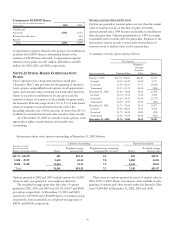

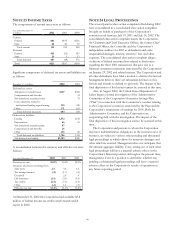

PNC Bank 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

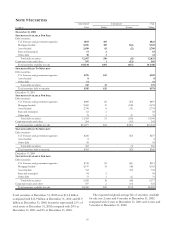

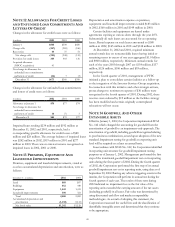

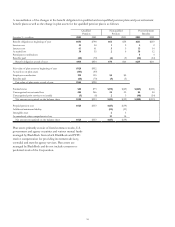

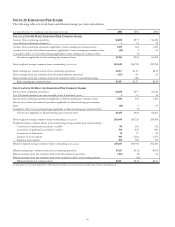

A summary of the changes in goodwill by business during

2002 follows:

Goodwill

January 1 Goodwill Adjust- Dec. 31

In millions 2002 Acquired ments 2002

Regional Community

Banking $438 $438

Corporate Banking 39 39

PNC Real Estate Finance 298 $4 302

PNC Business Credit 23 $277 (2) 298

PNC Advisors 151 1 152

BlackRock 175 175

PFPC 912 (3) 909

Total $2,036 $277 $2,313

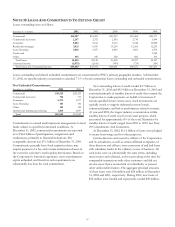

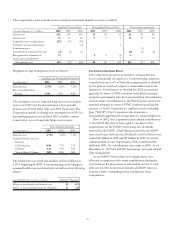

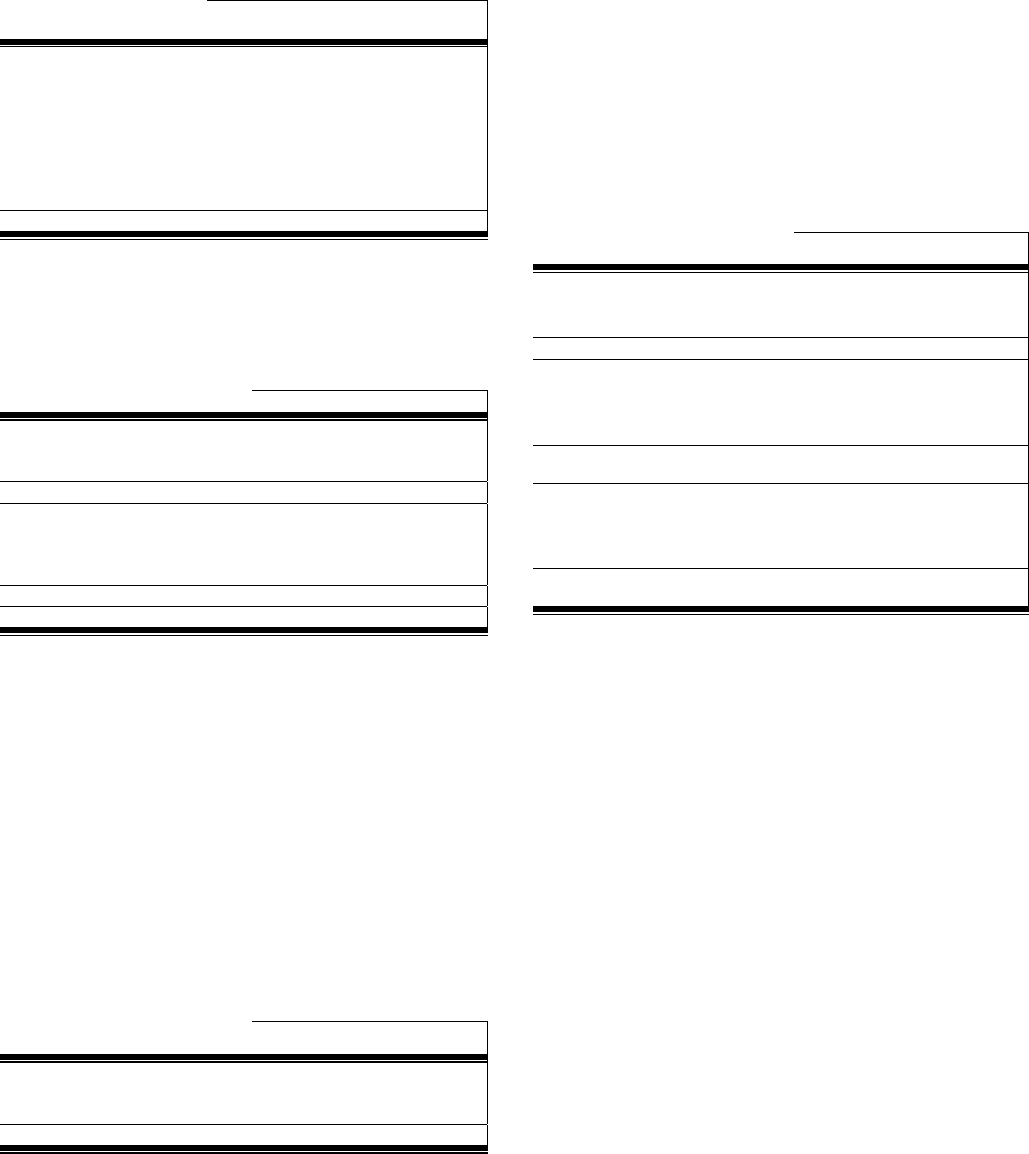

The gross carrying amount, accumulated amortization and net

carrying amount of other intangible assets by major category

consisted of the following:

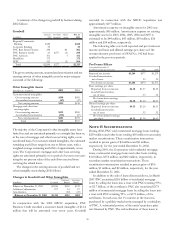

Other Intangible Assets

December 31 - in millions 2002 2001

Customer-related intangibles

Gross carrying amount $199 $185

Accumulated amortization (67) (47)

Net carrying amount $132 $138

Mortgage and other loan

servicing rights

Gross carrying amount $313 $286

Accumulated amortization (112) (87)

Net carrying amount $201 $199

Total $333 $337

The majority of the Corporation's other intangible assets have

finite lives and are amortized primarily on a straight-line basis or,

in the case of mortgage and other loan servicing rights, on an

accelerated basis. For customer-related intangibles, the estimated

remaining useful lives range from one to fifteen years, with a

weighted-average remaining useful life of approximately seven

years. The Corporation's mortgage and other loan servicing

rights are amortized primarily over a period of seven to ten years

using the net present value of the cash flows received from

servicing the related loans.

The changes in the carrying amount of goodwill and net

other intangible assets during 2002 follows:

Changes in Goodwill and Other Intangibles

In millions Goodwill

Customer-

Related

Servicing

Rights

Balance at December 31, 2001 $2,036 $138 $199

Additions/adjustments 277 14 27

Amortization (20) (25)

Balance at December 31, 2002 $2,313 $132 $201

In conjunction with the 2002 NBOC acquisition, PNC

Business Credit recorded a customer-based intangible of $12.4

million that will be amortized over seven years. Goodwill

recorded in connection with the NBOC acquisition was

approximately $277 million.

Amortization expense on intangible assets for 2002 was

approximately $45 million. Amortization expense on existing

intangible assets for 2003, 2004, 2005, 2006 and 2007 is

estimated to be $44 million, $43 million, $39 million, $36

million and $34 million, respectively.

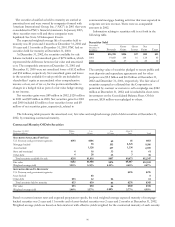

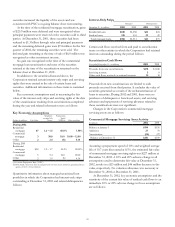

The following table sets forth reported and pro forma net

income and basic and diluted earnings per share as if the

nonamortization provisions of SFAS No. 142 had been

applied in the previous periods.

Pro Forma Effects

Y

ear ended December 31

In millions, except per share data 2002 2001 2000

Reported net income $1,184 $377 $1,279

Goodwill amortization,

net of taxes 93 93

Pro forma net income $1,184 $470 $1,372

Basic earnings per share

Reported, from net income $4.18 $1.27 $4.35

Goodwill amortization,

net of taxes .33 .32

Pro forma basic earnings

p

er share

$

4.18

$

1.60

$

4.67

Diluted earnings per share

Reported, from net income $4.15 $1.26 $4.31

Goodwill amortization,

net of taxes .32 .32

Pro forma diluted earnings

p

er share $4.15

$

1.58

$

4.63

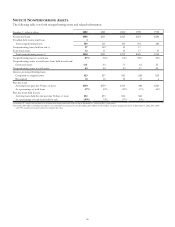

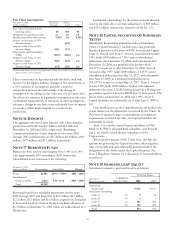

NOTE 15 SECURITIZATIONS

During 2002, PNC sold commercial mortgage loans totaling

$239 million and other loans totaling $38 million in secondary

market securitizations. These securitization transactions

resulted in pretax gains of $4 million and $2 million,

respectively, for the year ended December 31, 2002.

During 2001, the Corporation sold residential mortgage

loans, commercial mortgage loans and other loans totaling

$1.0 billion, $374 million, and $82 million, respectively, in

secondary market securitization transactions. These

securitization transactions resulted in pretax gains of $9.6

million, $1 million, and $2 million, respectively, for the year

ended December 31, 2001.

In addition to the sale of loans discussed above, in March

2001 PNC securitized $3.8 billion of residential mortgage

loans by selling the loans into a trust with PNC retaining 99%,

or $3.7 billion, of the certificates. PNC also securitized $175

million of commercial mortgage loans by selling the loans into

a trust with PNC retaining 99%, or $173 million, of the

certificates. In each case, the 1% interest in the trust was

purchased by a publicly-traded entity managed by a subsidiary

of PNC. A substantial portion of the entity’s purchase price

was financed by PNC. The reclassification of these loans to