PNC Bank 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

The Corporation uses a variety of financial derivatives as

part of the overall asset and liability risk management process

to help manage interest rate, market and credit risk inherent in

the Corporation’s business activities. Substantially all such

instruments are used to manage risk related to changes in

interest rates. Interest rate and total rate of return swaps,

purchased interest rate caps and floors and futures contracts

are the primary instruments used by the Corporation for

interest rate risk management.

Interest rate swaps are agreements with a counterparty to

exchange periodic fixed and floating interest payments

calculated on a notional amount. The floating rate is based on

a money market index, primarily short-term LIBOR. Total rate

of return swaps are agreements with a counterparty to

exchange an interest rate payment for the total rate of return

on a specified reference index calculated on a notional

amount. Purchased interest rate caps and floors are

agreements where, for a fee, the counterparty agrees to pay the

Corporation the amount, if any, by which a specified market

interest rate exceeds or is less than a defined rate applied to a

notional amount, respectively. Interest rate futures contracts

are exchange-traded agreements to make or take delivery of a

financial instrument at an agreed upon price and are settled in

cash daily.

Financial derivatives involve, to varying degrees, interest

rate, market and credit risk. For interest rate swaps and total

rate of return swaps, caps and floors and futures contracts,

only periodic cash payments and, with respect to caps and

floors, premiums, are exchanged. Therefore, cash

requirements and exposure to credit risk are significantly less

than the notional value.

Not all elements of interest rate, market and credit risk are

addressed through the use of financial or other derivatives,

and such instruments may be ineffective for their intended

purposes due to unanticipated market characteristics among

other reasons.

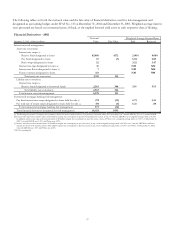

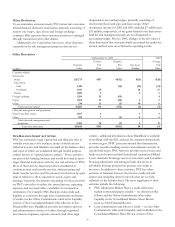

The following tables set forth changes, during 2002, in the notional value of financial derivatives used for risk management

and designated as accounting hedges under SFAS No. 133.

Financial Derivatives Activity

December 31 December 31 Weighted-Average

Dollars in millions 2001 Additions Maturities Terminations 2002 Maturity

Interest rate risk management

Interest rate swaps

Receive fixed (a) $6,748 $2,975 $(1,300) $(2,600) $5,823 3 yrs. 2 mos.

Pay fixed 107 5 (45) 67 4 yrs.

Basis swaps 87 45 (5) (75) 52 5 yrs. 10 mos.

Interest rate caps 25 (9) 16 4 yrs. 8 mos.

Interest rate floors 7 7 2 yrs. 3 mos.

Futures contracts 398 378 (463) 313 7 mos.

Total interest rate risk

management 7,372 3,403 (1,305) (3,192) 6,278

Commercial mortgage banking risk

mana

g

ement

Pay fixed interest rate swaps 105 800 (632) 273 10 yrs. 1 mo.

Total rate of return swaps 150 275 (325) 100 1 mo.

Total commercial mortgage

bankin

g

risk mana

g

ement 255 1,075 (325) (632) 373

Total $7,627 $4,478 $(1,630) $(3,824) $6,651

(a) On January 24, 2003, $1.2 billion of receive-fixed interest rate swaps were terminated. As cash flow hedge designated derivatives, unrealized gains or losses are classified as accumulated

other comprehensive income in the consolidated balance sheet. Upon termination, the net unrealized gains related to these swaps amounting to $34.5 million will be amortized from other

comprehensive income into earnings to match the earnings recognition pattern of the hedged items.