PNC Bank 2002 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

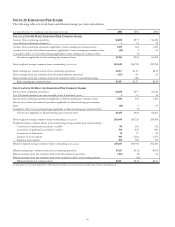

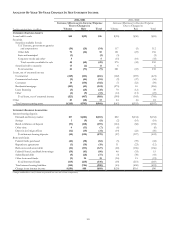

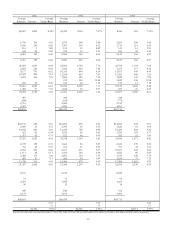

ANALYSIS OF YEAR-TO-YEAR CHANGES IN NET INTEREST INCOME

2002/2001 2001/2000

Increase/(Decrease) in Income/Expense

Due to Changes in:

Increase/(Decrease) in Income/Expense

Due to Changes in:

Taxable-equivalent basis - in millions Volume Rate Total Volume Rate Total

INTEREST-EARNING ASSETS

Loans held for sale $45 $(29) $16 $(35) $(50) $(85)

Securities

Securities available for sale

U.S. Treasury, government agencies

and corporations (34) (20) (54) 117 (5) 112

Other debt 76 (46) 30 181 (25) 156

State and municipal (1) (1) (3) (3)

Corporate stocks and other 55(15) (18) (33)

Total securities available for sale 48 (68) (20) 276 (44) 232

Securities held to maturity 13 (2) 11 66

Total securities 62 (71) (9) 281 (43) 238

Loans, net of unearned income

Commercial (245) (221) (466) (162) (259) (421)

Commercial real estate (9) (46) (55) (9) (47) (56)

Consumer 34 (136) (102) (7) (52) (59)

Residential mortgage (281) (43) (324) (275) 10 (265)

Lease financing (3) (25) (28) 70 (12) 58

Other (4) (9) (13) (14) (11) (25)

Total loans, net of unearned income (521) (467) (988) (399) (369) (768)

Other 81 (68) 13 24 (6) 18

Total interest-earning assets $(265) $(703) $(968) $(42) $(555) $(597)

INTEREST-BEARING LIABILITIES

Interest-bearing deposits

Demand and money market $17 $(282) $(265) $82 $(234) $(152)

Savings 1(9) (8) (2) (16) (18)

Retail certificates of deposit (91) (168) (259) (124) (68) (192)

Other time 4 (11) (7) (6) (6)

Deposits in foreign offices (12) (19) (31) (34) (22) (56)

Total interest-bearing deposits (45) (525) (570) (27) (397) (424)

Borrowed funds

Federal funds purchased (44) (38) (82) (5) (39) (44)

Repurchase agreements (1) (18) (19) 11 (23) (12)

Bank notes and senior debt (16) (111) (127) (60) (106) (166)

Federal Home Loan Bank borrowings (19) (61) (80) 48 (33) 15

Subordinated debt (9) (28) (37) (3) (38) (41)

Other borrowed funds (9) 24 15 (36) 15 (21)

Total borrowed funds (115) (215) (330) (18) (251) (269)

Total interest-bearing liabilities (144) (756) (900) (43) (650) (693)

Change in net interest income $(156) $88 $(68) $(20) $116 $96

Changes attributable to rate/volume are prorated into rate and volume components.