PNC Bank 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

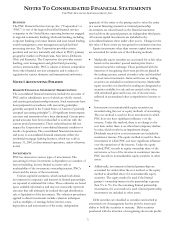

guidance provided by SFAS No. 148, “Accounting for Stock-

Based Compensation – Transition and Disclosure.” When

fully implemented, the current expected impact is a reduction

of approximately 3 percent to earnings per share.

RECENT ACCOUNTING PRONOUNCEMENTS

In July 2001, the FASB issued SFAS No. 142, “Goodwill and

Other Intangible Assets,” which changed the accounting from

amortizing goodwill to an impairment-only approach. The

amortization of goodwill, including goodwill recognized relating

to past business combinations, ceased upon adoption of the new

standard. Impairment testing for goodwill at a reporting unit

level is required on at least an annual basis. The standard also

addresses other accounting matters, disclosure requirements and

financial statement presentation issues relating to goodwill and

other intangible assets. The Corporation adopted SFAS No.

142 on January 1, 2002. As a result, during 2002 goodwill

amortization decreased by approximately $117 million and net

income increased by approximately $93 million. Refer to

"Goodwill And Other Intangible Assets" herein and to Note

14 Goodwill And Other Intangible Assets for additional

information.

In October 2001, the FASB issued SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived

Assets,” which replaces SFAS No. 121. This statement

primarily defines one accounting model for long-lived assets to

be disposed of by sale, including discontinued operations, and

addresses implementation issues regarding the impairment of

long-lived assets. The standard was effective January 1, 2002

and did not have a material impact on the Corporation’s

consolidated financial statements.

In July 2002, the FASB issued SFAS No. 146, “Accounting

for Costs Associated with Exit or Disposal Activities,” which

replaces Emerging Issues Task Force Issue No. 94-3, “Liability

Recognition for Certain Employee Termination Benefits and

Other Costs to Exit an Activity (including Certain Costs

Incurred in a Restructuring).” SFAS No. 146 addresses the

accounting and reporting for one-time employee termination

benefits, certain contract termination costs, and other costs

associated with exit or disposal activities such as facility

closings or consolidations and employee relocations. The

standard is effective for exit or disposal activities initiated after

December 31, 2002. The Corporation adopted SFAS No. 146

prospectively as of January 1, 2003.

In October 2002, the FASB issued SFAS No. 147,

"Acquisitions of Certain Financial Institutions." This

statement clarified that, only if certain criteria are met, an

acquisition of a less-than-whole financial institution (such as a

branch acquisition) should be accounted for as a business

combination. In addition, SFAS No. 147 amends SFAS No.

144 to include in its scope long-term customer-relationship

intangible assets of financial institutions such as depositor- and

borrower-relationship intangible assets. As a result, those

intangible assets are subject to the same undiscounted cash

flow recoverability test and impairment loss recognition and

measurement provisions that SFAS No. 144 requires for other

long-lived assets that are held and used by a company. SFAS

No. 147 became effective October 1, 2002 and did not have a

material impact on the Corporation’s consolidated financial

statements.

In November 2002, the FASB issued FIN 45, "Guarantor’s

Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others."

FIN 45 elaborates on the existing disclosure requirements for

most guarantees, including loan guarantees such as standby

letters of credit and indemnifications. It also clarifies that at

the time a company issues a guarantee, the company must

recognize an initial liability for the fair or market value of the

obligations it assumes under that guarantee and must disclose

that information in its interim and annual financial statements.

The provisions related to recognizing a liability at inception of

the guarantee for the fair value of the guarantor’s obligations

would not apply to guarantees accounted for as derivatives.

The initial recognition and measurement provisions apply on a

prospective basis to guarantees issued or modified after

December 31, 2002. See Note 29 Commitments And

Guarantees for the disclosures currently required under FIN

45.

In December 2002, the FASB issued SFAS No. 148,

"Accounting for Stock-Based Compensation--Transition and

Disclosure." This statement amends SFAS No. 123, to provide

alternative methods of transition for a voluntary change to the

fair value based method of accounting for stock-based

employee compensation. In addition, this statement amends

the disclosure requirements of SFAS No. 123 to require

disclosures in both annual and interim financial statements

regarding the method of accounting for stock-based employee

compensation and the effect of the method used on reported

results. See "Stock-Based Compensation" herein and Note 22

Stock-Based Compensation Plans for additional information.

In January 2003, the FASB issued FIN 46, "Consolidation

of Variable Interest Entities." See Note 1 Accounting Policies

for further information.

BLACKROCK LONG-TERM RETENTION AND INCENTIVE

PLAN

In October 2002, BlackRock adopted a new long-term

retention and incentive program for key employees. The

program permits BlackRock to grant up to 3.5 million stock

options with an exercise price of market value, subject to

vesting at December 31, 2006, and up to $240 million in

deferred compensation awards (the “Compensation Awards”),

with payment subject to the achievement of certain

performance hurdles no later than March 2007. BlackRock has

awarded approximately 3.37 million stock options and

approximately $130 million in Compensation Awards to more

than 100 senior professionals. The remainder of the program