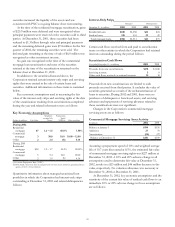

PNC Bank 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

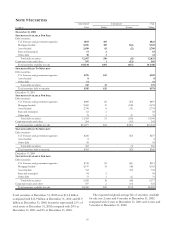

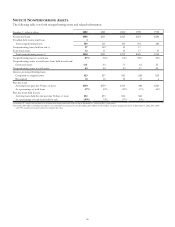

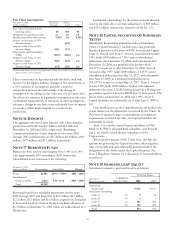

The following table sets forth regulatory capital ratios for

PNC and its only significant bank subsidiary, PNC Bank:

Regulatory Capital

Amount Ratios

December 31

Dollars in millions 2002 2001 2002 2001

Risk-based capital

Tier I

PNC $5,121 $4,599 8.8% 7.8%

PNC Bank, N.A. 5,160 4,704 9.8 8.7

Total

PNC 7,233 6,958 12.5 11.8

PNC Bank, N.A. 6,877 6,581 13.0 12.1

Leverage

PNC 5,121 4,599 8.1 6.8

PNC Bank, N.A. 5,160 4,704 9.0 7.6

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in large part, on a financial institution’s

capital strength. The minimum regulatory capital ratios are 4%

for Tier I risk-based, 8% for total risk-based and 3% for

leverage. However, regulators may require higher capital levels

when particular circumstances warrant. To qualify as “well

capitalized,” regulators require banks to maintain capital ratios

of at least 6% for Tier I risk-based, 10% for total risk-based

and 5% for leverage. At December 31, 2002, each bank

subsidiary of the Corporation met the “well capitalized”

capital ratio requirements.

The principal source of parent company revenue and cash

flow is the dividends it receives from PNC Bank. PNC Bank’s

dividend level may be impacted by its capital needs,

supervisory policies, corporate policies, contractual restrictions

and other factors. Also, there are statutory limitations on the

ability of national banks to pay dividends or make other capital

distributions. Without regulatory approval, the amount

available for payment of dividends by PNC Bank was $460

million at December 31, 2002. Management expects that the

parent company will have sufficient liquidity available to pay

dividends at current rates through 2003.

Under federal law, bank subsidiaries generally may not

extend credit to the parent company or its nonbank

subsidiaries on terms and under circumstances that are not

substantially the same as comparable extensions of credit to

nonaffiliates. No extension of credit may be made to the

parent company or a nonbank subsidiary which is in excess of

10% of the capital stock and surplus of such bank subsidiary

or in excess of 20% of the capital and surplus of such bank

subsidiary as to aggregate extensions of credit to the parent

company and its subsidiaries. Such extensions of credit, with

limited exceptions, must be fully collateralized by certain

specified assets. In certain circumstances, federal regulatory

authorities may impose more restrictive limitations.

Federal Reserve Board regulations require depository

institutions to maintain cash reserves with the Federal Reserve

Bank. During 2002, subsidiary banks maintained reserves

which averaged $112 million.

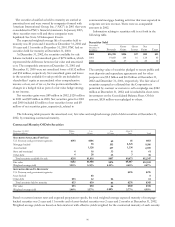

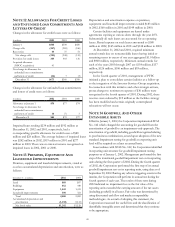

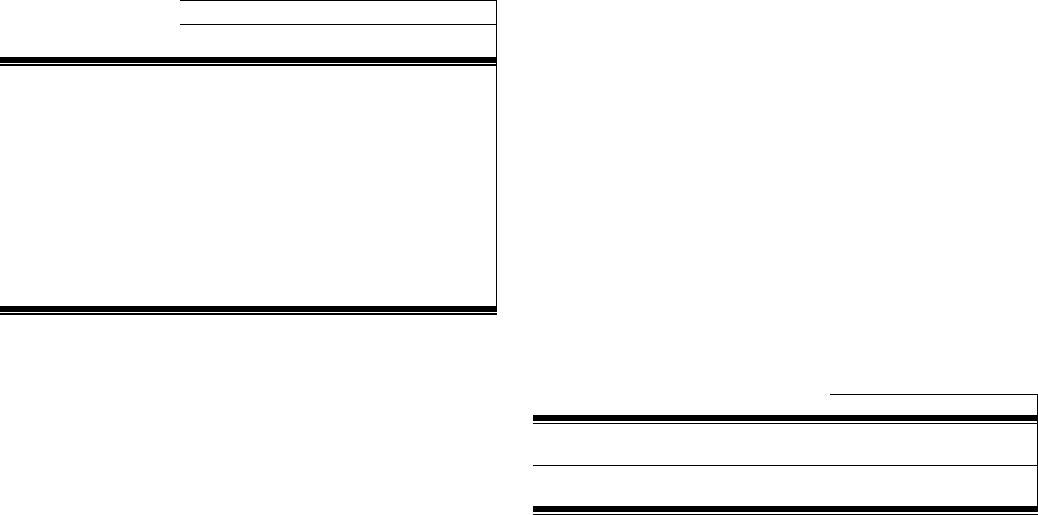

NOTE 4 DISCONTINUED OPERATIONS

In the first quarter of 2001, PNC closed the sale of its residential

mortgage banking business. In January 2003, PNC and the

buyer, Washington Mutual Bank, FA, agreed to a settlement of

all issues in dispute between them in connection with the sale.

The settlement has been reported in PNC’s fourth quarter

2002 results in discontinued operations. The results of the

residential mortgage banking business, which are presented on

one line in the Consolidated Statement Of Income, are as

follows:

Income (Loss) From Discontinued Operations

Year ended December 31 - in millions 2002 2001 2000

Income from operations, after tax $15 $65

Net loss on sale of business, after tax $(16) (10)

Total income (loss) from discontinued

operations $(16) $5 $65

There were no net assets of the residential mortgage banking

business remaining at either December 31, 2002 or December

31, 2001.

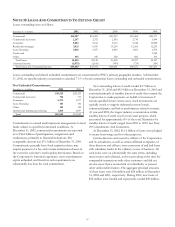

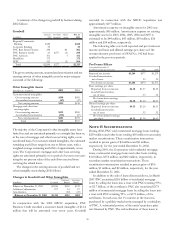

NOTE 5 FOURTH QUARTER 2001 ACTIONS

In the fourth quarter of 2001, PNC took several actions to

accelerate the strategic repositioning of its lending businesses

that began in 1998. The Corporation decided to exit

approximately $7.9 billion of credit exposure including $3.1

billion of loan outstandings in the institutional lending

portfolios. Of these amounts, approximately $5.2 billion of

credit exposure and $2.9 billion of loans, respectively, were

transferred to loans held for sale in 2001. In connection with

the transfer to held for sale, $653 million of charge-offs and

valuation adjustments were recognized in the fourth quarter of

2001. In addition, $90 million in charge-offs were taken

against the allowance for credit losses specifically allocated to

these loans in the fourth quarter of 2001. During 2002, actions

were begun to liquidate the institutional held for sale portfolio

resulting in net gains in excess of valuation adjustments

totaling $147 million. Approximately $626 million of exposure

and $298 million of loans remained to be liquidated at

December 31, 2002.

Also in the fourth quarter of 2001, PNC decided to

discontinue its vehicle leasing business due to continued

depressed market conditions and the increased difficulty and

cost of obtaining residual value insurance protection. The

vehicle leasing business had assets of $1.4 billion and $1.9