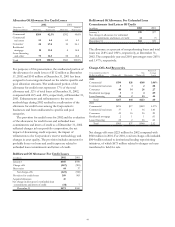

PNC Bank 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

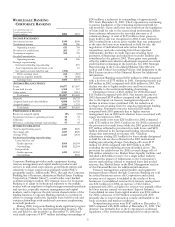

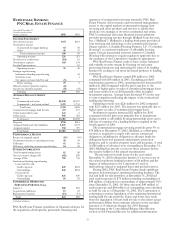

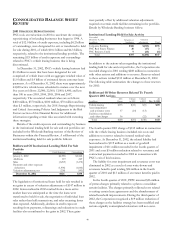

CONSOLIDATED BALANCE SHEET

REVIEW

2001 STRATEGIC REPOSITIONING

PNC took several actions in 2001 to accelerate the strategic

repositioning of its lending businesses that began in 1998. A

total of $12.0 billion of credit exposure, including $6.2 billion

of outstandings, were designated for exit or transferred to held

for sale during 2001, of which $10.1 billion and $4.3 billion,

respectively, related to the institutional lending portfolio. The

remaining $1.9 billion of credit exposure and outstandings

related to PNC’s vehicle leasing business that is being

discontinued.

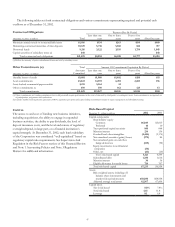

At December 31, 2002, PNC’s vehicle leasing business had

$1.4 billion in assets that have been designated for exit

comprised of vehicle leases with an aggregate residual value of

$1.0 billion and $.4 billion of estimated future customer lease

payments. As of December 31, 2002 there were approximately

64,800 active vehicle leases scheduled to mature over the next

five years as follows: 22,900, 22,500, 13,000, 6,400, and less

than 100 in years 2003, 2004, 2005, 2006 and 2007,

respectively. The associated residual values are as follows:

$400 million, $370 million, $180 million, $70 million and less

than $.5 million, respectively. See 2001 Strategic Repositioning

and Critical Accounting Policies And Judgments in the Risk

Factors section of this Financial Review for additional

information regarding certain risks associated with executing

these strategies.

Details of the credit exposure and outstandings by business

in the institutional lending held for sale and exit portfolios are

included in the Wholesale Banking sections of the Review of

Businesses within this Financial Review. A rollforward of the

institutional lending held for sale portfolio follows:

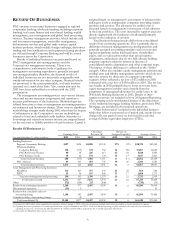

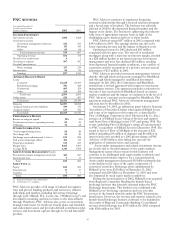

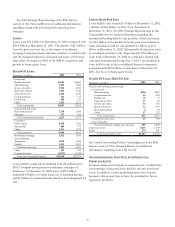

Rollforward Of Institutional Lending Held For Sale

Portfolio

In millions Credit Exposure Outstandings

January 1, 2002 $4,958 $2,568

Additions 119 249

Sales (2,205) (1,278)

Payments and other exposure

reductions (1,996) (1,046)

Valuation adjustments, net (250) (195)

December 31, 2002 $626 $298

The liquidation of institutional loans held for sale resulted in

net gains in excess of valuation adjustments of $147 million in

2002. Gains realized in 2002 resulted from a more active

market than was anticipated at the time the loans were

transferred to held for sale, the negotiation of individual loan

sales rather than bulk transactions, and sales occurring faster

than expected. Additionally, declines in credit exposure

resulting from payments, refinancings and reductions in credit

facilities also contributed to the gains in 2002. These gains

were partially offset by additional valuation adjustments

required on certain credit facilities remaining in the portfolio.

Details by Wholesale Banking business follow.

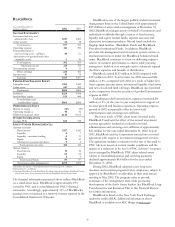

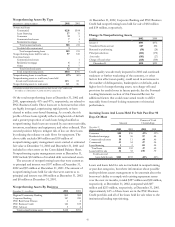

Institutional Lending Held for Sale Activity

Year ended

December 31, 2002 Net gains on Valuation

In millions liquidation adjustments Total

Corporate Banking $368 $(213) $155

PNC Real Estate Finance 20 (17) 3

PNC Business Credit 9 (20) (11)

Total $397 $(250) $147

In addition to the actions taken regarding the institutional

lending held for sale and exit portfolios, the Corporation also

recorded charges in 2001 totaling $208 million in connection

with other actions and additions to reserves. Reserves related

to these actions totaled $133 million at December 31, 2002.

The following table summarizes the changes to these reserves

for 2002:

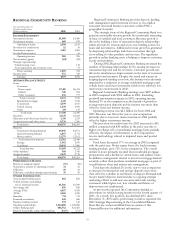

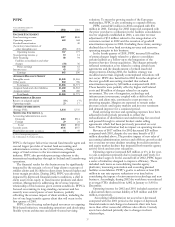

Rollforward Of Other Reserves Related To Fourth

Quarter 2001 Actions

In millions

2001

Charge

Utilized

in 2001

Utilized

in 2002

At

Dec. 31, 2002

Vehicle leasing $135 $(11) $(5) $119

Asset impairment

and severance costs 37 (24) (13)

Facilities consolidation

and other charges 36 (22) 14

Total $208 $(35) $(40) $133

The fourth quarter 2001 charge of $135 million in connection

with the vehicle leasing business included exit costs and

additions to reserves related to insured residual value

exposures. At December 31, 2002, the related liability had

been reduced to $119 million as a result of goodwill

impairment of $11 million recorded in the fourth quarter of

2001 and a net $5 million reduction related to severance and

contractual payments recorded in 2002 in connection with

PNC’s exit of this business.

The liability for asset impairment and severance costs was

eliminated in 2002 as a result of asset write-downs and

severance benefits paid totaling $24 million in the fourth

quarter of 2001 and $13 million of severance benefits paid in

2002.

In the fourth quarter of 2001, PFPC incurred $36 million

of pretax charges primarily related to a plan to consolidate

certain facilities. The charges primarily reflected costs related

to exiting certain lease agreements and the abandonment of

related leasehold improvements. During the third quarter of

2002, the Corporation recognized a $19 million reduction of

these charges as the facilities strategy has been modified and

certain originally contemplated relocations will not occur.