PNC Bank 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

securities increased the liquidity of the assets and was

consistent with PNC’s on-going balance sheet restructuring.

At the time of the residential mortgage securitization, gains

of $25.9 million were deferred and were recognized when

principal payments were received or the securities sold to third

parties. At December 31, 2001, these securities had been

reduced to $1.3 billion through sales and principal payments

and the remaining deferred gains were $7.8 million. In the first

quarter of 2002, the remaining securities were sold. The

deferred gain remaining at the time of sale of $6.0 million was

recognized as other noninterest income.

No gain was recognized at the time of the commercial

mortgage loan securitization and none of the securities

retained at the time of the securitization remained on the

balance sheet at December 31, 2001.

In addition to the securities discussed above, the

Corporation retained certain interest-only strips and servicing

rights that were created in the sale of certain loans and

securities. Additional information on these items is contained

below.

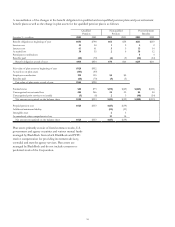

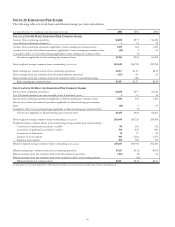

Key economic assumptions used in measuring the fair

value of the interest-only strips and servicing rights at the date

of the securitization resulting from securitizations completed

during the year and related information were as follows:

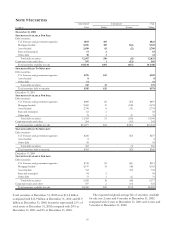

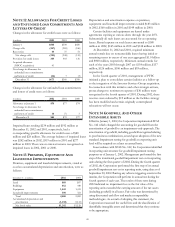

Key Economic Assumptions

Dollars in millions Fair Value

Weighted-

average Life

(Years)

Prepayment

Speed

(CPR)(a) Discount Rate

During 2002

Residential

mortgage $7 1.2 – 1.5 60.0% 7.50%

Commercial

mortgage 3 30.0 10.0 10.00 – 12.00

Other 2 2.4 (b) 4.14

During 2001

Residential

mortgage $38 1.2 – 1.7 36.0

%

10.00%

Commercial

mortgage 5 9.4 10.0 10.00

Other 21.9

(b) 4.14

(a) Constant Prepayment Rate (“CPR”).

(b) Historically, there have been no prepayments on these loans, which are guaranteed by an

agency of the U. S. Government.

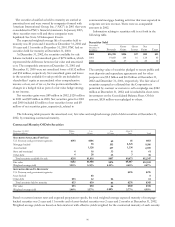

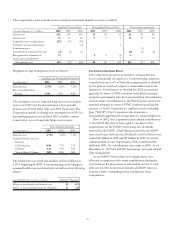

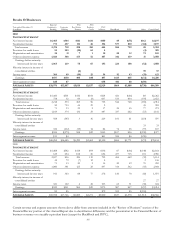

Quantitative information about managed securitized loan

portfolios in which the Corporation had interest-only strips

outstanding at December 31, 2002 and related delinquencies

follows:

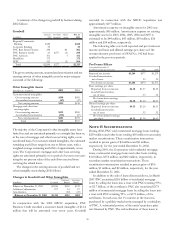

Interest-Only Strips

Managed Delinquencies

December 31 - in millions 2002 2001 2002 2001

Residential loans $650 $1,058 $22 $24

Student loans 338 453 39 49

Total managed loans $988 $1,511 $61 $73

Certain cash flows received from and paid to securitization

trusts or other entities in which the Corporation had retained

interests outstanding during the period follows:

Securitization Cash Flows

Year ended December 31 – in millions 2002 2001

Proceeds from new securitizations $278 $1,040

Servicing revenue 58

Other cash flows received on retained interests 12 16

Proceeds from new securitizations are limited to cash

proceeds received from third parties. It excludes the value of

securities generated as a result of the recharacterization of

loans to securities. During 2002 and 2001, there were no

purchases of delinquent or foreclosed assets, and servicing

advances and repayments of servicing advances related to

these securitizations were not significant.

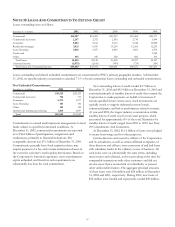

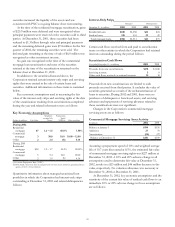

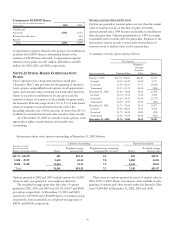

Changes in the Corporation’s commercial mortgage

servicing assets are as follows:

Commercial Mortgage Servicing Asset Activity

In millions 2002 2001

Balance at January 1 $199 $156

Additions 27 70

Amortization (25) (27)

Balance at December 31 $201 $199

Assuming a prepayment speed of 10% and weighted average

life of 10.7 years discounted at 8.5%, the estimated fair value

of commercial mortgage servicing rights was $227 million at

December 31, 2002. A 10% and 20% adverse change in all

assumptions used to determine fair value at December 31,

2002, results in a $23 million and $46 million decrease in fair

value, respectively. No valuation allowance was necessary at

December 31, 2002 or December 31, 2001.

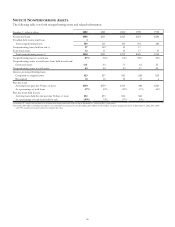

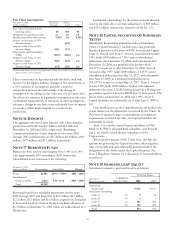

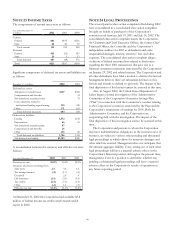

At December 31, 2002, key economic assumptions and the

sensitivity of the current fair value of residual cash flows to an

immediate 10% or 20% adverse change in those assumptions

are as follows: