PNC Bank 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

of PNC. A substantial portion of the entity’s purchase price

was financed by PNC. The reclassification of these loans to

securities increased the liquidity of the assets and was

consistent with PNC’s ongoing balance sheet restructuring. At

the time of the residential mortgage securitization, gains of

$25.9 million were deferred and are recognized as principal

payments are received or the securities are sold to third

parties. At December 31, 2001, these securities had been

reduced to $1.3 billion through sales and principal payments

and the remaining deferred gains were $7.8 million. In the first

quarter of 2002, the remaining securities were sold. The

deferred gain remaining at the time of sale of $6.0 million was

recognized as other noninterest income.

No gain was recognized at the time of the commercial

mortgage loan securitization and none of the securities

retained at the time of the securitization remained on the

balance sheet at December 31, 2001.

INTERNAL CONTROLS AND DISCLOSURE CONTROLS AND

PROCEDURES

As of December 31, 2002, an evaluation was performed under

the supervision and with the participation of the Corporation’s

management, including the Chief Executive Officer and the

Vice Chairman and Chief Financial Officer, of the

effectiveness of the design and operation of the Corporation’s

disclosure controls and procedures. Based on that evaluation,

the Corporation’s management, including the Chief Executive

Officer and the Vice Chairman and Chief Financial Officer,

concluded that the Corporation’s disclosure controls and

procedures were effective as of December 31, 2002.

There have been no significant changes in the

Corporation’s internal controls or in other factors that could

significantly affect internal controls subsequent to December

31, 2002, the date as of which the most recent evaluation of

such internal controls was performed.

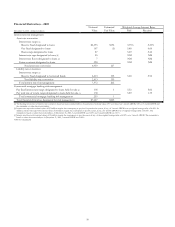

STATUS OF DEFINED BENEFIT PENSION PLAN

The Corporation has a noncontributory, qualified defined

benefit pension plan ("plan" or "pension plan") covering most

employees. Contributions to the pension plan are actuarially

determined with assets transferred to a trust to fund benefits

payable to plan participants. Plan assets are currently

approximately 60% invested in equity investments with most

of the remainder invested in fixed income instruments. Plan

investment strategy is determined and reviewed by plan

fiduciaries. On an annual basis, management reviews the

actuarial assumptions related to the pension plan, including the

discount rate, rate of compensation increase and the expected

return on plan assets.

The expense associated with the pension plan is calculated

in accordance with SFAS No. 87, "Employers' Accounting for

Pensions," and utilizes assumptions and methods determined

in accordance therewith, including a policy of reflecting trust

assets at their fair market value. The expense is not

significantly affected by the discount rate or compensation

increase assumptions, but is significantly affected by the

expected return on asset assumption, which has been changed

from 9.50% to 8.50% for 2003, increasing expense by

approximately $10 million. The expense is also significantly

affected by actual trust returns, with each one percentage point

difference in actual return versus the expectation causing the

following year’s expense to increase by as much as $2 million.

Management currently estimates 2003 expense for the pension

plan to be approximately $50 million, compared with $15

million for 2002. The amortization of actuarial losses and

lower expected return on plan assets are the primary reasons

for the expected increases in pension expense in 2003.

In accordance with SFAS No. 87 and SFAS No. 132,

"Employers' Disclosures about Pensions and Other

Postretirement Benefits," the Corporation may be required to

eliminate any prepaid pension asset and recognize a minimum

pension liability if the accumulated benefit obligation exceeds

the fair value of plan assets at year-end. The corresponding

charge would be recognized as a component of other

comprehensive income and reduce total shareholders' equity,

but would not impact net income. At December 31, 2002, the

fair value of plan assets was $966 million, which exceeded the

accumulated benefit obligation of $871 million. The status at

year-end 2003 will depend primarily upon 2003 trust returns

and the level of contributions made to the plan by the

Corporation. While the Corporation views as remote the

possibility of a minimum pension liability, such a liability

would cause a significant reduction in shareholders’ equity.

Contribution requirements are primarily affected by trust

investment performance and are not particularly sensitive to

actuarial assumptions. Although there were no required

contributions to the pension plan during 2002, the

Corporation continued its strategy of fully funding the plan at

maximum tax-deductible levels, contributing $210 million.

The Corporation expects to contribute a similar amount

during 2003. If future investment performance exceeds that

of recent years, the permitted tax-deductible contribution in

future years will be significantly reduced. In any case and

irrespective of any factors, any large near-term contributions

to the plan will be at the discretion of management as the

minimum required contributions under current law are

expected to be zero for several years.

STOCK-BASED COMPENSATION

PNC will expense stock-based compensation using the fair

value-based method, beginning with grants made in 2003.

Assuming recurring stock option grants of similar size and

value to those made during 2002, this impact is currently

estimated to be approximately 5 cents per share for the year

ending December 31, 2003. The annual impact is expected to

increase over the next three years under the transitional