PNC Bank 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

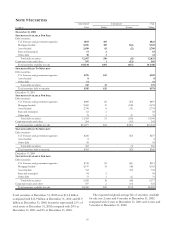

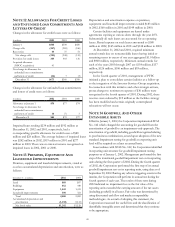

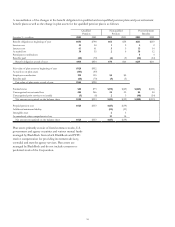

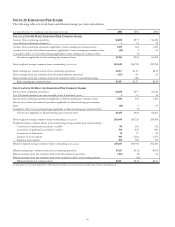

NOTE 12 ALLOWANCES FOR CREDIT LOSSES

AND UNFUNDED LOAN COMMITMENTS AND

LETTERS OF CREDIT

Changes in the allowance for credit losses were as follows:

In millions 2002 2001 2000

January 1 $560 $598 $600

Charge-offs (267) (985) (186)

Recoveries 44 37 51

Net charge-offs (223) (948) (135)

Provision for credit losses 309 903 136

Acquired allowance

(NBOC acquisition) 41

Net change in allowance for

unfunded loan commitments

and letters of credit (14) 7(3)

December 31 $673 $560 $598

Changes in the allowance for unfunded loan commitments

and letters of credit were as follows:

In millions 2002 2001 2000

Allowance at January 1 $70 $77 $74

Net change in allowance for

unfunded loan commitments

and letters of credit 14 (7) 3

December 31 $84 $70 $77

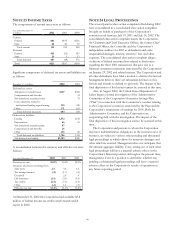

Impaired loans totaling $234 million and $192 million at

December 31, 2002 and 2001, respectively, had a

corresponding specific allowance for credit losses of $80

million and $28 million. The average balance of impaired loans

was $242 million in 2002, $319 million in 2001 and $277

million in 2000. There was no interest income recognized on

impaired loans in 2002, 2001 or 2000.

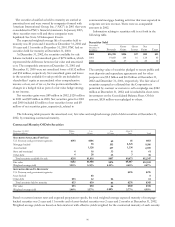

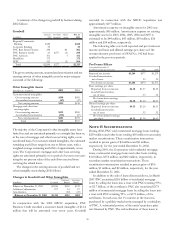

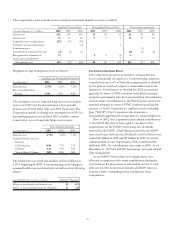

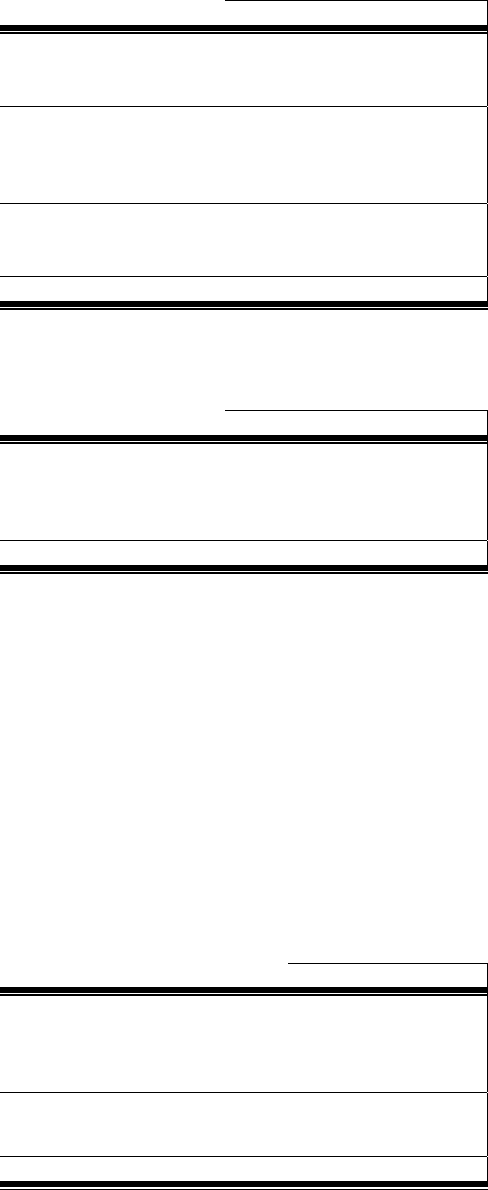

NOTE 13 PREMISES, EQUIPMENT AND

LEASEHOLD IMPROVEMENTS

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

December 31 - in millions 2002 2001

Land $88 $87

Buildings 452 448

Equipment 1,542 1,413

Leasehold improvements 398 321

T

otal 2,480 2,269

Accumulated depreciation and

amortization (1,238) (1,141)

Net book value $1,242 $1,128

Depreciation and amortization expense on premises,

equipment and leasehold improvements totaled $183 million

in 2002, $168 million in 2001 and $149 million in 2000.

Certain facilities and equipment are leased under

agreements expiring at various dates through the year 2071.

Substantially all such leases are accounted for as operating

leases. Rental expense on such leases amounted to $180

million in 2002, $165 million in 2001 and $148 million in 2000.

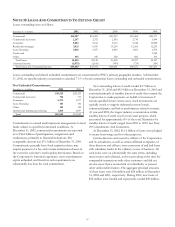

At December 31, 2002 and 2001, required minimum

annual rentals due on noncancelable leases having initial or

remaining terms in excess of one year aggregated $1.0 billion

and $908 million, respectively. Minimum annual rentals for

each of the years 2003 through 2007 are $154 million, $137

million, $126 million, $106 million and $93 million,

respectively.

In the fourth quarter of 2001, management of PFPC

initiated a plan to consolidate certain facilities as a follow-up

to the integration of the Investor Services Group acquisition.

In connection with this initiative and other strategic actions,

pretax charges to noninterest expense of $36 million were

recognized in the fourth quarter of 2001. During 2002, these

reserves were reduced by $19 million as the facilities strategy

has been modified and certain originally contemplated

relocations will not occur.

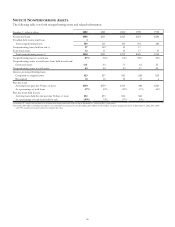

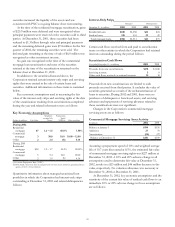

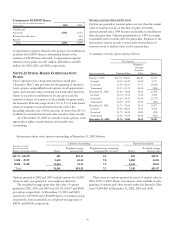

NOTE 14 GOODWILL AND OTHER

INTANGIBLE ASSETS

Effective January 1, 2002, the Corporation implemented SFAS

No. 142 which changed the accounting for goodwill from the

amortization of goodwill to an impairment-only approach. The

amortization of goodwill, including goodwill recognized relating

to past business combinations, ceased upon adoption of the new

standard. Impairment testing for goodwill at a reporting unit

level will be required on at least an annual basis.

In accordance with SFAS No. 142, the Corporation identified

its reporting unit structure for goodwill impairment testing

purposes as of January 1, 2002. Management performed the first

step of the transitional goodwill impairment test on its reporting

units during the first quarter of 2002. During the fourth quarter

of 2002, the Corporation performed the first step of its annual

goodwill impairment test on its reporting units, using data as of

September 30, 2002. Barring any adverse triggering events in the

interim, the Corporation will perform its annual test during the

fourth quarter of each year. The results of these tests during

2002 indicated no impairment loss as the fair value of the

reporting units exceeded the carrying amount of the net assets

(including goodwill) in all cases. Fair value was determined by

using discounted cash flow and market comparability

methodologies. As a result of adopting this statement, the

Corporation reassessed the useful lives and the classification of

identifiable intangible assets and determined that they continue

to be appropriate.