PNC Bank 2002 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

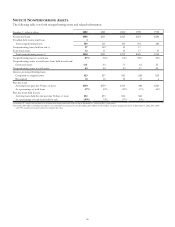

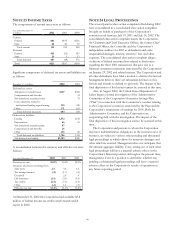

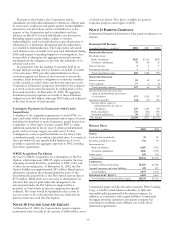

NOTE 23 INCOME TAXES

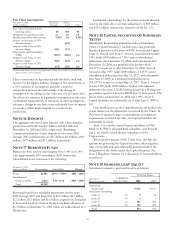

The components of income taxes were as follows:

Year ended December 31

In millions 2002 2001 2000

Current

Federal $86 $195 $226

State 48 40 32

T

otal current 134 235 258

Deferred

Federal 463

(

51

)

363

State 24 313

Total deferred 487 (48) 376

Total $621 $187 $634

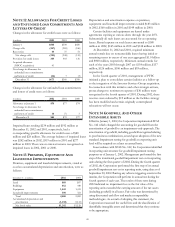

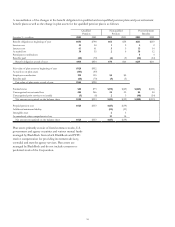

Significant components of deferred tax assets and liabilities are

as follows:

December 31 - in millions 2002 2001

Deferred tax assets

A

llowance for credit losses $297 $225

Compensation and benefits 31

Net unrealized securities losses 75

Loan valuations related to

institutional lending repositioning 135 330

Other 171 163

T

otal deferred tax assets 603 824

D

eferred tax liabilities

Leasing 1,372 1,182

Depreciation 66 53

Net unrealized securities

g

ains 87

Com

p

ensation and benefits 26

Other 155 89

T

otal deferred tax liabilities 1

,

706 1

,

324

Net deferred tax liability $1,103 $500

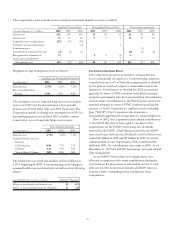

A reconciliation between the statutory and effective tax rates

follows:

Year ended December 31 2002 2001 2000

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes 2.5 4.6 1.6

Tax-exempt interest (.4) (1.7) (.6)

Goodwill 2.9 .9

Life insurance (1.1) (3.3) (1.0)

Tax credits (2.4) (7.2) (1.8)

Other (.2) 1.0 (.3)

Effective tax rate 33.4% 31.3% 33.8%

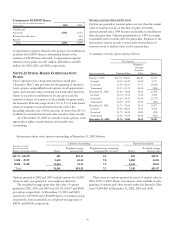

At December 31, 2002 the Corporation had available $3.8

million of federal income tax credit carryforwards which

expire in 2022.

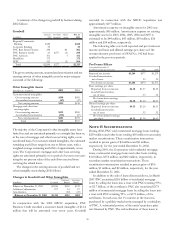

NOTE 24 LEGAL PROCEEDINGS

The several putative class action complaints filed during 2002

were consolidated in a consolidated class action complaint

brought on behalf of purchasers of the Corporation’s

common stock between July 19, 2001 and July 18, 2002. The

consolidated class action complaint names the Corporation,

the Chairman and Chief Executive Officer, the former Chief

Financial Officer, the Controller and the Corporation’s

independent auditors for 2001 as defendants and seeks

unquantified damages, interest, attorneys’ fees and other

expenses. The consolidated class action complaint alleges

violations of federal securities laws related to disclosures

regarding the three 2001 transactions that gave rise to a

financial statement restatement announced by the Corporation

on January 29, 2002 and related matters. The Corporation and

all other defendants have filed a motion to dismiss this lawsuit.

Management believes there are substantial defenses to this

lawsuit and intends to defend it vigorously. The impact of the

final disposition of this lawsuit cannot be assessed at this time.

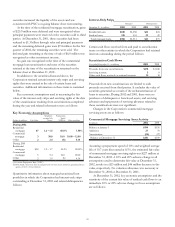

Also, in August 2002, the United States Department of

Labor began a formal investigation of the Administrative

Committee of the Corporation’s Incentive Savings Plan

(“Plan”) in connection with the Committee’s conduct relating

to the Corporation’s common stock held by the Plan and the

Corporation’s restatement of earnings for 2001. Both the

Administrative Committee and the Corporation are

cooperating fully with the investigation. The impact of the

final disposition of this investigation cannot be assessed at this

time.

The Corporation and persons to whom the Corporation

may have indemnification obligations, in the normal course of

business, are subject to various other pending and threatened

legal proceedings in which claims for monetary damages and

other relief are asserted. Management does not anticipate that

the ultimate aggregate liability, if any, arising out of such other

legal proceedings will have a material adverse effect on the

Corporation’s financial position, although at the present time,

management is not in a position to determine whether any

pending or threatened legal proceedings will have a material

adverse effect on the Corporation’s results of operations in

any future reporting period.