PNC Bank 2002 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117

|

|

103

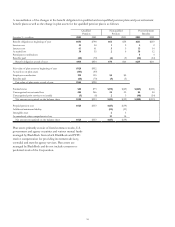

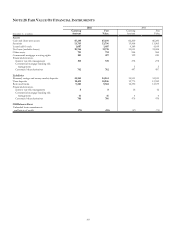

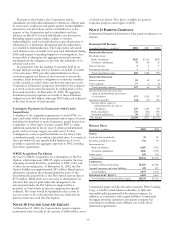

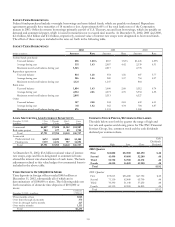

NOTE 28 FAIR VALUE OF FINANCIAL INSTRUMENTS

2002 2001

December 31 - in millions

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Cash and short-term assets $7,295 $7,295 $6,200 $6,200

Securities 13,763 13,796 13,908 13,905

Loans held for sale 1,607 1,607 4,189 4,189

Net loans (excludes leases) 30,766 31,718 33,011 33,588

Other assets 791 791 966 966

Commercial mortgage servicing rights 201 227 199 240

Financial derivatives

Interest rate risk management 519 519 278 278

Commercial mortgage banking risk

management 55

Customer/other derivatives 762 762 497 497

Liabilities

Demand, savings and money market deposits 34,363 34,363 34,531 34,531

Time deposits 10,619 10,946 12,773 12,942

Borrowed funds 9,383 9,544 12,390 12,579

Financial derivatives

Interest rate risk management 8816 16

Commercial mortgage banking risk

management 16 16 44

Customer/other derivatives 766 766 476 476

Off-Balance-Sheet

Unfunded loan commitments

and letters of credit (71) (85) (57) (71)