PNC Bank 2002 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

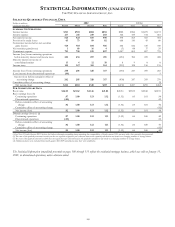

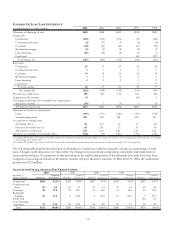

111

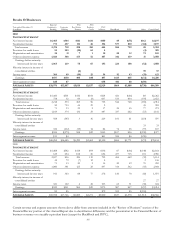

2000 1999 1998

Average

Balances Interest

Average

Yields/Rates

Average

Balances Interest

Average

Yields/Rates

Average

Balances Interest

Average

Yields/Rates

$2,507 $204 8.14% $1,392 $104 7.47% $436 $31 7.11%

1,760 104 5.91 1,970 108 5.48 3,665 208 5.68

3,545 234 6.60 3,307 209 6.32 1,770 114 6.44

114 9 7.89 135 12 8.89 141 14 9.93

642 42 6.54 672 37 5.51 553 30 5.42

6,061 389 6.42 6,084 366 6.02 6,129 366 5.97

6,061 389 6.42 6,084 366 6.02 6,129 366 5.97

21,685 1,839 8.48 23,082 1,792 7.76 22,768 1,794 7.88

2,685 240 8.94 3,362 265 7.88 3,279 277 8.45

9,177 791 8.62 10,310 844 8.19 11,073 940 8.49

12,599 900 7.14 12,258 859 7.01 12,421 900 7.25

3,222 235 7.29 2,564 182 7.10 2,028 143 7.05

672 100 14.88 3,849 538 13.98

650 55 8.46 532 40 7.52 195 14 7.18

50,018 4,060 8.12 52,780 4,082 7.73 55,613 4,606 8.28

1,289 97 7.53 1,045 53 5.07 899 47 5.23

59,875 4,750 7.93 61,301 4,605 7.51 63,077 5,050 8.01

487 449 348

(

608

)

(619) (772)

2,718 2,082 2,211

6,581 5,226 4,851

$69,053 $68,439 $69,715

$18,735 658 3.51 $16,921 493 2.91 $14,285 439 3.07

2,050 36 1.76 2,390 39 1.63 2,620 51 1.95

14,642 826 5.64 14,220 708 4.98 15,420 826 5.36

621 40 6.44 1,515 85 5.61 1,786 103 5.77

1,473 93 6.31 872 44 5.05 935 52 5.56

37,521 1,653 4.41 35,918 1,369 3.81 35,046 1,471 4.20

2,139 135 6.31 1,662 84 5.05 2,526 139 5.50

754 45 5.97 621 31 4.99 791 42 5.31

6,532 431 6.60 8,517 457 5.37 10,657 605 5.68

1,113 68 6.11 1,929 105 5.44 1,026 60 5.85

2,406 179 7.44 2,051 154 7.51 1,799 140 7.78

802 57 7.11 686 39 5.69 1,109 79 7.12

13,746 915 6.66 15,466 870 5.63 17,908 1,065 5.95

51,267 2,568 5.01 51,384 2,239 4.36 52,954 2,536 4.79

8,151 8,234 8,848

75 76 91

2,479 1,995 1,465

96 32 14

848 848 762

6,137 5,870 5,581

$69,053 $68,439 $69,715

2.92 3.15 3.22

.72 .71 .77

$2,182 3.64% $2,366 3.86% $2,514 3.99%

Loan fees for each of the years ended December 31, 2002, 2001, 2000, 1999 and 1998 were $106 million, $119 million, $115 million, $120 million and $107 million, respectively.