PNC Bank 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

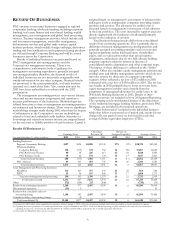

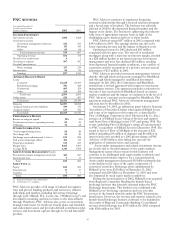

OVERVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

The Corporation is one of the largest diversified financial

services companies in the United States, operating businesses

engaged in regional community banking; wholesale banking,

including corporate banking, real estate finance and asset-

based lending; wealth management; asset management and

global fund processing services. The Corporation provides

certain products and services nationally and others in PNC’s

primary geographic markets in Pennsylvania, New Jersey,

Delaware, Ohio and Kentucky. The Corporation also provides

certain banking, asset management and global fund processing

services internationally.

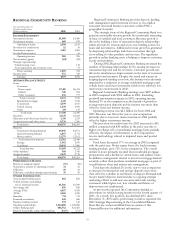

PNC’s strategies to enhance shareholder value include

expanding its deposit-driven banking franchise through

internal growth and, as opportunities arise, through targeted

acquisitions. In addition, the Corporation plans to leverage its

customer base and leading technology to grow the asset

management and processing businesses in an efficient and

effective manner. Efforts in recent years to reduce risk, grow

deposits and diversify the Corporation’s revenue mix have

enabled PNC to improve liquidity and build a strong capital

position.

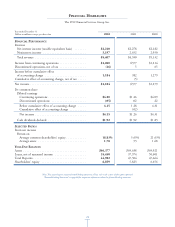

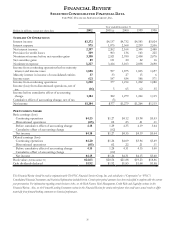

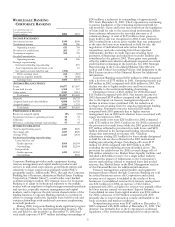

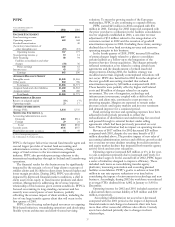

SUMMARY FINANCIAL RESULTS

Consolidated net income for 2002 was $1.184 billion or $4.15

per diluted share compared with $377 million or $1.26 per

diluted share for 2001. Results for 2002 reflected the adoption

of Statement of Financial Accounting Standards (“SFAS”) No.

142, “Goodwill and Other Intangible Assets,” under which

goodwill is no longer amortized to expense. Results for 2001

reflected the cost of actions taken during the year to accelerate

the repositioning of PNC’s lending business and other

strategic initiatives. These charges totaled $1.2 billion pretax

and reduced 2001 net income by $768 million or $2.65 per

diluted share. Excluding the effects of the strategic

repositioning charges and goodwill amortization expense, net

income for 2001 would have been $1.238 billion, or $4.23 per

diluted share.

Results for 2002 included a loss from discontinued

operations of $16 million, or $.05 per diluted share, compared

with income from discontinued operations in 2001 of $5

million, or $.02 per diluted share. Results for 2001 also

included an after-tax loss of $5 million, or $.02 per diluted

share, related to the cumulative effect of the accounting

change for the adoption of SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” as amended.

Return on average common shareholders’ equity was

18.83% and return on average assets was 1.78% for 2002

compared with 5.65% and .53%, respectively, for 2001.

The residential mortgage banking business, which was sold

in January 2001, is reflected in discontinued operations

throughout the Corporation’s consolidated financial

statements. The remainder of the presentation in this

Financial Review reflects continuing operations, unless

otherwise noted. See Note 4 Discontinued Operations in the

Notes to Consolidated Financial Statements for additional

information.

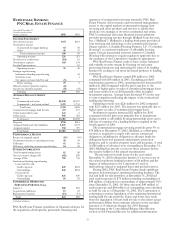

The Corporation’s results for 2002 reflected significant

progress in a number of key areas:

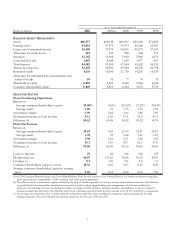

• As part of the Corporation’s overall risk repositioning

efforts, institutional loans held for sale were reduced $2.3

billion, or 88%, from December 31, 2001, with net gains

in excess of valuation adjustments totaling $147 million in

2002.

• Total shareholders’ equity increased $1.0 billion during

2002 to $6.9 billion at December 31, 2002.

• Capital flexibility was strengthened during 2002 as the

ratio of common shareholders’ equity to total assets

increased to 10.3% at December 31, 2002 compared with

8.3% at December 31, 2001.

• Lower cost funding sources increased as average total

transaction deposits increased $1.1 billion, to $30.7 billion,

compared with the prior year.

• In January 2003, PNC and Washington Mutual Bank, FA,

agreed to a settlement of all issues in dispute between

them in connection with the sale of the Corporation’s

residential mortgage banking business.

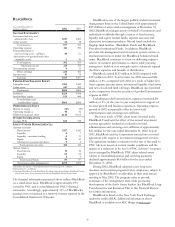

Management expects that 2003 will continue to be a

challenging operating environment that will limit opportunities

for revenue growth. The Corporation’s success in 2003 will

depend on the economy, interest rates, financial market

conditions, the impact of international hostilities and its

success in implementing current strategies, as well as PNC’s

ability to address its key operating challenges. These challenges

include the stability of asset quality, revenue growth and

development of value-added customer relationships. Other

factors that will affect the Corporation’s success include

leveraging technology, execution of a share repurchase

program, managing the revenue/expense relationship

including additional pension and stock-based compensation

costs, and regulatory actions. See also the Risk Factors, Risk

Management and Forward-Looking Statements sections of

this Financial Review.