PNC Bank 2002 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

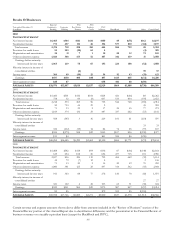

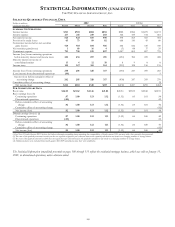

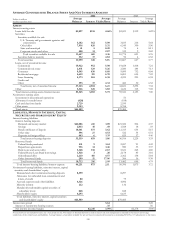

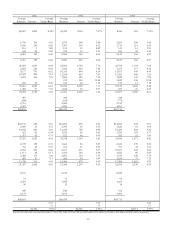

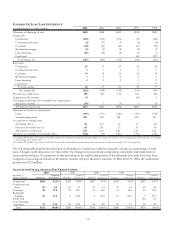

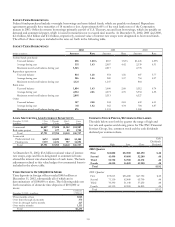

STATISTICAL INFORMATION (UNAUDITED)

THE PNC FINANCIAL SERVICES GROUP, INC.

108

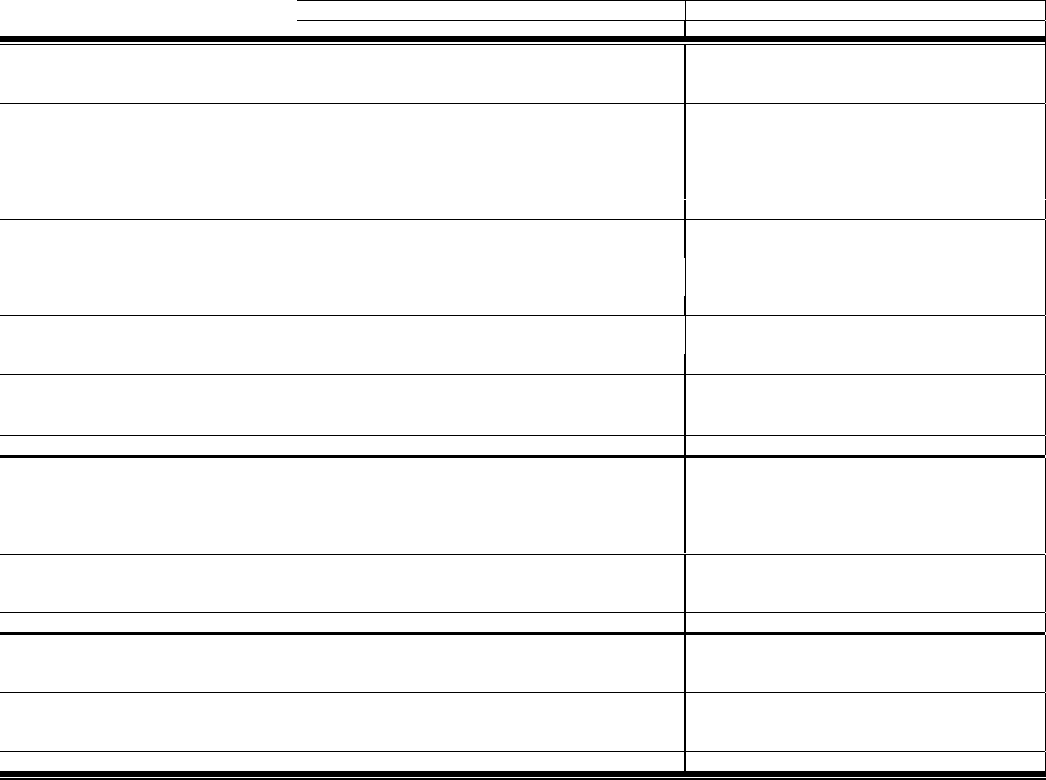

SELECTED QUARTERLY FINANCIAL DATA

2002 2001(a)

Dollars in millions,

except per share data Fourth Third Second First Fourth Third Second First

SUMMARY OF OPERATIONS

Interest income $741 $769 $804 $858 $902 $984 $1,079 $1,172

Interest expense 217 241 249 268 324 419 514 618

Net interest income 524 528 555 590 578 565 565 554

Provision for credit losses 65 73 89 82 668 110 45 80

Noninterest income before net securities

gains (losses) 765 703 854 786 446 646 729 700

Net securities gains(losses) 168 16 4 (3)881729

Noninterest expense 791 790 839 807 1,007 805 807 795

Income (loss) from continuing operations

before minority interest and income taxes 434 436 497 491 (654) 384 459 408

Minority interest in income of

consolidated entities 11 4 12 10 8988

Income taxes 145 147 165 164 (232) 128 156 135

Income (loss) from continuing operations 278 285 320 317 (430) 247 295 265

(Loss) income from discontinued operations (16) 5

Income (loss) before cumulative effect of

accounting change 262 285 320 317 (430) 247 295 270

Cumulative effect of accounting change (5)

Net income (loss) $262 $285 $320 $317 $(430) $247 $295 $265

PER COMMON SHARE DATA

Book value $24.03 $23.62 $22.46 $21.02 $20.54 $23.09 $22.60 $22.39

Basic earnings (loss) (b)

Continuing operations .97 1.00 1.13 1.12 (1.52) .85 1.01 .90

Discontinued operations (.05) .02

Before cumulative effect of accounting

change .92 1.00 1.13 1.12 (1.52) .85 1.01 .92

Cumulative effect of accounting change (.02)

Net income (loss) .92 1.00 1.13 1.12 (1.52) .85 1.01 .90

Diluted earnings (loss) (c) (d)

Continuing operations .97 1.00 1.12 1.11 (1.52) .84 1.00 .89

Discontinued operations (.05) .02

Before cumulative effect of accounting

change .92 1.00 1.12 1.11 (1.52) .84 1.00 .91

Cumulative effect of accounting change (.02)

Net income (loss) .92 1.00 1.12 1.11 (1.52) .84 1.00 .89

(a) See Note 5 Fourth Quarter 2001 Actions for further information regarding items impacting the comparability of fourth quarter 2001 amounts with other quarterly data presented.

(b) The sum of the quarterly amounts for each year do not equal the respective year’s amount because the quarterly calculations are based on a changing number of average shares.

(c) The sum of the quarterly amounts in 2001 does not equal the year’s amount because the quarterly calculations are based on a changing number of average shares.

(d) Additional shares were excluded from fourth quarter 2001 EPS calculations since they were antidilutive.

The Statistical Information (unaudited) presented on pages 108 through 113 reflects the residential mortgage business, which was sold on January 31,

2001, in discontinued operations, unless otherwise noted.