PNC Bank 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

All changes in forecasted net interest income are relative to

results in a base rate scenario where current market rates are

assumed to remain unchanged over the forecast horizon.

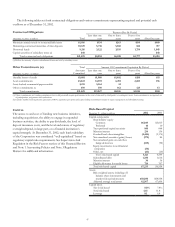

Net Interest Income Sensitivity to Alternative Rate

Scenarios

In millions

PNC

Economist

Market

Forward Low/Steep High/Flat

Change in forecasted

net interest income:

First year sensitivity .3% .3% .5% (1.2)%

Second year sensitivity 1.2% 1.0% .7% (2.6)%

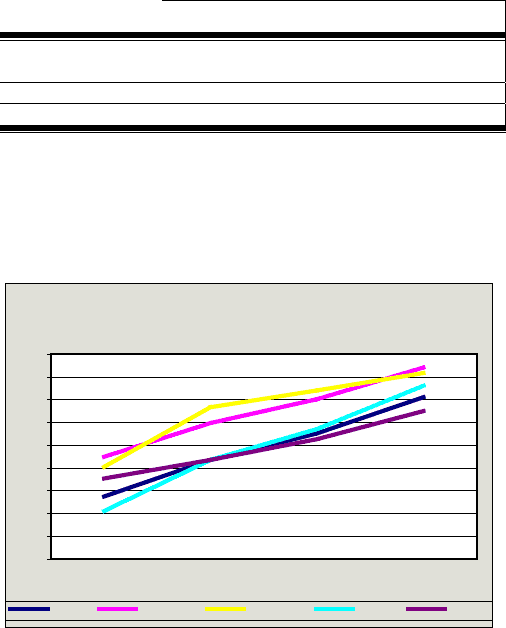

The graph below presents the final December 2003 yield

curves for each of the alternative scenarios and for the base

rate scenario in which rates are constant throughout the year.

OPERATIONAL RISK

The Corporation is exposed to a variety of operational risks

that can affect each of its business activities, particularly those

involving processing and servicing. Operational risk is defined

as the risk of loss resulting from inadequate or failed internal

processes, people or systems or from external events. The risk

of loss also includes losses that may arise from the potential

legal actions that could result from operational deficiencies or

noncompliance with contracts, laws or regulations. PNC

monitors and evaluates operational risk on an ongoing basis

through systems of internal control, formal corporate-wide

policies and procedures, and an internal audit function.

TRADING ACTIVITIES

Most of PNC’s trading activities are designed to provide

capital markets services to customers and not to position the

Corporation’s portfolio for gains from market movements.

Trading activities are confined to financial instruments and

financial derivatives. PNC participates in derivatives and

foreign exchange trading as well as underwriting and “market

making” in equity securities as an accommodation to

customers. PNC also engages in trading activities as part of

risk management strategies. Net trading income was $92

million in 2002 compared with $147 million in 2001. See Note

8 Trading Activities for additional information.

Risk associated with trading, capital markets and foreign

exchange activities is managed using a value-at-risk approach

that combines interest rate risk, foreign exchange rate risk,

equity risk, spread risk and volatility risk. Using this approach,

exposure is measured as the potential market-to-market loss

within a 99% confidence interval of one-day moves in key

market risk factors, such as interest rates. The estimated

average combined value-at-risk of all trading operations using

this measurement was $.7 million for both 2002 and 2001. The

estimated combined period-end value-at-risk was $.5 million at

December 31, 2002 and $.9 million at December 31, 2001.

FINANCIAL AND OTHER DERIVATIVES

As required, effective January 1, 2001, the Corporation

implemented SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended by SFAS

No. 137 and No. 138. The statement requires the Corporation

to recognize all derivative instruments at fair value as either

assets or liabilities. Financial derivatives are reported at fair

value in other assets or other liabilities. The cumulative effect

of the change in accounting principle resulting from the

adoption of SFAS No. 133 was an after-tax charge of $5

million reported in the consolidated income statement and an

after-tax accumulated other comprehensive loss of $4 million

in the consolidated balance sheet. See Note 20 Financial

Derivatives for additional information.

Alternative Interest Rate Scenarios

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

1-month LIBOR 2-year Swap 3-year Swap 5-year Swap

Base Rates PNC Economist Market Forward Low / Steep High / Flat