PNC Bank 2002 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

CREDIT RISK

Credit risk represents the possibility that a borrower,

counterparty or insurer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities and entering into financial

derivative transactions. The Corporation seeks to manage

credit risk through, among others, diversification, limiting

credit exposure to any single industry or customer, requiring

collateral, selling participations to third parties, and purchasing

credit-related derivatives.

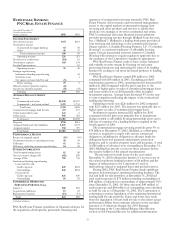

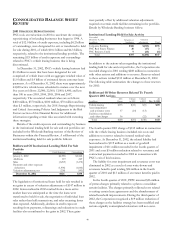

Allowances For Credit Losses And Unfunded Loan

Commitments And Letters Of Credit

The Corporation maintains an allowance for credit losses to

absorb losses from the loan portfolio. The allowance is

determined based on quarterly assessments of the probable

estimated losses inherent in the loan portfolio. The

methodology for measuring the appropriate level of the

allowance consists of several elements, including specific

allocations to impaired loans, allocations to pools of non-

impaired loans and unallocated reserves. While allocations are

made to specific loans and pools of loans, the total reserve is

available for all loan losses. Enhancements and refinements to

the reserve methodology during 2002 resulted in a reallocation

of the allowance for credit losses among the Corporation’s

businesses and from unallocated to specific and pool

categories.

In addition to the allowance for credit losses, the

Corporation maintains an allowance for unfunded loan

commitments and letters of credit. This amount, reported as a

liability on the Consolidated Balance Sheet, is determined

using estimates of the probability of the ultimate funding and

losses related to those credit exposures. The methodology

used is similar to the methodology used for determining the

adequacy of the allowance for credit losses.

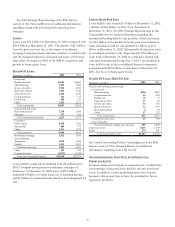

Specific allowances are established for loans considered

impaired by a method prescribed by SFAS No. 114,

“Accounting by Creditors for Impairment of a Loan.” All

nonperforming loans are considered impaired under SFAS

No. 114. Specific allowances are determined for individual

loans over a dollar threshold by PNC’s Special Asset

Committee based on an analysis of the present value of its

expected future cash flows discounted at its effective interest

rate, its observable market price or the fair value of the

underlying collateral. A minimum specific allowance is

established on all impaired loans at the applicable pool reserve

allocation for similar loans.

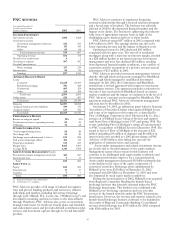

Allocations to non-impaired commercial and commercial

real estate loans (pool reserve allocations) are assigned to

pools of loans as defined by PNC’s business structure and

internal risk rating categories. Key elements of the pool

reserve methodology include expected default probabilities

(“EDP”), loss given default (“LGD”) and exposure at default

(“EAD”). EDPs are derived from historical default analyses

and are a function of the borrower’s risk rating grade and

expected loan term. LGDs are derived from historical loss

data and are a function of the loan’s collateral value and other

structural factors that may affect the ultimate ability to collect

on the loan. EADs are derived from banking industry and

PNC’s own exposure at default data. Enhancements and

refinements to the reserve methodology in 2002 consisted of

updating data elements in the pool reserve model. Specifically,

the EDP, EAD and LGD parameters were enhanced to reflect

updated historical performance data.

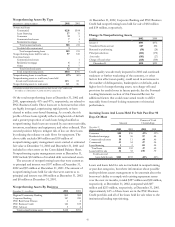

This methodology is sensitive to changes in key risk

parameters such as EDPs and LGDs. In general, a given

change in any of the major risk parameters will have a

commensurate change in the pool reserve allocations to non-

impaired commercial loans. Additionally, other factors such as

the rate of migration in the severity of problem loans or

changes in the maturity distribution of the loans will

contribute to the final pool reserve allocations.

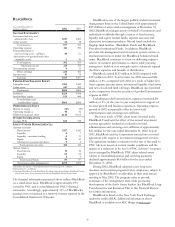

Consumer (including residential mortgage) loan

allocations are made at a total portfolio level by consumer

product line based on historical loss experience. A four-

quarter average loss rate is computed as net charge-offs for

the prior four quarters as a percentage of the average loan

outstandings in those quarters. This loss rate is applied to

loans outstanding at the end of the current period.

The final loan reserve allocations are based on this

methodology and management’s judgment of other

qualitative factors which may include, among others,

regional and national economic conditions, business

segment and portfolio concentrations, historical versus

estimated losses, model risk and changes to the level of

credit risk in the portfolio.

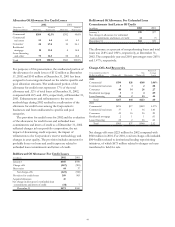

Unallocated reserves are established to provide coverage

for probable losses not considered in the specific, pool and

consumer reserve methodologies, such as, but not limited to,

potential judgment and data errors. Furthermore, events may

have occurred as of the reserve evaluation date that are not yet

reflected in the risk measures or characteristics of the portfolio

due to inherent lags in information. Management’s evaluation

of these and other relevant factors determines the level of

unallocated reserves established at the evaluation date.

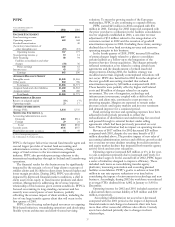

The Reserve Adequacy Committee provides oversight for

the allowance evaluation process, including quarterly

evaluations and methodology and estimation changes. The

results of the evaluations are reported to the Credit

Committee of the Board of Directors.