PNC Bank 2002 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

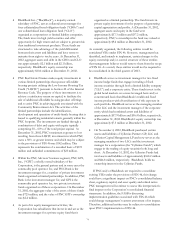

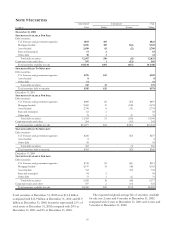

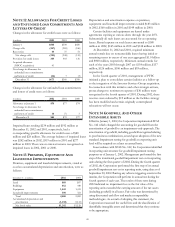

STOCK-BASED COMPENSATION

At December 31, 2002, the Corporation has stock-based

employee compensation plans, which are described more fully

in Note 22 Stock-Based Compensation Plans. PNC accounts

for these plans under APB Opinion No. 25, “Accounting for

Stock Issued to Employees,” and related interpretations. No

stock-based employee compensation expense has been

reflected in net income for the Employee Stock Purchase Plan

(“ESPP”) and stock options as all rights and options to

purchase PNC stock granted under these plans had an exercise

price equal to the market value of the underlying stock on the

date of grant. The following table illustrates the income from

continuing operations and earnings per share as if the

Corporation had applied the fair value recognition provisions

of SFAS No. 123, “Accounting for Stock-Based

Compensation,” as amended, to stock-based employee

compensation plans.

Pro Forma Income From Continuing Operations

And Earnings Per Share

Year Ended December 31

In millions, except per share

data

2002 2001 2000

Income from continuing

operations, as reported $1,200 $377 $1,214

Less: Total stock-

based employee

compensation expense

determined under the

fair value method for

all awards, net of

related tax effects (47) (33) (18)

Pro forma income from

continuing operations $1,153 $344 $1,196

Earnings per share

from continuing

operations

Basic-as reported $4.23 $1.27 $4.12

Basic-pro forma 4.06 1.15 4.06

Diluted-as reported 4.20 1.26 4.09

Diluted-pro forma 4.04 1.14 4.02

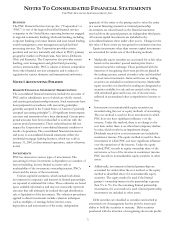

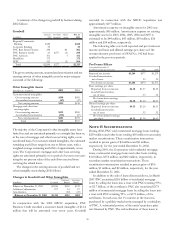

RECENT ACCOUNTING PRONOUNCEMENTS

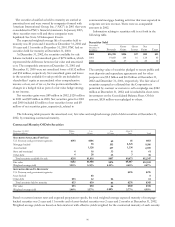

In July 2001, the FASB issued SFAS No. 142 which changed the

accounting from amortizing goodwill to an impairment-only

approach. The amortization of goodwill, including goodwill

recognized relating to past business combinations, ceased upon

adoption of the new standard. Impairment testing for goodwill at

a reporting unit level is required on at least an annual basis. The

standard also addresses other accounting matters, disclosure

requirements and financial statement presentation issues relating

to goodwill and other intangible assets. The Corporation adopted

SFAS No. 142 on January 1, 2002. As a result, during 2002

goodwill amortization decreased by approximately $117 million

and net income increased by approximately $93 million. Refer

to "Goodwill And Other Intangible Assets" herein and to Note

14 Goodwill And Other Intangible Assets for additional

information.

In October 2001, the FASB issued SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived

Assets,” which replaces SFAS No. 121. This statement

primarily defines one accounting model for long-lived assets to

be disposed of by sale, including discontinued operations, and

addresses implementation issues regarding the impairment of

long-lived assets. The standard was effective January 1, 2002

and did not have a material impact on the Corporation’s

consolidated financial statements.

In July 2002, the FASB issued SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities,” which

replaces Emerging Issues Task Force Issue No. 94-3, “Liability

Recognition for Certain Employee Termination Benefits and

Other Costs to Exit an Activity (including Certain Costs

Incurred in a Restructuring).” SFAS No. 146 addresses the

accounting and reporting for one-time employee termination

benefits, certain contract termination costs, and other costs

associated with exit or disposal activities such as facility

closings or consolidations and employee relocations. The

standard is effective for exit or disposal activities initiated after

December 31, 2002. The Corporation adopted SFAS No. 146

prospectively as of January 1, 2003.