PNC Bank 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81

In October 2002, the FASB issued SFAS No. 147,

"Acquisitions of Certain Financial Institutions." This

statement clarified that, only if certain criteria are met, an

acquisition of a less-than-whole financial institution (such as a

branch acquisition) should be accounted for as a business

combination. In addition, SFAS No. 147 amends SFAS No.

144 to include in its scope long-term customer-relationship

intangible assets of financial institutions such as depositor- and

borrower-relationship intangible assets. As a result, those

intangible assets are subject to the same undiscounted cash

flow recoverability test and impairment loss recognition and

measurement provisions that SFAS No. 144 requires for other

long-lived assets that are held and used by a company. SFAS

No. 147 became effective October 1, 2002 and did not have a

material impact on the Corporation’s consolidated financial

statements.

In November 2002, the FASB issued FIN 45, "Guarantor’s

Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others."

FIN 45 elaborates on the existing disclosure requirements for

most guarantees, including loan guarantees such as standby

letters of credit and indemnifications. It also clarifies that at

the time a company issues a guarantee, the company must

recognize an initial liability for the fair or market value of the

obligations it assumes under that guarantee and must disclose

that information in its interim and annual financial statements.

The provisions related to recognizing a liability at inception of

the guarantee for the fair value of the guarantor’s obligations

would not apply to guarantees accounted for as derivatives.

The initial recognition and measurement provisions apply on a

prospective basis to guarantees issued or modified after

December 31, 2002. See Note 29 Commitments And

Guarantees for the disclosures currently required under FIN

45.

In December 2002, the FASB issued SFAS No. 148,

"Accounting for Stock-Based Compensation--Transition and

Disclosure." This statement amends SFAS No. 123, to provide

alternative methods of transition for a voluntary change to the

fair value based method of accounting for stock-based

employee compensation. In addition, this statement amends

the disclosure requirements of SFAS No. 123 to require

disclosures in both annual and interim financial statements

regarding the method of accounting for stock-based employee

compensation and the effect of the method used on reported

results. See "Stock-Based Compensation" herein and Note 22

Stock-Based Compensation Plans for additional information.

In January 2003, the FASB issued FIN 46, "Consolidation

of Variable Interest Entities." See “Special Purpose Entities”

herein for further information.

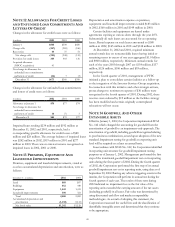

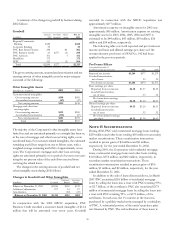

NOTE 2 NBOC ACQUISITION

In January 2002, PNC Business Credit acquired a portion of

National Bank of Canada’s (“NBOC”) U.S. asset-based lending

business in a purchase business combination. With this

acquisition, PNC Business Credit established six new marketing

offices. The transaction was designed to allow PNC to acquire

the higher-quality portion of the portfolio, and provide NBOC a

means for the orderly liquidation and exit of the remaining

portfolio.

PNC acquired 245 lending customer relationships

representing approximately $2.6 billion of credit exposure

including $1.5 billion of loans outstanding with the balance

representing unfunded loan commitments. PNC also acquired

certain other assets and assumed liabilities resulting in a total

acquisition cost of approximately $1.8 billion that was paid

primarily in cash. Goodwill recorded was approximately $277

million, of which approximately $101 million is non-deductible

for federal income tax purposes. The results of the acquired

business have been included in results of operations for PNC

Business Credit since the acquisition date.

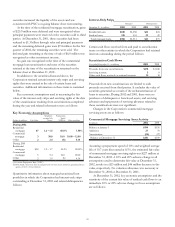

NBOC retained a portfolio (“Serviced Portfolio”) totaling

approximately $662 million of credit exposure, including $463

million of outstandings, which is being serviced by PNC for an

18-month term unless a different date is mutually agreed upon.

In June 2002, NBOC and PNC reached final agreement as to

the Serviced Portfolio’s financial information. As such, certain

financial data previously disclosed with regard to the NBOC

Serviced Portfolio has been modified to reflect the terms of

this revised agreement. The Serviced Portfolio retained by

NBOC primarily represents the portion of NBOC’s U.S. asset-

based loan portfolio with the highest risk. The loans are either

to borrowers with deteriorating trends or with identified

weaknesses which if not corrected could jeopardize full

satisfaction of the loans or in industries to which PNC

Business Credit wants to limit its exposure. Approximately

$138 million of the Serviced Portfolio outstandings were

nonperforming on the acquisition date. At the end of the

servicing term, NBOC has the right to transfer the then

remaining Serviced Portfolio to PNC (“Put Option”).

NBOC’s and PNC’s strategy is to aggressively liquidate the

Serviced Portfolio during the servicing term. PNC may sell or

otherwise liquidate any remaining loans in the event NBOC

puts them to PNC at the end of the servicing term.

NBOC retains significant risks and rewards of owning the

Serviced Portfolio, including realized credit losses, during the

servicing term as described below. NBOC assigned $24

million of specific reserves to certain of the loans in the

Serviced Portfolio. Additionally, NBOC absorbs realized

credit losses on the Serviced Portfolio in addition to the

specific reserves on individual identified loans. If during the