PNC Bank 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

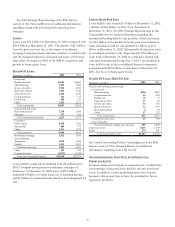

34

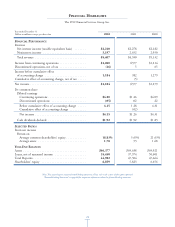

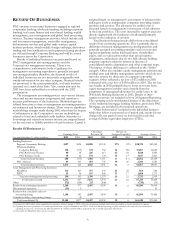

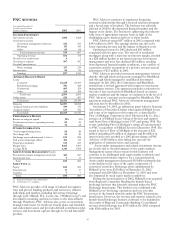

WHOLESALE BANKING

PNC BUSINESS CREDIT

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2002 2001

INCOME STATEMENT

Net interest income $134 $104

Noninterest income 59 30

Operating revenue 193 134

Provision for credit losses 64 19

Noninterest expense 53 29

Goodwill amortization 2

Operating income 76 84

Strategic repositioning:

Institutional lending repositioning 48

Net losses on loans held for sale 11

Pretax earnings 65 36

Income taxes 25 14

Earnings $40 $22

AVERAGE BALANCE SHEET

Loans $3,535 $2,331

Loans held for sale 68 72

Other assets 234 60

Total assets $3,837 $2,463

Deposits $84 $77

Assigned funds and other liabilities 3,503 2,223

Assigned capital 250 163

Total funds $3,837 $2,463

PERFORMANCE RATIOS

Return on assigned capital 16% 13%

Noninterest income to operating revenue 31 22

Efficiency 29 30

Efficiency, excluding strategic repositioning 27 22

OTHER INFORMATION

Total nonperforming assets $142 $109

Net charge-offs $32 $19

Marketing locations 23 14

Average FTEs 241 137

Institutional lending repositioning

Loans held for sale

Credit exposure $13 $40

Outstandings $9 $30

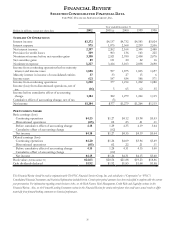

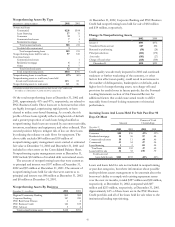

PNC Business Credit provides asset-based lending, treasury

management and capital markets products and services to

middle market customers nationally. PNC Business Credit’s

lending services include loans secured by accounts receivable,

inventory, machinery and equipment, and other collateral, and

its customers include manufacturing, wholesale, distribution,

retailing and service industry companies.

In January 2002, PNC Business Credit acquired a portion of

NBOC’s U.S. asset-based lending business in a purchase

business combination. See Note 2 NBOC Acquisition for

additional information.

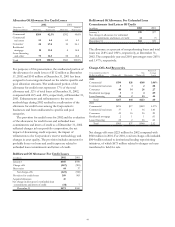

PNC Business Credit earned $40 million in 2002 compared

with $22 million in 2001. Operating income for 2002 was $76

million compared with $84 million in 2001. Operating income

for 2002 included revenue and expense resulting from the

NBOC acquisition and a $28 million benefit resulting from a

reduction in the NBOC put option liability. The impact of

these items was more than offset by an increase of $45 million

in the provision for credit losses.

Operating revenue was $193 million for 2002, a $59 million

increase compared with 2001 as both net interest income and

noninterest income increased. The increase in net interest

income for 2002 reflected a net increase of $1.2 billion or 52%

in total average loans for the period resulting primarily from

the NBOC acquisition. Noninterest income for 2002 included

a $28 million benefit resulting from a reduction in the put

option liability related to the NBOC acquisition. Noninterest

income for 2001 included gains on sales of equity interests

received as compensation in conjunction with lending

relationships. There were no such gains in 2002.

The provision for credit losses for 2002 was $64 million

compared with $19 million for 2001. Net charge-offs were $32

million for 2002 compared with $19 million a year ago. The

provision for credit losses increased in 2002 as additions to

reserves were made due to a decline in credit quality and the

impact of refinements to the Corporation’s reserve

methodology related to impaired loans and pooled reserves.

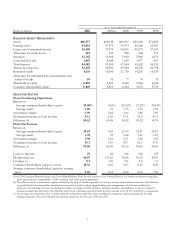

PNC Business Credit loans, including those acquired in the

NBOC acquisition, are secured loans to borrowers, many who

are highly leveraged, experiencing rapid growth, or have

elected to utilize asset-based financing. As a result, the risk

profile of these loans typically reflects a higher risk of default

and a greater proportion being classified as nonperforming.

The impact of these loans on the provision for credit losses

and the level of nonperforming assets may be even more

pronounced during periods of economic downturn consistent

with PNC Business Credit’s recent experience. PNC Business

Credit attempts to manage this risk through the stringent

control of the borrowers’ collateral. Therefore, net charge-offs

on asset-based loans have historically been relatively low due

to recoveries provided by the underlying collateral.

Compensation for this higher risk of default is obtained by

way of higher interest rates charged.

Total noninterest expense increased $24 million to $53

million for 2002 primarily due to costs added with the NBOC

acquisition.

Nonperforming assets were $142 million at December 31,

2002 compared with $109 million at December 31, 2001. The

increase was primarily due to the transfer of a single credit to

nonperforming status that was partially offset by reductions to

credits through managed liquidation and run-offs.

PNC Business Credit’s balance sheet included several

credits that were part of the Corporation’s institutional lending

repositioning. Credit exposure of $13 million, including $9

million of outstandings classified as held for sale, remained at

December 31, 2002.