PNC Bank 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• We added Vice Chairman

and CFO Bill Demchak and

Vice Chairmen Bill Mutterperl

and Joe Whiteside, who

bring additional talent and

experience to our senior

leadership team.

• We also added new board

members — J. Gary Cooper,

Richard Kelson, Anthony

Massaro, and Stephen Thieke

— who provide significant

financial and industry expertise.

In addition, to further

enhance corporate governance,

our employees adopted a

Statement of Principles and we

strengthened our Code of Ethics.

I believe the extensive

amount of time and energy we

spent on risk management and

corporate governance in 2002 will

serve to reinforce our company’s

strong foundation.

In this economy, we also contin-

ued to strengthen critical ele-

ments of our balance sheet,

such as our liquidity and capital

positions. Our loan-to-deposit

ratio is 79%, down from 106%

at the end of 2000, and our

Tier I capital ratio is 8.8%. Each

is the strongest in our company’s

recent history and among the

best in our peer group.

We expect to proactively

manage our capital in 2003. Our

top priorities include investing

in our businesses and resuming

our share repurchase program.

We also continued an exten-

sive effort to reduce credit risk in

2002, removing roughly $2.8

billion in higher-risk, low-return

assets from our balance sheet.

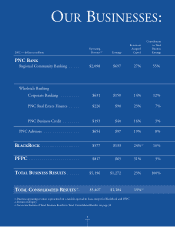

In addition, our business

mix continues to fuel a diverse

revenue stream. In 2002,

deposits, asset management,

processing, and lending each

contributed roughly equal por-

tions of total business revenue.

I believe we’ve been succes-

ful in building a strong balance

sheet and enhancing risk

management and corporate

governance. Moving forward,

we’re working to harness the

energy we’ve focused on these

issues to help improve perform-

ance business by business.

This happens to be a partic-

ular strength of Joe Guyaux, the

30-year PNC veteran we named

president of PNC in August

2002. In his new role, Joe heads

all of our banking businesses,

including Wholesale Banking

and PNC Advisors. He is

working to build on the

remarkable success Regional

Community Banking achieved

under his leadership.

2

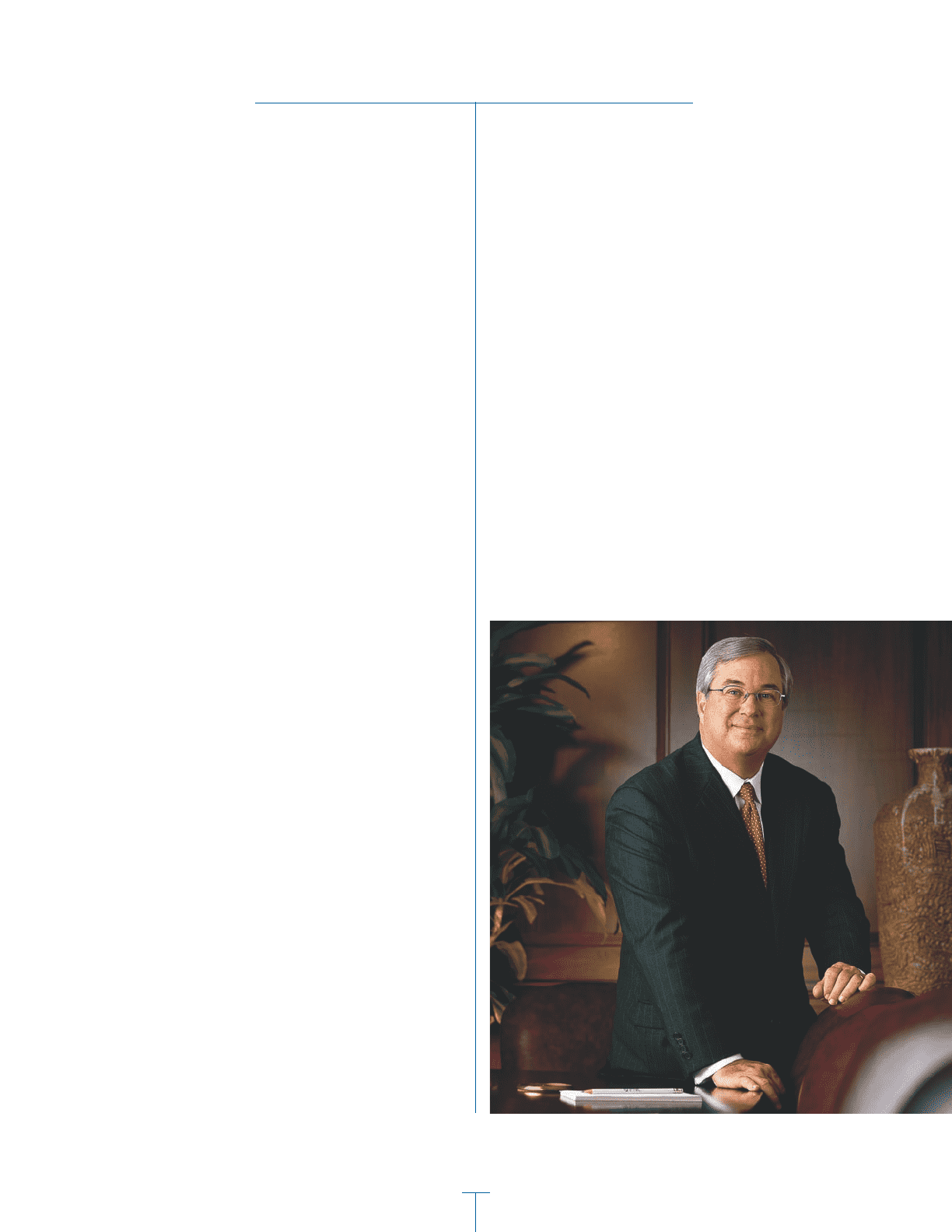

James E. Rohr

Chairman and

Chief Executive Officer

Well-Positioned Balance Sheet