PNC Bank 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

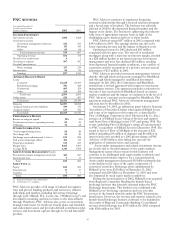

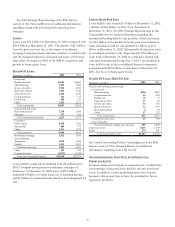

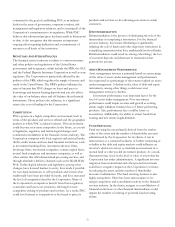

Allocation Of Allowance For Credit Losses

2002 2001

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $504 42.3% $392 40.0%

Commercial

real estate 52 6.4 63 6.3

Consumer 28 27.8 39 24.1

Residential

mortgage 10 11.0 8 16.8

Lease financing

and other 79 12.5 58 12.8

Total $673 100.0% $560 100.0%

For purposes of this presentation, the unallocated portion of

the allowance for credit losses of $112 million at December

31, 2002 and $143 million at December 31, 2001 has been

assigned to loan categories based on the relative specific and

pool allocation amounts. The unallocated portion of the

allowance for credit losses represents 17% of the total

allowance and .32% of total loans at December 31, 2002,

compared with 26% and .38%, respectively, at December 31,

2001. Enhancements and refinements to the reserve

methodology during 2002 resulted in a reallocation of the

allowance for credit losses among the Corporation’s

businesses and from unallocated to specific and pool

categories.

The provision for credit losses for 2002 and the evaluation

of the allowances for credit losses and unfunded loan

commitments and letters of credit as of December 31, 2002

reflected changes in loan portfolio composition, the net

impact of downsizing credit exposure, the impact of

refinements to the Corporation’s reserve methodology and

changes in asset quality. The provision includes amounts for

probable losses on loans and credit exposure related to

unfunded loan commitments and letters of credit.

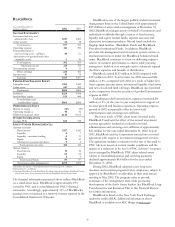

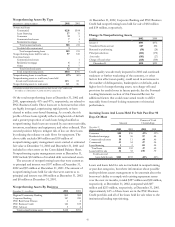

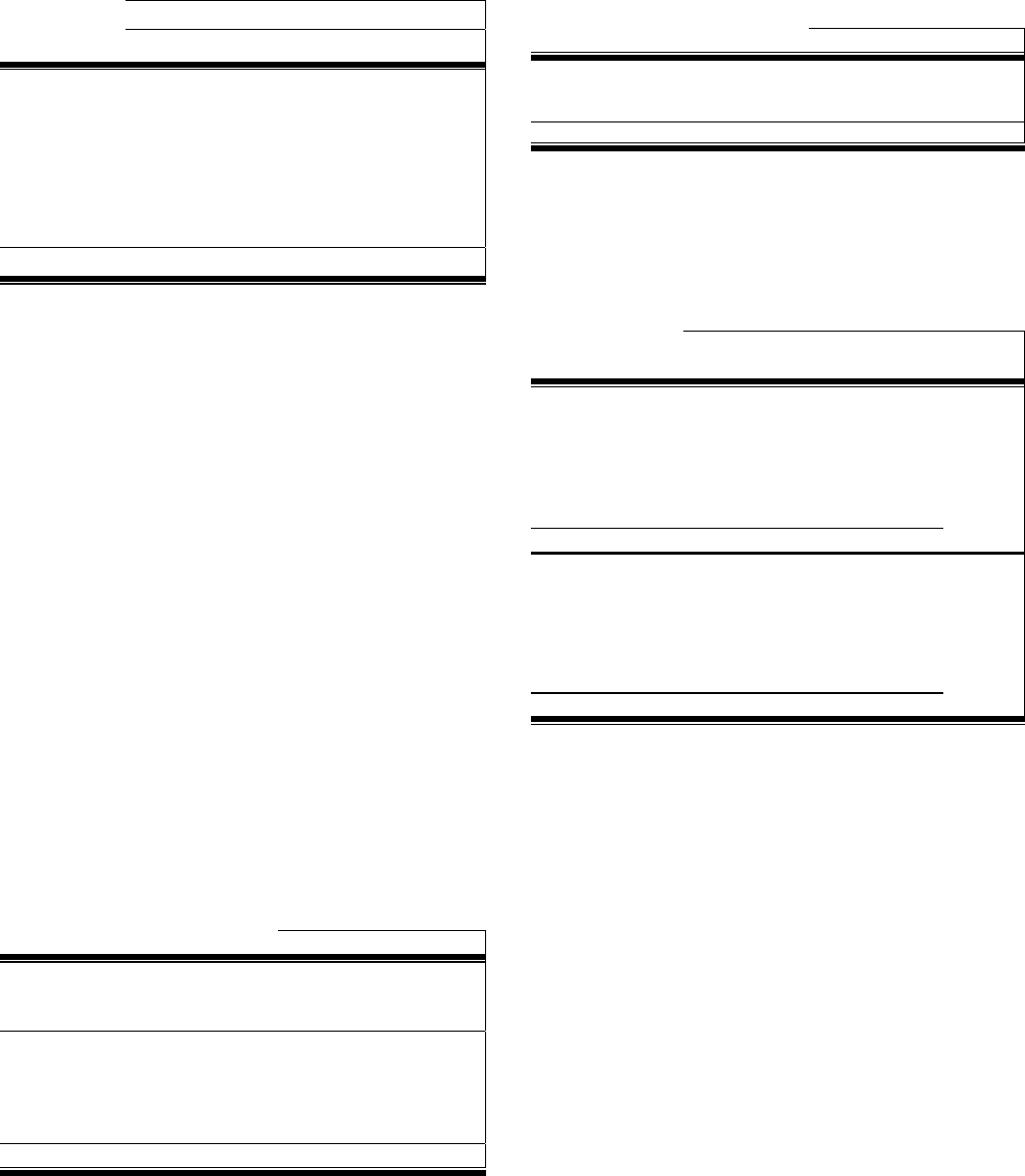

Rollforward Of Allowance For Credit Losses

In millions 2002 2001

January 1 $560 $598

Charge-offs (267) (985)

Recoveries 44 37

Net charge-offs (223) (948)

Provision for credit losses 309 903

Acquired allowance 41

N

et change in allowance for unfunded loa

n

commitments and letters of credit (14) 7

December 31 $673 $560

Rollforward Of Allowance For Unfunded Loan

Commitments And Letters Of Credit

In millions 2002 2001

January 1 $70 $77

Net change in allowance for unfunded

loan commitments and letters of credit 14 (7)

December 31 $84 $70

The allowance as a percent of nonperforming loans and total

loans was 218% and 1.90%, respectively, at December 31,

2002. The comparable year end 2001 percentages were 265%

and 1.47%, respectively.

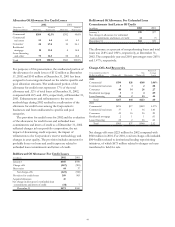

Charge-Offs And Recoveries

Percent of

Year ended December 31 Net Average

Dollars in millions Charge-offs Recoveries Charge-offs Loans

2002

Commercial $194 $26 $168 1.06%

Commercial real estate 312.08

Consumer 40 14 26 .27

Residential mortgage 514.09

Lease financing 25 2 23 .55

Total $267 $44 $223 .60

2001

Commercial $876 $17 $859 4.37%

Commercial real estate 37 1 36 1.40

Consumer 42 16 26 .29

Residential mortgage 2 1 1 .01

Lease financing 28 2 26 .62

Total $985 $37 $948 2.12

Net charge-offs were $223 million for 2002 compared with

$948 million in 2001. For 2001, total net charge-offs included

$804 million related to institutional lending repositioning

initiatives, of which $673 million related to charges on loans

transferred to held for sale.