PNC Bank 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

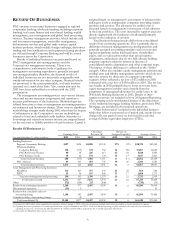

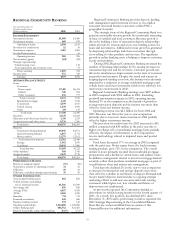

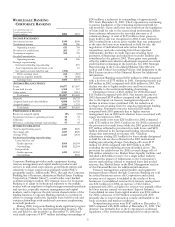

33

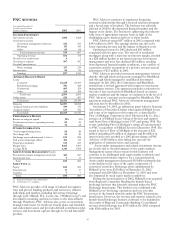

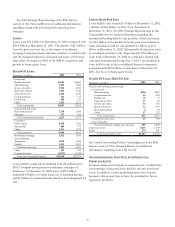

WHOLESALE BANKING

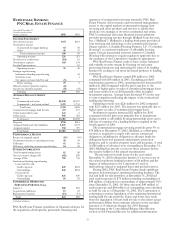

PNC REAL ESTATE FINANCE

Year ended December 31

Taxable-equivalent basis

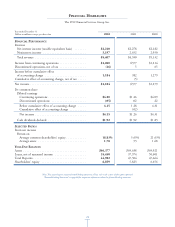

Dollars in millions 2002 2001

INCOME STATEMENT

Net interest income $117 $118

Noninterest income

Commercial mortgage banking 65 58

Other 44 37

Total noninterest income 109 95

Operating revenue 226 213

Provision for credit losses (10) 16

Noninterest expense 160 139

Goodwill amortization 18

Operating income 76 40

Strategic repositioning:

Institutional lending repositioning 34

Severance costs 1

Net (gains) on loans held for sale (3)

Pretax earnings 79 5

Minority interest (benefit) expense (2)

Income tax (benefit) expense (9) (33)

Earnings $90 $38

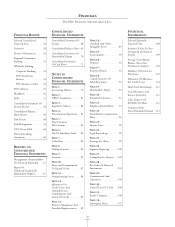

AVERAGE BALANCE SHEET

Loans

Commercial real estate $2,230 $2,337

Commercial – real estate related 1,471 1,751

Total loans 3,701 4,088

Commercial mortgages held for sale 271 273

Other loans held for sale 141 6

Other assets 905 923

Total assets $5,018 $5,290

Deposits $750 $518

Assigned funds and other liabilities 3,876 4,375

Assigned capital 392 397

Total funds $5,018 $5,290

PERFORMANCE RATIOS

Return on assigned capital 23% 10%

Noninterest income to operating revenue 48 45

Efficiency 63 60

Efficiency, excluding strategic repositioning 64 58

OTHER INFORMATION

Total nonperforming assets $2 $6

Net (recoveries) charge-offs $(6) $30

Average FTEs 789 743

Institutional lending repositioning

Loans held for sale

Credit exposure $49 $324

Outstandings $44 $244

Exit portfolio

Credit exposure $25 $30

Outstandings $4 $5

COMMERCIAL MORTGAGE

SERVICING PORTFOLIO (a)

January 1 $68 $54

Acquisitions/additions 19 25

Repayments/transfers (13) (11)

Total $74 $68

(a) Dollars in billions.

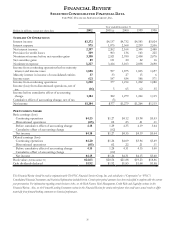

PNC Real Estate Finance specializes in financial solutions for

the acquisition, development, permanent financing and

operation of commercial real estate nationally. PNC Real

Estate Finance offers treasury and investment management,

access to the capital markets, commercial mortgage loan

servicing and other products and services to clients that

develop, own, manage or invest in commercial real estate.

PNC’s commercial real estate financial services platform

provides processing services through Midland Loan Services,

Inc. (“Midland”). Midland is a leading third-party provider of

loan servicing and technology to the commercial real estate

finance industry. Columbia Housing Partners, L.P. (“Columbia

Housing”) is a national syndicator of affordable housing

equity. Certain incremental activities related to Columbia

Housing will continue to require regulatory approvals due to

the existence of the Corporation’s regulatory agreements.

PNC Real Estate Finance seeks to have a more balanced

and valuable revenue stream by focusing on real estate

processing businesses and increasing the value of its lending

business by seeking to sell more fee-based products to lending

customers.

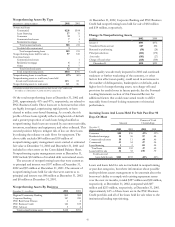

PNC Real Estate Finance earned $90 million in 2002

compared with $38 million in 2001. Excluding goodwill

amortization expense in 2001, operating income increased $18

million in 2002 compared with the prior year due to the

impact of higher gains on sales of commercial mortgage loans

and lower credit costs in 2002 partially offset by higher

noninterest expense. Average loans decreased 9% in the year-

to-year comparison reflecting the impact of the institutional

lending repositioning.

Operating revenue was $226 million for 2002 compared

with $213 million for 2001. The increase was primarily due to

higher gains on sales of commercial mortgage loans.

Noninterest expense increased $21 million for 2002

compared with the prior year primarily due to impairment

charges related to affordable housing partnership assets and a

full year of expenses for a lending business acquired in the

fourth quarter of 2001.

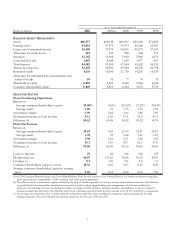

The commercial mortgage servicing portfolio grew 9% to

$74 billion at December 31, 2002. Midland, as a third-party

servicer, is required to comply with various contractual

obligations, including the obligation to advance funds for

delinquent borrower payments and property protection

purposes, and to monitor property taxes and insurance. A total

of $80 million of advances were outstanding at December 31,

2002. Midland has priority to recover these advances before

the security holders of the related securitizations.

The provision for credit losses for the year ended

December 31, 2002 reflected the benefit of a net recovery in

the exited warehouse lending business of $6 million and the

impact of refinements to the Corporation’s reserve

methodology related to impaired loans and pooled reserves.

During 2002, PNC Real Estate Finance made significant

progress in downsizing its institutional lending business. The

exit and held for sale portfolios at December 31, 2002 had

total credit exposure of $74 million including outstandings of

$48 million, a reduction in outstandings of approximately 81%

since December 31, 2001. Of these amounts, $49 million of

credit exposure and $44 million of outstandings were classified

as held for sale as of December 31, 2002. The Corporation is

continuing to pursue liquidation of the remaining institutional

lending held for sale portfolio. Gains and losses may result

from the liquidation of loans held for sale to the extent actual

performance differs from estimates inherent in the recorded

amounts or if valuations change. See 2001 Strategic

Repositioning in the Consolidated Balance Sheet Review

section of this Financial Review for additional information.