PNC Bank 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

years and consistent with current market conditions. More

emphasis is being placed on the management of capital for

other investors. See Equity Management Asset Valuation in

the Risk Factors section of this Financial Review for additional

information.

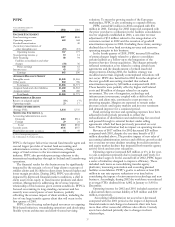

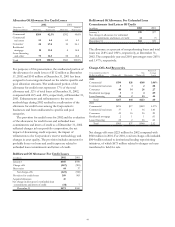

FUNDING SOURCES

Total funding sources were $54.1 billion at December 31, 2002

and $59.4 billion at December 31, 2001, a decrease of $5.3

billion corresponding to a decrease of $3.3 billion in total

assets and increases in accrued expenses and other liabilities

and in total shareholders’ equity of $.9 billion and $1.0 billion,

respectively. Total deposits decreased $2.3 billion from

December 31, 2001 primarily due to a $1.1 billion decrease in

deposits in foreign offices and a $.9 billion decrease in retail

certificates of deposit. Borrowed funds decreased consistent

with declines in total assets and earning assets.

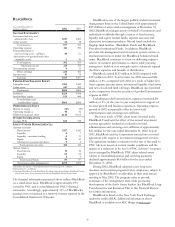

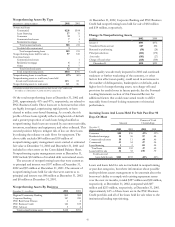

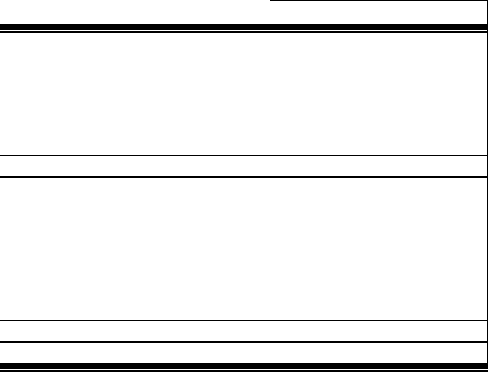

Details Of Funding Sources

December 31 - in millions 2002 2001

Deposits

Demand and money market $32,349 $32,589

Savings 2,014 1,942

Retail certificates of deposit 9,839 10,727

Other time 317 472

Deposits in foreign offices 463 1,574

Total deposits 44,982 47,304

Borrowed funds

Federal funds purchased 38 167

Repurchase agreements 814 954

Bank notes and senior debt 4,400 6,362

Federal Home Loan Bank borrowings 1,256 2,047

Subordinated debt 2,423 2,298

Other borrowed funds 185 262

Total borrowed funds 9,116 12,090

Total $54,098 $59,394

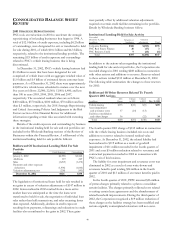

LIQUIDITY

Liquidity represents the Corporation’s ability to obtain cost-

effective funding to meet the needs of customers as well as the

Corporation’s financial obligations. Liquidity is centrally

managed by Asset and Liability Management, with oversight

provided by the Executive Asset and Liability Committee and

the Finance Committee of the Board of Directors.

The Corporation’s main sources of funds to meet its

liquidity requirements are access to the capital markets, sale of

liquid assets, secured advances from the Federal Home Loan

Bank, its core deposit base and the capability to securitize

assets.

Access to capital markets is a key factor affecting

liquidity management. Access to such markets is in part based

on the Corporation’s credit ratings, which are influenced by a

number of factors including capital ratios, asset quality and

earnings. Additional factors that impact liquidity include the

maturity structure of existing assets, liabilities, and off-balance-

sheet positions, the level of liquid securities and loans available

for sale, and the Corporation’s ability to securitize and sell

various types of loans.

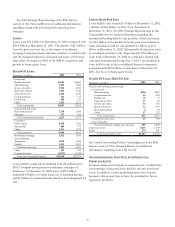

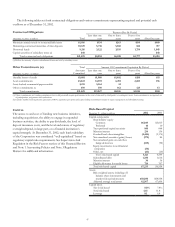

Liquid assets consist of short-term investments and

securities available for sale. At December 31, 2002, such assets

totaled $17.1 billion, with $9.5 billion pledged as collateral for

borrowings, trust and other commitments. Secured advances

from the Federal Home Loan Bank, of which PNC Bank,

N.A. (“PNC Bank”) PNC’s principal bank subsidiary, is a

member, are generally secured by residential mortgages, other

real-estate related loans and mortgage-backed securities. At

December 31, 2002, total unused borrowing capacity from the

Federal Home Loan Bank under current collateral

requirements was $10.0 billion. Funding can also be obtained

through alternative forms of borrowing, including federal

funds purchased, repurchase agreements and short-term and

long-term debt issuance.

Liquidity for the parent company and PNC’s non-bank

subsidiaries is also generated through the issuance of securities

in public or private markets and lines of credit. At December

31, 2002, the Corporation had unused capacity under effective

shelf registration statements of approximately $3.3 billion of

debt or equity securities and $400 million of trust preferred

capital securities. The parent company had an unused line of

credit of $460 million at December 31, 2002, which expires in

2003.

The principal source of parent company revenue and cash

flow is the dividends it receives from PNC Bank. PNC Bank’s

dividend level may be impacted by its capital needs,

supervisory policies, corporate policies, contractual restrictions

and other factors. Also, there are statutory limitations on the

ability of national banks to pay dividends or make other capital

distributions. The amount available for dividend payments to

the parent company by all bank subsidiaries without prior

regulatory approval was approximately $460 million at

December 31, 2002.

In addition to dividends from PNC Bank, other sources of

parent company liquidity include cash and short-term

investments, as well as dividends and loan repayments from

other subsidiaries. As of December 31, 2002, the parent

company had approximately $719 million in funds available

from its cash and short-term investments or other funds

available from unrestricted subsidiaries. Management expects

that the parent company will have sufficient liquidity available

to meet current obligations to its debt holders, vendors, and

others and to pay dividends at current rates through 2003.