PNC Bank 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

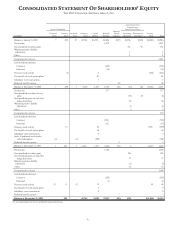

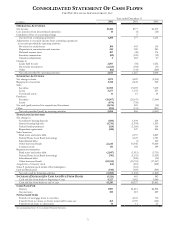

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

THE PNC FINANCIAL SERVICES GROUP, INC.

70

Shares Outstanding

Accumulated Other

Comprehensive

Income (Loss) from

In millions

Preferred

Stock

Common

Stock

Preferred

Stock

Common

Stock

Capital

Surplus

Retained

Earnings

Deferred

Benefit

Expense

Continuing

Operations

Discontinued

Operations

Treasury

Stock Total

Balance at January 1, 2000 7 293 $7 $1,764 $1,276 $6,006 $(17) $(132) $(135) $(2,823) $5,946

Net income 1,279 1,279

Net unrealized securities gains 86 90 176

Minimum pension liability

adjustment 11

Other 22

Comprehensive income 1,458

Cash dividends declared

Common (530) (530)

Preferred (19) (19)

Treasury stock activity (3) 6 (218) (212)

Tax benefit of stock option plans 20 20

Subsidiary stock transactions 1 1

Deferred benefit expense (8) (8)

Balance at December 31, 2000 7 290 7 1,764 1,303 6,736 (25) (43) (45) (3,041) 6,656

Net income 377 377

Net unrealized securities (losses)

gains (51) 45 (6)

Net unrealized gains on cash flow

hedge derivatives 98 98

Minimum pension liability

adjustment (1) (1)

Other 22

Comprehensive income 470

Cash dividends declared

Common (552) (552)

Preferred (12) (12)

Treasury stock activity (7) 26 (516) (490)

Tax benefit of stock option plans 40 40

Subsidiary stock transactions 33

Series F preferred stock tender

offer/redemption (6) (6) (295) (301)

Deferred benefit expense 99

Balance at December 31, 2001 1 283 1 1,764 1,077 6,549 (16) 5 (3,557) 5,823

Net income 1,184 1,184

Net unrealized securities gains 265 265

Net unrealized gains on cash flow

hedge derivatives 37 37

Minimum pension liability

adjustment (2) (2)

Other 16 16

Comprehensive income 1,500

Cash dividends declared

Common (545) (545)

Preferred (1) (1)

Treasury stock activity (1) 2 (1) 13 52 64

Tax benefit of stock option plans 9 9

Subsidiary stock transactions 2 2

Deferred benefit expense 77

Balance at December 31, 2002 285 $1,764 $1,101 $7,187 $(9) $321 $(3,505) $6,859

See accompanying Notes To Consolidated Financial Statements.