PNC Bank 2002 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

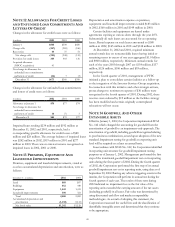

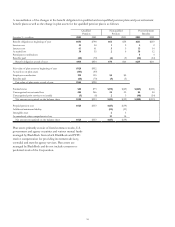

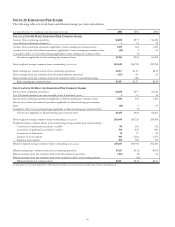

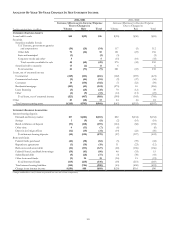

NOTE 25 EARNINGS PER SHARE

The following table sets forth basic and diluted earnings per share calculations.

Year ended December 31 - in millions, except share and per share data 2002 2001 2000

CALCULATION OF BASIC EARNINGS PER COMMON SHARE

Income from continuing operations $1,200 $377 $1,214

Less: Preferred dividends declared (a) 113 19

Income from continuing operations applicable to basic earnings per common share 1,199 364 1,195

Income (loss) from discontinued operations applicable to basic earnings per common share (16) 565

Cumulative effect of accounting change applicable to basic earnings per common share (5)

Net income applicable to basic earnings per common share $1,183 $364 $1,260

Basic weighted-average common shares outstanding (in thousands) 283,449 286,726 289,958

Basic earnings per common share from continuing operations $4.23 $1.27 $4.12

Basic earnings (loss) per common share from discontinued operations (.05) .02 .23

Basic earnings (loss) per common share from cumulative effect of accounting change (.02)

Basic earnings per common share $4.18 $1.27 $4.35

CALCULATION OF DILUTED EARNINGS PER COMMON SHARE

Income from continuing operations $1,200 $377 $1,214

Less: Dividends declared on nonconvertible Series F preferred stock (a) 113 18

Income from continuing operations applicable to diluted earnings per common share 1,199 364 1,196

Income (loss) from discontinued operations applicable to diluted earnings per common

share (16) 565

Cumulative effect of accounting change applicable to diluted earnings per common share (5)

Net income applicable to diluted earnings per common share $1,183 $364 $1,261

Basic weighted-average common shares outstanding (in thousands) 283,449 286,726 289,958

Weighted-average common shares to be issued using average market price and assuming:

Conversion of preferred stock Series A and B 98 106 118

Conversion of preferred stock Series C and D 795 870 986

Conversion of debentures 16 17 20

Exercise of stock options 496 1,661 1,531

Incentive share awards 299 368 173

Diluted weighted-average common shares outstanding (in thousands) 285,153 289,748 292,786

Diluted earnings per common share from continuing operations $4.20 $1.26 $4.09

Diluted earnings (loss) per common share from discontinued operations (.05) .02 .22

Diluted earnings (loss) per common share from cumulative effect of accounting change (.02)

Diluted earnings per common share $4.15 $1.26 $4.31

(a) Adjustment for year ended December 31, 2001 includes $1 million of cost incurred due to tender offer of Series F preferred stock.