PNC Bank 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

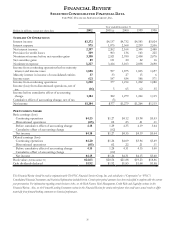

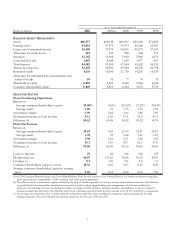

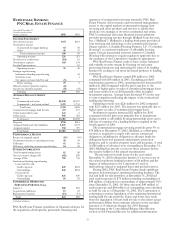

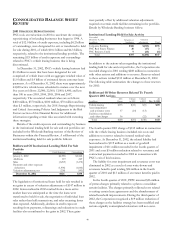

31

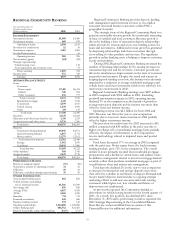

REGIONAL COMMUNITY BANKING

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2002 2001

INCOME STATEMENT

Net interest income $1,409 $1,466

Noninterest income 689 679

Operating revenue 2,098 2,145

Provision for credit losses 52 50

Noninterest expense 1,061 1,063

Goodwill amortization 36

Operating income 985 996

Net securities (gains) (84) (86)

Strategic repositioning:

Vehicle leasing costs 135

Asset impairment and severance costs 13

Pretax earnings 1,069 934

Income taxes 372 338

Earnings $697 $596

AVERAGE BALANCE SHEET

Loans

Consumer

Home equity $7,101 $6,351

Indirect 541 814

Other consumer 632 777

Total consumer 8,274 7,942

Residential mortgage 4,110 7,912

Commercial 3,599 3,557

Vehicle leasing 1,678 1,901

Other 119 133

Total loans 17,780 21,445

Securities 11,139 10,241

Education and other loans held for sale 1,319 1,293

Assigned assets and other assets 8,738 7,306

Total assets $38,976 $40,285

Deposits

Noninterest-bearing demand $5,046 $4,571

Interest-bearing demand 6,057 5,713

Money market 12,279 12,162

Total transaction deposits 23,382 22,446

Savings 1,962 1,870

Certificates 10,045 11,906

Total deposits 35,389 36,222

Other liabilities 958 1,345

Assigned capital 2,629 2,718

Total funds $38,976 $40,285

PERFORMANCE RATIOS

Return on assigned capital 27% 22%

Noninterest income to operating revenue 33 32

Efficiency 49 54

Efficiency, excluding strategic repositioning 51 50

OTHER INFORMATION

Total nonperforming assets $82 $52

Vehicle leasing outstandings,

net of unearned income $1,386 $1,930

Net charge-offs $56 $50

Average FTEs 9,657 9,953

ATMs 3,550 3,250

Branches 714 712

Financial consultants 645 568

Business banking centers 193 140

Checking relationships 1,542,000 1,440,000

Online banking users 606,752 421,325

Deposit households using online banking 36.6% 27.2%

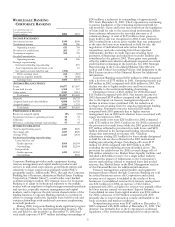

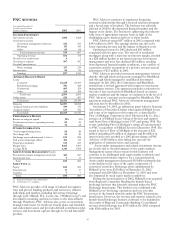

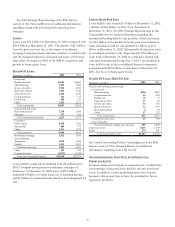

Regional Community Banking provides deposit, lending,

cash management and investment services to two million

consumer and small business customers within PNC’s

geographic footprint.

The strategic focus of the Regional Community Bank is to

generate sustainable revenue growth by consistently increasing

its base of satisfied and loyal customers. Revenue growth is

driven by building a base of transaction deposit relationships

which provide fee revenue and a low-cost funding source for

loans and investments. Additional revenue growth is generated

by deepening relationships with these customers through

cross-selling of other products and services. The significant

growth in online banking users is helping to improve customer

loyalty and retention.

During 2002, Regional Community Banking increased the

number of checking relationships by 8% causing increases in

transaction deposits and fee revenues. Customer growth was

driven by simultaneous improvements in the rates of customer

acquisition and retention. Despite this trend and success in

keeping deposit funding costs low, this business was adversely

impacted by a reduction in average residential mortgages and

vehicle leases and lower investment yields in the relatively low

interest rate environment in 2002.

Regional Community Banking earnings were $697 million

in 2002 compared with $596 million in 2001. Excluding

goodwill amortization expense in 2001, operating income

declined 5% in the comparison as the benefit of growth in

average transaction deposits and fee income was more than

offset by lower net interest income.

Operating revenue was $2.1 billion for both 2002 and

2001. Revenue was flat in the year-to-year comparison

primarily due to lower net interest income in 2002 partially

offset by higher noninterest income.

The provision for credit losses for 2002 increased to $52

million compared with $50 million in the prior year due to

higher net charge-offs on residential mortgage loans partially

offset by the impact of refinements to the Corporations’

reserve methodology related to impaired loans and pooled

reserves.

Total loans decreased 17% on average in 2002 compared

with the prior year. Home equity loans, the lead consumer

lending product, grew 12% in the comparison. The overall

decline in loans primarily resulted from residential mortgage

prepayments and a decline in vehicle leases and indirect loans.

In addition, management elected to invest in mortgage-backed

securities rather than purchase residential mortgages as part of

overall balance sheet and interest rate management.

Total deposits declined 2% in the year-to-year comparison

as increases in transaction and savings deposits were more

than offset by a decline in certificates of deposit. Demand and

money market deposits increased due to ongoing strategic

marketing efforts to add new accounts and retain existing

customers while higher cost, less valuable certificates of

deposit were not emphasized.

As previously reported, the Corporation decided to

discontinue its vehicle leasing business in the fourth quarter of

2001. As a result, this portfolio has declined 28% since

December 31, 2001 and is performing overall as expected. See

2001 Strategic Repositioning in the Consolidated Balance

Sheet Review section and Risk Factors section of this

Financial Review for additional information.