PNC Bank 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

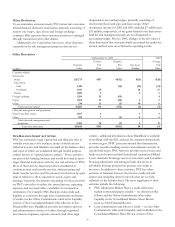

ACQUISITIONS

The Corporation expands its business from time to time by

acquiring other financial services companies. Factors

pertaining to acquisitions that could adversely affect the

Corporation’s business and earnings include, among others:

anticipated cost savings or potential revenue enhancements

that may not be fully realized or realized within the expected

time frame; key employee, customer or revenue loss following

an acquisition that may be greater than expected; and costs or

difficulties related to the integration of businesses that may be

greater than expected. The Corporation could also be

prevented from pursuing attractive acquisition opportunities

due to regulatory restraints.

TERRORIST ACTIVITIES AND INTERNATIONAL

HOSTILITIES

The impact of terrorist activities and responses to such

activities and of possible international hostilities cannot be

predicted at this time with respect to severity or duration, but

may adversely affect the general economy, financial and capital

markets, specific industries and the Corporation. The impact

could adversely affect the Corporation in a number of ways

including, among others, an increase in delinquencies,

bankruptcies or defaults that could result in a higher level of

nonperforming assets, net charge-offs and provision for credit

losses.

RISK MANAGEMENT

In the normal course of business, the Corporation assumes

various types of risk, which include, among other things, credit

risk, market risk and operational risk. Credit risk and liquidity

risk are described in the Consolidated Balance Sheet Review

section of this Financial Review. These factors and others

could impact the Corporation’s business, financial condition,

results of operations and cash flows.

PNC has risk management processes designed to provide

for risk identification, measurement and monitoring. PNC has

taken a number of actions to enhance these processes,

including centralization of the risk management function,

ongoing development of an enterprise-wide risk profile and

the addition of key risk management positions. The

Corporation announced several management appointments in

2002 and early 2003, including those described below, to

enhance the Corporation’s risk management structure.

• In April 2002 the Corporation created a new position,

Chief Risk Officer. The Chief Risk Officer directs credit

policy, balance sheet risk management and operational

risk management, with the aim to help PNC sharpen its

strategic focus and integrated coordination of all risk

management activities throughout the Corporation. The

Corporation’s General Auditor reports directly to the

Audit Committee of the Board of Directors and receives

administrative support from the Chief Risk Officer.

• The Corporation appointed a Chief Regulatory Officer

effective August 1, 2002 and a Chief Compliance Officer

effective October 1, 2002. The Chief Regulatory Officer, a

newly-created position, is responsible for the management

of all issues related to PNC’s regulatory affairs and

compliance. The Chief Compliance Officer reports to the

Chief Regulatory Officer and is responsible for corporate

compliance risk management strategies, policies and

program development across all PNC business units,

including PNC Bank.

• In October 2002, PNC appointed a new Vice Chairman

who has broad administrative responsibilities including

assisting the Corporation in implementing corporate

governance enhancements.

• In January 2003, the Corporation appointed a Chief

Market Risk Officer. The Chief Market Risk Officer

reports to the Chief Risk Officer and is responsible for

managing all aspects of market risk management

processes, including interest rate, liquidity and trading risk

across PNC.

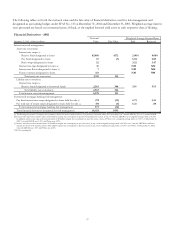

INTEREST RATE RISK

Interest rate risk arises primarily through the Corporation’s

traditional business activities of extending loans and accepting

deposits. Many factors, including economic and financial

conditions, movements in interest rates and consumer

preferences affect the spread between interest earned on assets

and interest paid on liabilities. In managing interest rate risk, the

Corporation seeks to minimize its reliance on a particular

interest rate scenario as a source of earnings while maximizing

net interest income and net interest margin. To further these

objectives, the Corporation uses securities purchases and sales,

short-term and long-term funding, financial derivatives and

other capital markets instruments.

The Corporation actively measures and monitors

components of interest rate risk including term structure or

repricing risk, yield curve or nonparallel rate shift risk, basis

risk and options risk. The Corporation measures and manages

both the short-term and long-term effects of changing interest

rates. An income simulation model measures the sensitivity of

net interest income to changing interest rates over the next

twenty-four month period. An economic value of equity

model measures the sensitivity of the value of existing on-

balance-sheet and off-balance-sheet positions to changing

interest rates.

The income simulation model is the primary tool used to

measure the direction and magnitude of changes in net interest

income resulting from changes in interest rates. Forecasting