PNC Bank 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

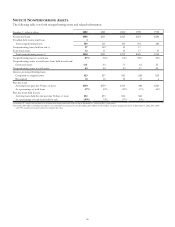

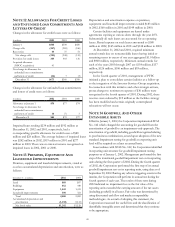

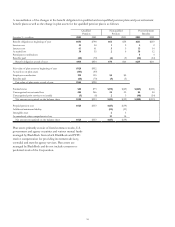

NOTE 11 NONPERFORMING ASSETS

The following table sets forth nonperforming assets and related information:

December 31 - dollars in millions 2002 2001 2000 1999 1998

Nonaccrual loans $308 $211 $323 $291 $286

Troubled debt restructured loan 1

Total nonperforming loans 309 211 323 291 286

Nonperforming loans held for sale (a) 97 169 33 17

Foreclosed assets 12 11 16 17 33

T

otal non

p

erformin

g

assets (b) $418 $391 $372 $325 $319

Nonperforming loans to total loans .87% .56% .64% .59% .50%

Nonperforming assets to total loans, loans held for sale and

foreclosed assets 1.13 .93 .71 .61 .55

Nonperforming assets to total assets .63 .56 .53 .47 .45

Interest on nonperforming loans

Computed on original terms $23 $27 $42 $28 $25

Recognized 10 10 10 11 6

Past due loans

Accruing loans past due 90 days or more $130 $159 $113 $86 $263

As a percentage of total loans .37% .42% .22% .17% .46%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more $32 $33 $16 $24

As a percentage of total loans held for sale 1.99% .79% .97% .69%

(a) Includes $17 million and $6 million of troubled debt restructured loans held for sale at December 31, 2002 and 2001, respectively.

(b) Excludes $40 million (including $12 million of troubled debt restructured assets), $18 million, $18 million and $13 million of equity management assets at December 31, 2002, 2001, 2000

and 1999, respectively, that are carried at estimated fair value.