PNC Bank 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

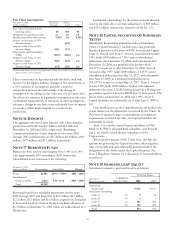

The securities classified as held to maturity are carried at

amortized cost and were owned by companies formed with

American International Group, Inc. (“AIG”) in 2001 that were

consolidated in PNC’s financial statements. In January 2003,

these securities were sold and these companies were

liquidated. See Note 32 Subsequent Events.

The expected weighted-average life of securities held to

maturity was 20 years and 2 months at December 31, 2002 and

18 years and 11 months at December 31, 2001. PNC had no

securities held for maturity at December 31, 2000.

At December 31, 2002, the securities available for sale

balance included a net unrealized gain of $274 million, which

represented the difference between fair value and amortized

cost. The comparable amounts at December 31, 2001 and

December 31, 2000 were net unrealized losses of $132 million

and $54 million, respectively. Net unrealized gains and losses

in the securities available for sale portfolio are included in

shareholders’ equity as accumulated other comprehensive

income or loss, net of tax or, for the portion attributable to

changes in a hedged risk as part of a fair value hedge strategy,

in net income.

Net securities gains were $89 million in 2002, $128 million

in 2001 and $29 million in 2000. Net securities gains for 2001

and 2000 included $3 million of net securities losses and $9

million of net securities gains, respectively, related to

commercial mortgage banking activities that were reported in

corporate services revenue. There were no comparable

amounts in 2002.

Information relating to securities sold is set forth in the

following table.

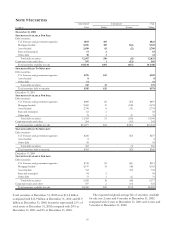

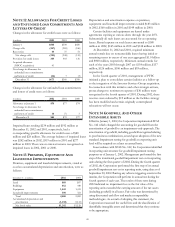

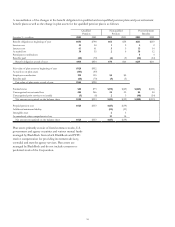

Securities Sold

Year ended

December 31

In millions Proceeds

Gross

Gains

Gross

Losses

Net

Gains Taxes

2002 $16,395 $106 $17 $89 $31

2001 19,693 144 16 128 45

2000 7,630 37 8 29 10

The carrying value of securities pledged to secure public and

trust deposits and repurchase agreements and for other

purposes was $9.5 billion and $6.2 billion at December 31,

2002 and December 31, 2001, respectively. The fair value of

securities accepted as collateral that the Corporation is

permitted by contract or custom to sell or repledge was $582

million at December 31, 2002, and is included in short-term

investments on the Consolidated Balance Sheet. Of this

amount, $524 million was repledged to others.

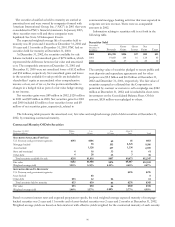

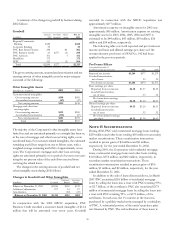

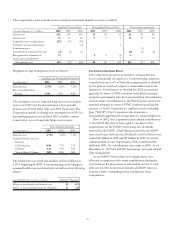

The following table presents the amortized cost, fair value and weighted-average yield of debt securities at December 31,

2002, by remaining contractual maturity.

Contractual Maturity Of Debt Securities

December 31, 2002 Within 1 to 5 to After 10

Dollars in millions 1 Year 5 Years 10 Years Years Total

SECURITIES AVAILABLE FOR SALE

U.S. Treasury and government agencies $193 $606 $9 $5 $813

Mortgage-backed 38 555 8,323 8,916

Asset-backed 1,128 237 1,334 2,699

State and municipal 418 33 661

Other debt 428 23 358

Total securities available for sale $201 $1,818 $857 $9,671 $12,547

Fair value $202 $1,908 $876 $9,847 $12

,

833

Weighted-average yield 1.35% 5.34% 4.22% 4.65% 4.67%

SECURITIES HELD

T

O M

A

TURIT

Y

U.S. Treasury and government agencies $276 $276

Asset-backed $8 8

Other debt $33 22 $6 61

Total securities held to maturity $33 $30 $6 $276 $345

Fair value $33 $30 $6 $309 $378

Weighted-average yield 1.48% 1.57% 5.88% 5.77% 4.99%

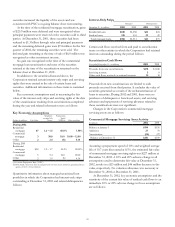

Based on current interest rates and expected prepayment speeds, the total weighted-average expected maturity of mortgage-

backed securities was 2 years and 11 months and of asset-backed securities was 2 years and 2 months at December 31, 2002.

Weighted-average yields are based on historical cost with effective yields weighted for the contractual maturity of each security.