PNC Bank 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

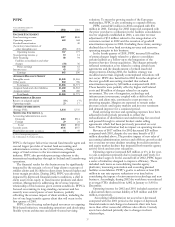

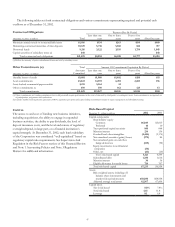

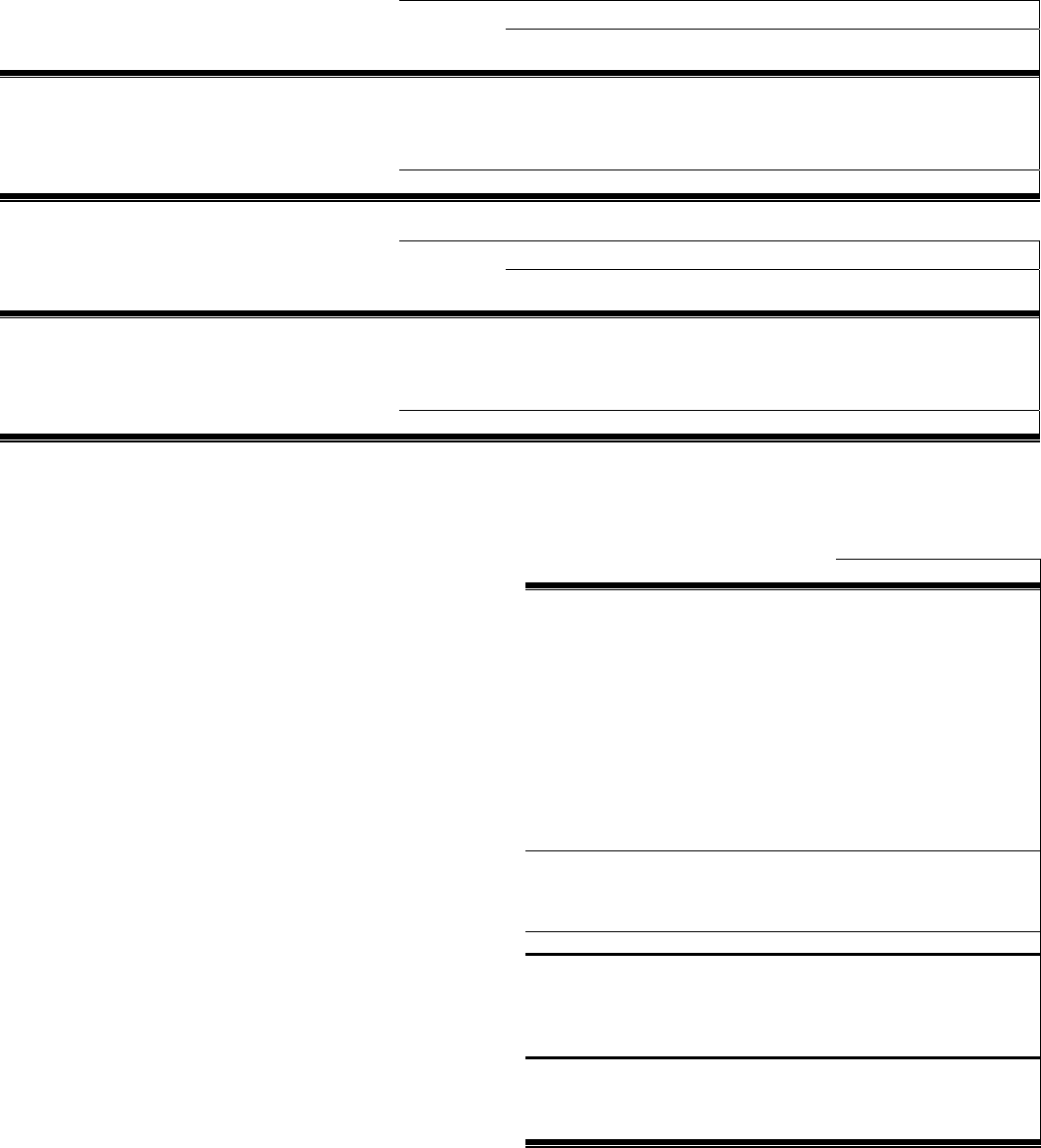

The following tables set forth contractual obligations and various commitments representing required and potential cash

outflows as of December 31, 2002.

Contractual Obligations Payment Due By Period

December 31, 2002 - in millions Total

Less than one

year

One to three

years

Four to five

years After five years

Minimum annual rentals on noncancellable leases $1,016 $154 $263 $199 $400

Remaining contractual maturities of time deposits 10,619 5,718 3,360 824 717

Borrowed funds 9,116 3,122 3,195 1,754 1,045

Capital securities of subsidiary trusts (a) 848 848

Total contractual cash obligations $21,599 $8,994 $6,818 $2,777 $3,010

(a) Reflects the maturity of junior subordinated debentures held by subsidiary trusts.

Other Commitments (a) Total Amount Of Commitment Expiration By Period

December 31, 2002 - in millions

Amounts

Committed

Less than one

year

One to three

years

Four to five

years After five years

Standby letters of credit $3,681 $1,980 $1,402 $288 $11

Loan commitments 23,643 14,393 6,491 2,603 156

Asset-backed commercial paper conduit 3,215 3,164 51

Other commitments (b) 690 390 162 125 13

Total commitments $31,229 $19,927 $8,106 $3,016 $180

(a) Other commitments are funding commitments that could potentially require performance in the event of demands by third parties or contingent events. Loan commitments are reported net

of participations, assignments and syndications.

(b) Includes standby bond repurchase agreements, NBOC acquisition put option and equity funding commitments related to equity management and affordable housing.

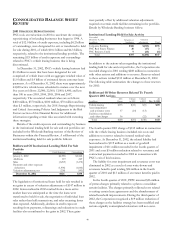

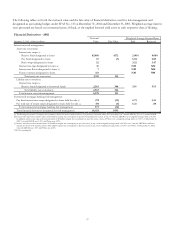

CAPITAL

The access to and cost of funding new business initiatives,

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of regulatory

oversight depend, in large part, on a financial institution’s

capital strength. At December 31, 2002, each bank subsidiary

of the Corporation was considered “well-capitalized” based on

regulatory capital ratio requirements. See Supervision And

Regulation in the Risk Factors section of this Financial Review

and Note 1 Accounting Policies and Note 3 Regulatory

Matters for additional information.

Risk-Based Capital

December 31 - dollars in millions 2002 2001

Capital components

Shareholders’ equity

Common $6,849 $5,813

Preferred 10 10

Trust preferred capital securities 848 848

Minority interest 234 134

Goodwill and other intangibles (2,446) (2,174)

Net unrealized securities (gains)/losses (179) 86

Net unrealized gains on cash flow

hedge derivatives (135) (98)

Equity investments in nonfinancial

companies (34)

Other, net (26) (20)

Tier I risk-based capital 5,121 4,599

Subordinated debt 1,350 1,616

Minority interest 36 36

Eligible allowance for credit losses 726 707

Total risk-based capital $7,233 $6,958

Assets

Risk-weighted assets, including off-

balance-sheet instruments and

market risk equivalent assets $58,030 $58,958

Adjusted average total assets 62,967 67,604

Capital ratios

Tier I risk-based 8.8% 7.8%

Total risk-based 12.5 11.8

Leverage 8.1 6.8