for 14 universities and

colleges plus six hospitals and

long-term care facilities

•Through Midland Loan

Services, PNC Real Estate

Finance has built a total servic-

ing portfolio of $74 billion