PNC Bank 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

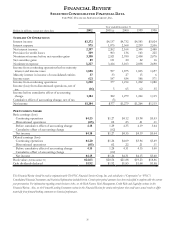

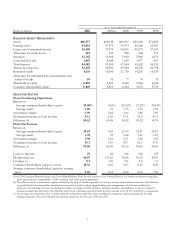

35

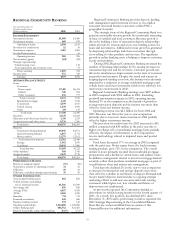

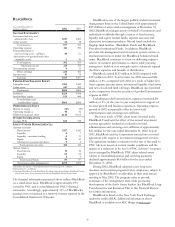

PNC ADVISORS

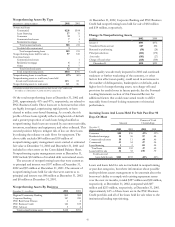

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2002 2001

INCOME STATEMENT

Net interest income $100 $128

Noninterest income

Investment management and trust 334 393

Brokerage 131 130

Other 89 84

Total noninterest income 554 607

Operating revenue 654 735

Provision for credit losses 42

Noninterest expense 497 497

Goodwill amortization 7

Pretax earnings 153 229

Income taxes 56 86

Earnings $97 $143

AVERAGE BALANCE SHEET

Loans

Consumer $1,228 $1,103

Residential mortgage 501 848

Commercial 460 528

Other 320 384

Total loans 2,509 2,863

Other assets 420 467

Total assets $2,929 $3,330

Deposits $2,007 $2,058

Assigned funds and other liabilities 399 730

Assigned capital 523 542

Total funds $2,929 $3,330

PERFORMANCE RATIOS

Return on assigned capital 19% 26%

Noninterest income to operating revenue 85 83

Efficiency 76 68

OTHER INFORMATION

Total nonperforming assets $5 $4

Net charge-offs $4 $2

Brokerage assets administered (in billions) $32 $28

Full service brokerage offices 106 113

Financial consultants 615 681

Margin loans $260 $309

Average FTEs 3,351 3,598

ASSETS UNDER MANAGEMENT (a)(b)

Personal investment management and trust $41 $47

Institutional trust 913

Total $50 $60

ASSET TYPE (b)

Equity $26 $36

Fixed income 17 17

Liquidity 77

Total $50 $60

(a) Excludes brokerage assets administered

(b) At December 31 – in billions.

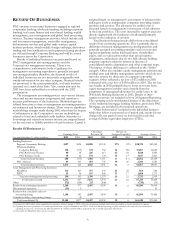

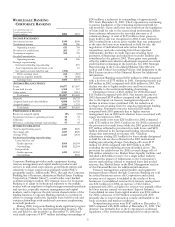

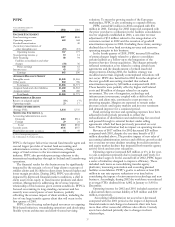

PNC Advisors provides a full range of tailored investment,

trust and private banking products and services to affluent

individuals and families, including full-service brokerage

through J.J.B. Hilliard, W.L. Lyons, Inc. (“Hilliard Lyons”) and

investment consulting and trust services to the ultra-affluent

through Hawthorn. PNC Advisors also serves as investment

manager and trustee for employee benefit plans and charitable

and endowment assets and provides defined contribution plan

services and investment options through its Vested Interest

product.

PNC Advisors continues to emphasize deepening

customer relationships through a focused retention program

and a broad array of products. The business was adversely

affected in 2002 by the depressed financial markets and the

impact on its clients. The business is addressing the industry-

wide issue of appropriate expense levels in light of the

challenging equity markets and loss of client wealth.

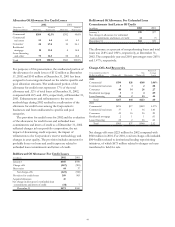

PNC Advisors earned $97 million in 2002 compared with

$143 million in 2001. The earnings decline was driven by

lower operating revenue and the impact of litigation costs.

Operating revenue for 2002 decreased $81 million

compared with the prior year. The run-off of residential

mortgages along with a narrower net interest margin, resulted

in a $28 million decline in net interest income. Investment

management and trust fees declined $59 million, resulting

from depressed financial market conditions, a net outflow of

customers, and the recognition of a positive revenue accrual

adjustment of $15 million in 2001.

PNC Advisors provides investment management services

directly, through funds and accounts managed by BlackRock

and through funds managed by unaffiliated investment

managers. In July 2002, the Corporation and BlackRock

entered into a revised agreement with respect to investment

management services. The agreement includes a reduction in

the rate of fees received from BlackRock based on current

market conditions and the impact of a reduction in the level of

PNC Advisors’ customer assets managed by BlackRock. This

agreement reduced PNC Advisors’ investment management

and trust fees by $6 million in 2002.

On January 14, 2003, an arbitration panel with the National

Association of Securities Dealers ruled against Hilliard Lyons

and some of its employees with respect to a claim filed by

First of Michigan Corporation (now Fahnestock & Co., Inc.)

arising out of Hilliard Lyons’ hiring of brokers and support

staff from First of Michigan in late 1997 and spring 1998. The

events underlying First of Michigan’s claims all occurred prior

to PNC’s acquisition of Hilliard Lyons in December 1998. The

award in favor of First of Michigan in the amount of $22

million (including $16 million in damages and $6 million in

interest and costs) resulted in a 2002 pretax charge at PNC

Advisors of $10 million, after taking into account the

application of related reserves and accruals.

Assets under management and related noninterest income

are closely tied to the performance of the equity markets.

Management expects that revenues in this business will

continue to be challenged until equity market conditions and

investment performance improve for a sustained period.

Assets under management decreased $10 billion primarily due

to the decline in the value of the equity component of

customers’ portfolios. Brokerage assets administered by

Hilliard Lyons were $32 billion at December 31, 2002

compared with $28 billion at December 31, 2001 and were

also impacted by weak equity market conditions.

During the second quarter of 2002, Hilliard Lyons acquired

from Regional Community Banking the branch-based

brokerage business that formerly operated under the PNC

Brokerage brand name. This business was combined with

Hilliard Lyons’ brokerage operations and now provides

services in the branch network under the PNC Investments

brand name. However, the revenue and expense related to the

branch-based brokerage business continues to be included in

the results of Regional Community Banking. Consolidated

revenue from brokerage was $195 million for 2002 compared

with $206 million for 2001.