PNC Bank 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

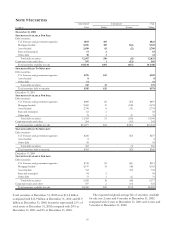

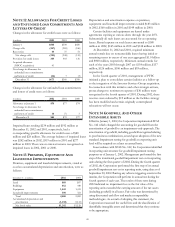

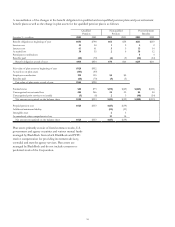

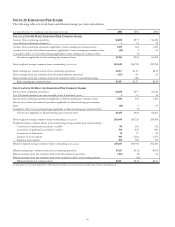

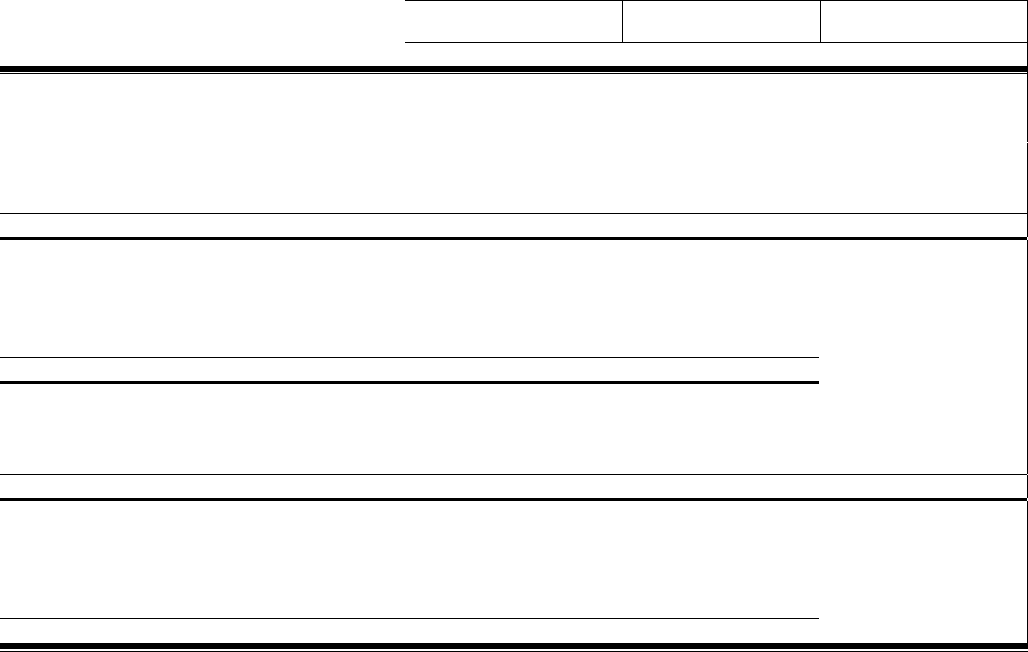

A reconciliation of the changes in the benefit obligation for qualified and nonqualified pension plans and post-retirement

benefit plans as well as the change in plan assets for the qualified pension plan is as follows:

Qualified

Pension

Nonqualified

Pension

Post-retirement

Benefits

December 31 – in millions 2002 2001 2002 2001 2002 2001

Benefit obligation at beginning of year $854 $798 $66 $58 $211 $203

Service cost 33 30 1222

Interest cost 61 61 5515 14

A

ctuarial loss 38 35 2638 12

Participant contributions 54

Benefits paid (68) (70) (4) (5) (26) (24)

Benefit obli

g

ation at end of

y

ear $918 $854 $70 $66 $245 $211

Fair value of plan assets at beginning of year $928 $952

Actual loss on plan assets (104) (89)

Employer contribution 210 135 $5 $5

Benefits paid (68) (70) (5) (5)

Fair value of

p

lan assets at end of

y

ear $966 $928

Funded status $48 $73 $

(

70

)

$

(

65

)

$

(

245

)

$

(

211

)

Unrecognized net actuarial loss 485 266 25 23 85 50

Unrecognized prior service cost (credit) (5) (6) 23(48) (54)

Net amount reco

g

nized on the balance sheet $528 $333 $

(

43

)

$

(

39

)

$

(

208

)

$

(

215

)

Prepaid pension cost $528 $333 $(43) $(39)

Additional minimum liability (23) (21)

Intangible asset 23

Accumulated other comprehensive loss 21 18

Net amount recognized on the balance sheet $528 $333 $(43) $(39)

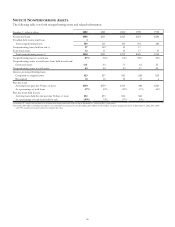

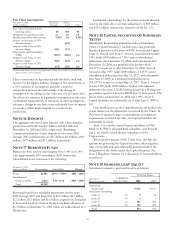

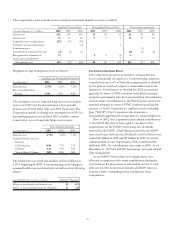

Plan assets primarily consist of listed common stocks, U.S.

government and agency securities and various mutual funds

managed by BlackRock from which BlackRock and PFPC

receive compensation for providing investment advisory,

custodial and transfer agency services. Plan assets are

managed by BlackRock and do not include common or

preferred stock of the Corporation.