PNC Bank 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

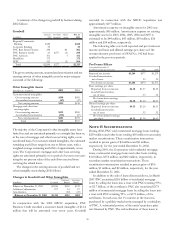

billion at December 31, 2002 and December 31, 2001,

respectively, that were designated for exit and will mature over

a period of approximately four years. Costs incurred in 2001

to exit this business, including the impairment of goodwill

associated with a prior acquisition and employee severance

costs and additions to reserves related to insured residual value

exposures, totaled $135 million and were charged to

noninterest expense in 2001.

The Corporation also recorded charges of $65 million in

the fourth quarter of 2001 for certain integration, severance

and other costs related to other strategic initiatives. During

2002, the Corporation recognized a $19 million reduction of

these charges that related to a PFPC facilities consolidation

strategy that has been modified, as certain originally

contemplated relocations will not occur.

NOTE 6 SALE OF SUBSIDIARY STOCK

PNC recognizes as income the gain from the sale of stock by

its subsidiaries. The gain is the difference between PNC’s basis

in the stock and the proceeds per share received. PNC

provides applicable taxes on the gain. Gains from the sale of

stock by PNC’s subsidiaries are recorded in other noninterest

income in the Consolidated Statement Of Income and were

not material for 2002, 2001 or 2000.

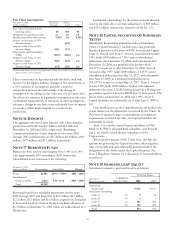

NOTE 7 CASH FLOWS

For the consolidated statement of cash flows, cash and cash

equivalents are defined as cash and due from banks.

The following table sets forth information pertaining to

acquisitions and divestitures that affected cash flows:

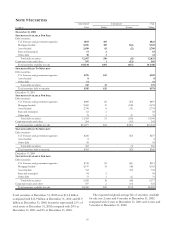

Cash Flows

Y

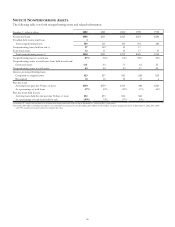

ear ended December 31 - in millions 2002 2001 2000

Assets (acquired) divested $(1,736) $7,252 $(4)

Liabilities (acquired) divested (60) 6,852 (4)

Cash paid 1,676 18 31

Cash and due from banks received 503 1

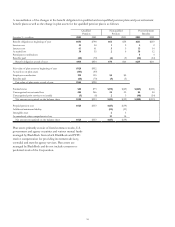

NOTE 8 TRADING ACTIVITIES

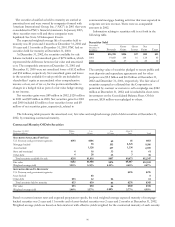

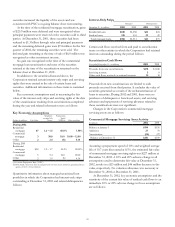

Most of PNC’s trading activities are designed to provide

capital markets services to customers and not to position the

Corporation’s portfolio for gains from market movements.

PNC participates in derivatives and foreign exchange trading

as well as underwriting and “market making” in equity

securities as an accommodation to customers. PNC also

engages in trading activities as part of risk management

strategies.

Net trading income in 2002, 2001 and 2000 included in

noninterest income was as follows:

Details Of Trading Activities

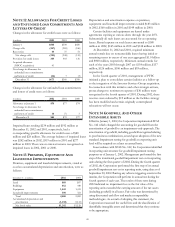

Year ended December 31 - in millions 2002 2001 2000

Corporate services $1 $5 $7

Other noninterest income

Securities underwriting and

trading 55 55 42

Derivatives trading 11 61 20

Foreign exchange 25 26 22

Net tradin

g

income $92 $147 $91